Are you struggling to stay afloat in a sea of debt and seeking a solid lifeline to financial freedom? Look no further! Our comprehensive guide on creating a successful debt management plan is here to help you navigate those treacherous financial waters with ease. With practical steps, expert advice, and proven strategies, we’ll equip you with the essential tools to conquer your debts and achieve lasting financial stability. Dive into our wealth of knowledge and start your journey towards a debt-free future today!

Assess your financial situation thoroughly.

Begin your debt management journey by taking a deep dive into your financial situation. Analyze your income, expenses, assets, and outstanding debts to get a clear picture of where you stand. This crucial step helps you identify potential areas for improvement and sets the foundation for a personalized, effective debt management plan.

Prioritize debts, focus on high-interest.

In order to crush your debt like a boss, it’s crucial to prioritize your debts by focusing on high-interest ones first. This savvy move can save you heaps of cash in the long run. So, roll up your sleeves and start tackling those pesky high-interest debts to pave the way towards financial freedom!

Create a realistic monthly budget.

Creating a realistic monthly budget is the foundation of a successful debt management plan. To start, track your income and expenses to identify areas where you can cut back. Prioritize your essential expenses and eliminate unnecessary ones. This will help you allocate funds effectively towards paying off debts while maintaining a comfortable lifestyle.

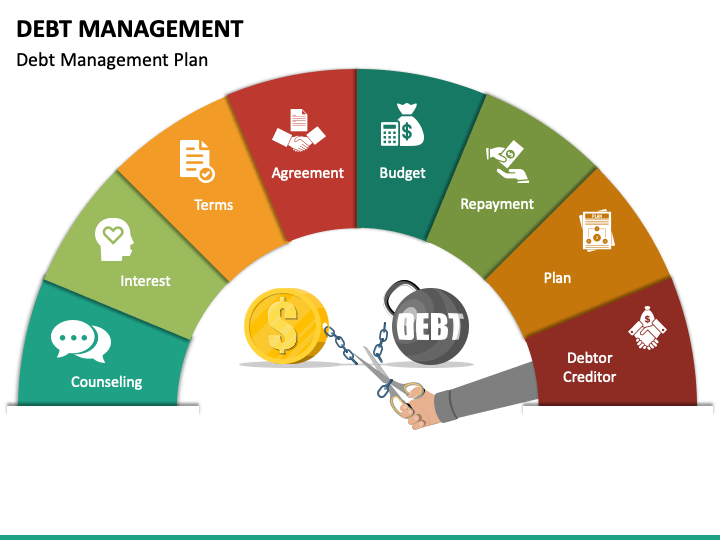

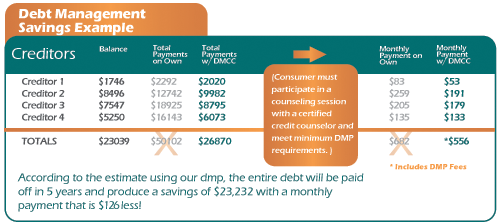

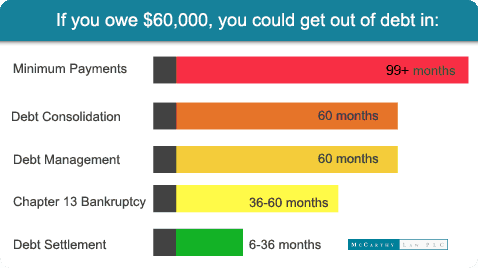

Consider debt consolidation or negotiation.

One effective strategy to streamline your debt management plan is by exploring debt consolidation or negotiation. Combining multiple debts into one loan or negotiating better terms with your creditors can not only simplify your debt repayment process but also potentially lower interest rates and monthly payments, ultimately helping you regain control over your finances faster.

Track progress, adjust plan accordingly.

Keep a close eye on your debt management journey by consistently tracking your progress. Regularly evaluate your financial status and make necessary adjustments to your plan. Staying flexible and adaptive to changes will ensure that you’re always on the right path towards a debt-free life.

Seek professional guidance if needed.

Don’t hesitate to seek professional guidance if needed for your debt management plan. Reaching out to financial experts, like credit counselors, can provide valuable insights and support to ensure your plan is effective and sustainable. Remember, asking for help isn’t a failure – it’s a smart move towards financial freedom.