Are you looking to purchase a home but aren’t sure if a traditional mortgage is the right fit for you? Or maybe you’ve heard about non-traditional mortgages but don’t know exactly what they are? Non-traditional mortgages are becoming increasingly popular as an alternative to traditional mortgages for those who don’t meet the requirements for a traditional loan. In this article, we’ll explain what a non-traditional mortgage is, the different types, and the pros and cons of each. Read on to learn more about the non-traditional mortgage options available and if one is right for you.

Types of Non-Traditional Mortgages

Non-traditional mortgages are becoming increasingly popular as more and more people look for alternative financing options. These types of mortgages offer borrowers more flexibility and creative solutions, allowing them to purchase a home without having to adhere to the traditional mortgage guidelines. Conventional mortgages are the most common type of non-traditional mortgage and are ideal for borrowers with strong credit and a solid income. These mortgages offer competitive rates and terms and can be tailored to meet the needs of the individual borrower. Non-QM mortgages are a type of non-traditional mortgage that can provide financing for borrowers who don’t meet the strict requirements of conventional mortgages. These mortgages are designed to meet the needs of borrowers with unique financial situations, such as those with lower credit scores, irregular income, or other special circumstances. Jumbo loans are another type of non-traditional mortgage that allows borrowers to purchase homes that exceed the standard loan limits set by the government. These loans are ideal for borrowers who need to borrow above the conforming loan limit but still want a competitive rate and term. Alternative financing is becoming an increasingly popular option for borrowers who don’t meet the traditional requirements for a mortgage. Non-traditional mortgages offer borrowers a wider range of

Benefits of Non-Traditional Mortgages

Non-traditional mortgages offer a ton of benefits for those looking to purchase a home! They are a great way to get into a home when traditional financing options aren’t available. Some of the key benefits of non-traditional mortgages include a lower down payment, relaxed credit requirements, more lenient debt-to-income ratios, and more flexible terms. With a lower down payment, buyers can get into the market faster and start building their equity. Relaxed credit requirements make it easier for those who have had some credit issues to still purchase a home. With more lenient debt-to-income ratios, buyers can afford a larger mortgage payment and get a better home. And with flexible terms, buyers can restructure their mortgage payment to fit their budget better. Non-traditional mortgages are a great way to make home ownership a reality for those who may not qualify for traditional mortgages.

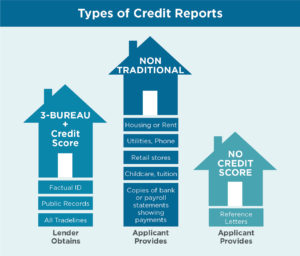

Qualifying for a Non-Traditional Mortgage

When it comes to qualifying for a non-traditional mortgage, it’s important to know that the requirements can vary from lender to lender. Generally, you’ll need to have an excellent credit score and a steady income to qualify. Lenders may also require you to have a certain amount of assets and/or a solid debt-to-income ratio. Depending on the lender, you may also need to show proof of income or other financial documents. It’s important to do your research and find a lender that best meets your needs, so you can get the most out of your non-traditional mortgage.

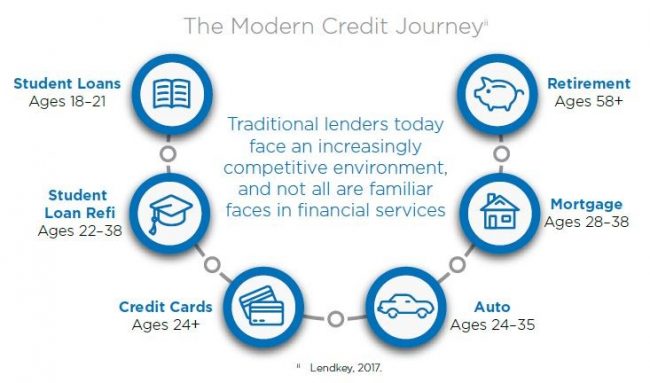

How Non-Traditional Mortgages May Impact Your Credit

Non-traditional mortgages can have a major impact on your credit. If you are considering taking out a nontraditional mortgage, it’s important to understand how this type of loan could affect your credit score. Because nontraditional mortgages are often more risky than traditional mortgages, lenders charge higher interest rates and require more stringent qualification criteria. This means that if you take out a nontraditional mortgage, it could have a negative effect on your credit score. Additionally, if you fail to make timely payments on your loan, it could further damage your credit score. On the other hand, if you make all of your payments on time, you could benefit from a higher credit score. Ultimately, it’s important to weigh the pros and cons of a nontraditional mortgage before signing on the dotted line.

Shopping Around for the Right Non-Traditional Mortgage

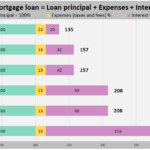

Shopping around for the right non-traditional mortgage is key to finding the best deal for your situation. Taking the time to explore your options and compare mortgage rates can help you save thousands of dollars in the long run. With so many lenders to choose from, it’s important to look at all of them and ask the right questions. Find out what type of non-traditional mortgage is available and what the interest rates are. Be sure to inquire about any fees or other expenses associated with the loan. Ask about the repayment terms, as well as the length of the loan and the type of collateral required. Comparing lenders and their various offerings can help you find the best deal for your unique needs. Don’t be afraid to negotiate as well; many lenders are willing to work with customers to get the best terms available. Shopping around for the right non-traditional mortgage can save you time and money, so make sure to do your research and get the best deal for your situation!