Are you in the market for a fixed-rate mortgage? We’ve got you covered! This comprehensive guide will walk you through the process, from understanding the basics to finding the best rate for your needs. We’ll break down the different types of fixed-rate mortgages, the advantages and disadvantages, as well as provide you with tips to help you make the best choice. By the end, you’ll be ready to make an informed decision and secure the best fixed-rate mortgage for your situation.

What is a Fixed-Rate Mortgage?

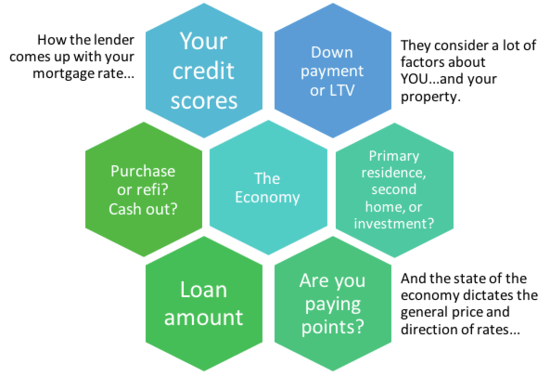

If you’re looking to buy a home, you may have heard about fixed-rate mortgages. But what is a fixed-rate mortgage? Basically, it’s a loan that has the same interest rate for the entire life of the loan. That means that you won’t be affected by changes in the market or have to worry about your rate changing over time. With a fixed-rate mortgage, you know exactly what your monthly payments will be and you don’t have to worry about them going up or down. This makes budgeting much easier and allows you to plan ahead. Plus, you can usually lock in a lower interest rate with a fixed-rate mortgage, which can save you money over the life of the loan. If you’re looking for a reliable and cost-effective way to finance your home, a fixed-rate mortgage could be the perfect option for you.

Advantages of a Fixed-Rate Mortgage

Fixed-rate mortgages are one of the most popular home loan options out there. They come with a number of advantages, making them an attractive option for many home buyers. One of the main advantages of a fixed-rate mortgage is that your interest rate will remain the same for the entire duration of the loan, meaning you can stick to a budget without worrying about fluctuating rates. There’s also no need to worry about rising rates as they won’t affect your mortgage payments. Plus, with a fixed-rate mortgage, you can easily plan for the future, as you’ll know exactly what your payments will be over the entire life of the loan. Additionally, a fixed-rate mortgage can provide peace of mind, as you won’t have to worry about the possibility of rising interest rates. With a fixed-rate mortgage, you can rest assured that your payments won’t suddenly increase. So, if you’re looking for a home loan option that offers security, stability, and predictability, a fixed-rate mortgage could be the perfect choice for you.

Disadvantages of a Fixed-Rate Mortgage

Fixed-rate mortgages have some drawbacks, too. For one, if you’re in a situation where interest rates are dropping, you could be stuck with a higher rate than the market. Also, if you’re planning to move or refinance in the near future, you’ll likely need to pay a hefty prepayment penalty which can add up quickly. Lastly, you’ll be limited to the same rate for the duration of the loan term, so if rates go up, you’re stuck with a higher rate than you could have gotten if you had chosen an adjustable-rate mortgage. Bottom line, fixed-rate mortgages are great if you’re looking for peace of mind and don’t think you’ll be moving or refinancing anytime soon, but they may not be the best option if you’re looking for flexibility.

