Are you considering taking out a high ratio mortgage to purchase your dream home? There are many factors to consider when making this important decision, including the risks and benefits associated with high ratio mortgages. In this article, we will explain what a high ratio mortgage is and how it works, so you can make an informed decision. We will also look at the advantages and disadvantages of high ratio mortgages so you can decide if it is the right choice for you. With this knowledge, you can make a decision that is right for your financial future.

What Are the Benefits of a High Ratio Mortgage?

A high ratio mortgage is a great way to get into the housing market with minimal down payment. With a high ratio mortgage, you can get a home loan even if you don’t have a large down payment. There are plenty of benefits that come with a high ratio mortgage, making it an attractive option for many. One of the main benefits of a high ratio mortgage is that you don’t need to come up with a large down payment. This means you don’t have to spend months saving up and you can get into your dream home quicker. Furthermore, with a high ratio mortgage, you can get lower interest rates and longer repayment terms. This can make it easier to manage your monthly mortgage payments and help you avoid falling into debt. High ratio mortgages are a great option for those who are looking to get into the housing market but don’t have the necessary funds for a large down payment.

What to Consider Before Taking Out a High Ratio Mortgage

Before taking out a high ratio mortgage, there are a few things to consider. First, you need to make sure that you understand the terms and conditions of the mortgage. Make sure to read through the fine print carefully and ask questions if anything is unclear. Also, consider the interest rate and whether or not it is a fixed or variable rate. The interest rate is important because it can determine how much your monthly payments will be and how long it will take to pay off the loan. Additionally, you should consider the length of the loan and whether it is a closed or open mortgage. Lastly, it is important to determine how much you can realistically afford to pay each month and whether you will be able to commit to making those payments. Taking out a high ratio mortgage can be a great way to purchase a home, but it is important to understand the risks and be prepared to make the payments.

How Do High Ratio Mortgages Work?

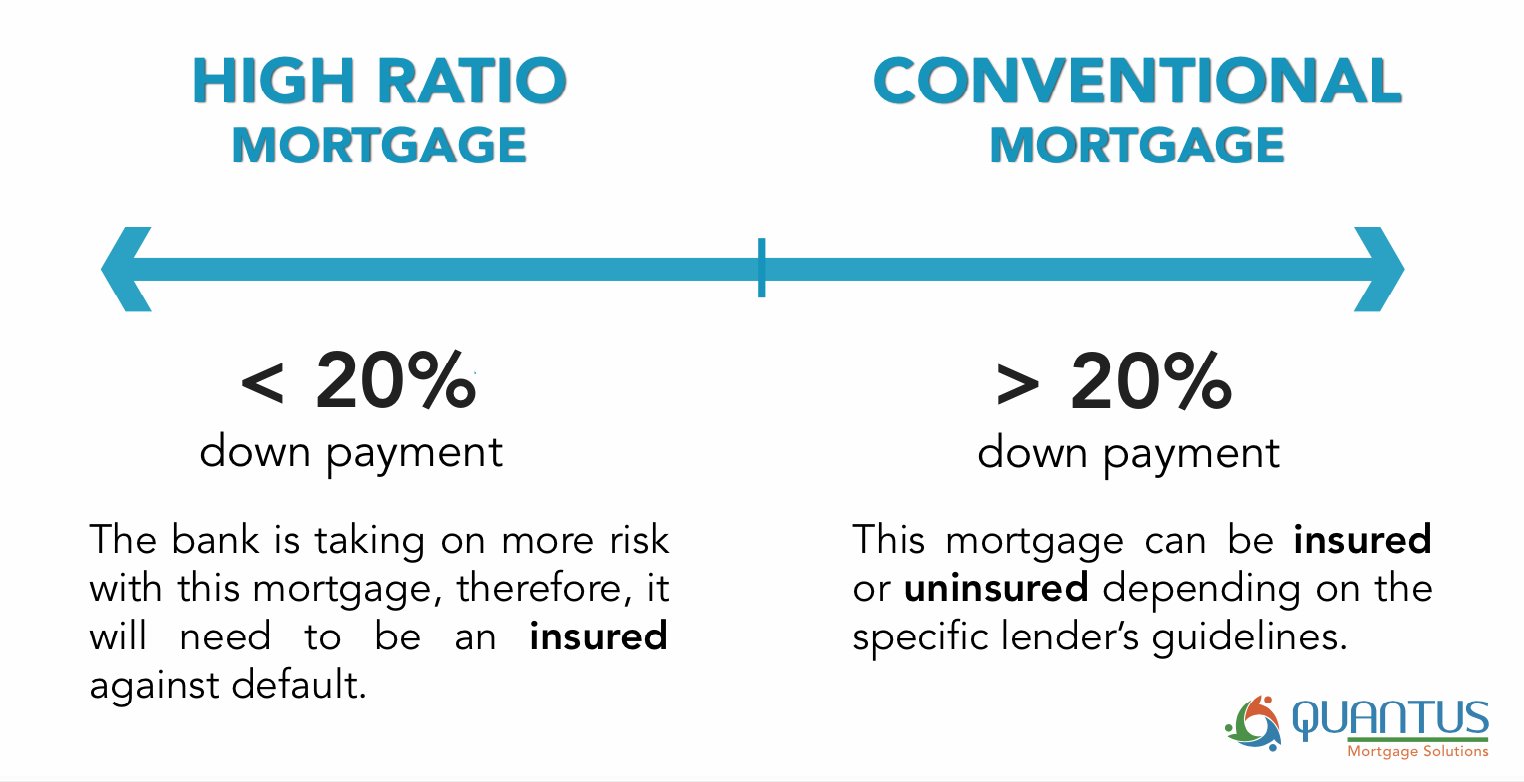

High ratio mortgages work by allowing you to borrow more money than you would normally be able to with a conventional loan. With a high ratio mortgage, you can purchase a home with as little as 5% down. The remaining 95% is covered by your lender. This is great news for first-time homebuyers, as it allows them to buy a home without having to come up with a large down payment. The downside to a high ratio mortgage is that you will likely have to purchase mortgage insurance to protect the lender in case you default on the loan. The premiums for mortgage insurance can be expensive, so it’s important to weigh the costs before deciding if a high ratio mortgage is the right choice for you.

What Types of Borrowers Qualify for High Ratio Mortgages?

High ratio mortgages are great for borrowers who don’t have a large down payment and want to get into the real estate market. These mortgages are typically offered to first-time buyers, those with limited income, or those who can’t meet the traditional down payment requirements. To qualify for a high ratio mortgage, borrowers must have a good credit score, be able to demonstrate an ability to make the monthly payments, and have enough income to cover the mortgage payments. The borrower will also need to provide proof of income, and a down payment of at least 5% of the purchase price. Although high ratio mortgages require a higher interest rate, they are a great way for people who don’t have a lot of money saved up to get into homeownership.

Is a High Ratio Mortgage Right for You?

If you’re considering a high ratio mortgage, it’s important to ask yourself if it’s the right choice for you. High ratio mortgages require a higher down payment than conventional mortgages, usually 20% or more. This means that you need to have a substantial amount of money saved up in order to qualify. Additionally, high ratio mortgages usually come with higher interest rates and more stringent requirements, so it’s important to make sure you can handle the financial burden before signing on the dotted line. Ultimately, it comes down to your financial situation and what makes the most sense for you. Do your research and talk to an expert before making your decision.