Are you a non-profit employee burdened with overwhelming student loan debt? Discover the world of Student Loan Forgiveness for Non-Profit Employees: What You Need to Know, and unlock the secrets to significantly easing your financial stress. As a dedicated worker contributing to the greater good, you deserve relief from the crippling weight of student loans. Dive into our comprehensive guide, which will unveil the ins and outs of various forgiveness programs, qualifying criteria, and application processes. Say goodbye to sleepless nights and hello to financial freedom as you take the first step towards a debt-free future!

Understanding the Basics of Student Loan Forgiveness for Non-Profit Employees: Eligibility and Requirements

In order to reap the benefits of student loan forgiveness for non-profit employees, it is crucial to understand the eligibility and requirements. To qualify, you must be employed full-time at a qualifying non-profit organization or government agency, and have a Direct Loan or Federal Family Education Loan (FFEL) that is consolidated into a Direct Consolidation Loan. Additionally, you must be enrolled in an income-driven repayment plan and make 120 qualifying monthly payments under the Public Service Loan Forgiveness (PSLF) program. By staying informed about these essential criteria, you can successfully navigate the process and potentially save thousands on your student loans.

Public Service Loan Forgiveness (PSLF) Program: A Comprehensive Guide for Non-Profit Workers

The Public Service Loan Forgiveness (PSLF) Program is a crucial resource for non-profit employees seeking relief from student loan debt. Designed specifically for those dedicated to serving their communities, this program provides a pathway to financial freedom by forgiving the remaining balance on qualifying federal loans after making 120 eligible monthly payments. To maximize your PSLF benefits, it’s essential to understand the program’s requirements, including eligible loans and employment, qualifying payment plans, and necessary documentation. Our comprehensive guide will navigate you through the PSLF process, empowering non-profit workers to achieve their financial goals while continuing to make a meaningful impact in their communities.

Income-Driven Repayment Plans: Maximizing Your Benefits as a Non-Profit Employee with Student Loans

As a non-profit employee with student loans, it’s essential to understand Income-Driven Repayment (IDR) plans to maximize your loan forgiveness benefits. IDR plans adjust your monthly payments based on your income and family size, ensuring you’re not overburdened financially. By enrolling in an IDR plan, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), or Revised Pay As You Earn (REPAYE), you can benefit from lower monthly payments and potential loan forgiveness after 20-25 years. However, for non-profit employees in Public Service Loan Forgiveness (PSLF) programs, the remaining loan balance may be forgiven tax-free after 120 qualifying payments. Make sure to explore these IDR options and choose the best plan that suits your financial situation and long-term goals.

Navigating the Application Process: Tips and Resources for Non-Profit Workers Seeking Student Loan Forgiveness

Navigating the application process for student loan forgiveness can be challenging for non-profit employees. To simplify the process and maximize your chances of success, it’s essential to stay organized and informed. Begin by researching the specific requirements for Public Service Loan Forgiveness (PSLF) and ensure your non-profit job qualifies. Next, diligently track your qualifying payments and submit the Employment Certification Form (ECF) annually or whenever you change employers. Utilize resources like the PSLF Help Tool and seek guidance from your loan servicer to avoid common mistakes. By staying proactive and well-informed, you can pave the way to financial relief and student loan forgiveness.

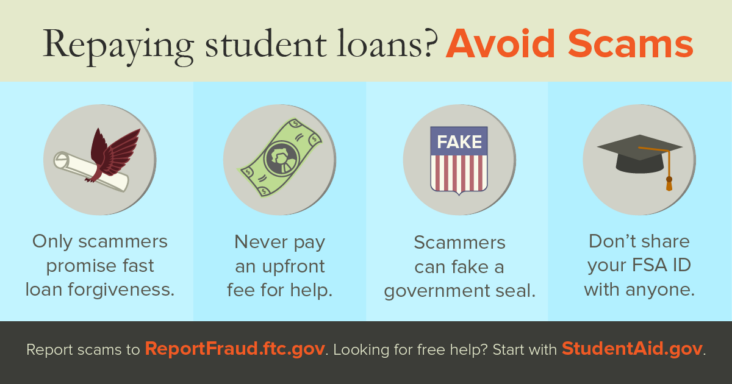

Common Mistakes and Misconceptions: Debunking Myths About Student Loan Forgiveness for Non-Profit Employees

One of the most prevalent misconceptions surrounding student loan forgiveness for non-profit employees is that all loans and employment situations qualify. In reality, only federal Direct Loans and specific types of non-profit employment are eligible for Public Service Loan Forgiveness (PSLF). Many borrowers mistakenly believe that enrolling in any repayment plan will lead to forgiveness, but only Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans qualify. It’s essential to understand these nuances and avoid common mistakes to maximize the benefits of student loan forgiveness for non-profit employees.