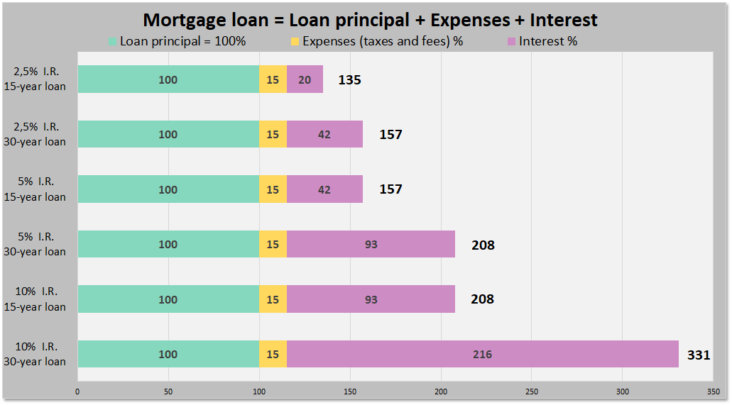

How to Calculate the Interest of a Fixed-Rate Mortgage

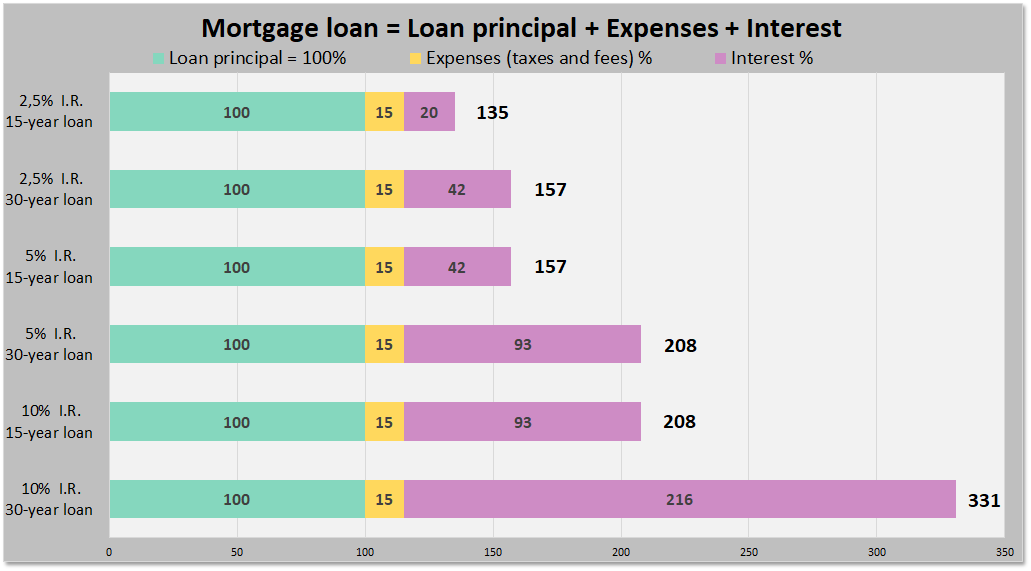

Calculating the interest of a fixed-rate mortgage doesn’t have to be intimidating or complicated. You can easily figure out how much you’ll be spending in interest each month by understanding the math behind it. First, you’ll need to know the loan amount, the interest rate, and the number of payments you’ll make. From there, you’ll calculate the periodic interest rate by dividing the annual interest rate by 12, then multiply that by the loan amount. Finally, multiply the periodic interest rate by the number of payments to get the total amount of interest you will be paying over the life of your loan. With a few simple calculations, you can easily determine your monthly interest payments and plan your budget accordingly.

Tips to Avoid Plagiarism When Writing About a Fixed-Rate Mortgage

If you’re writing about a fixed-rate mortgage, it’s important to avoid plagiarizing. Even if you’re not intentionally trying to pass off someone else’s work as your own, it can still be a problem. To stay on the safe side, here are some tips to help you avoid plagiarism when writing about a fixed-rate mortgage. First, do your own research. Look at different sources and make sure to cite any facts or ideas that you reference. Second, be creative. Come up with your own examples and analogies to explain the concept. Third, rewrite other sources in your own words. Summarize the main points and make sure to give credit to the original author. Finally, get a second opinion. Have someone else read your work to make sure it’s original and not too close to an existing source. By following these tips, you can be sure to avoid plagiarism and write a great article about a fixed-rate mortgage.