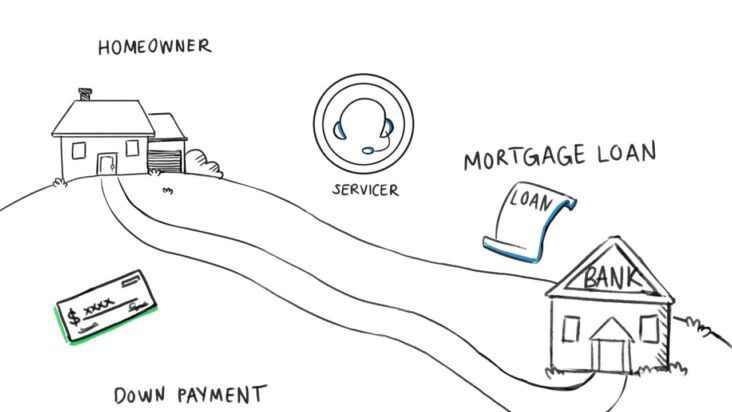

A mortgage servicer is a financial institution that handles the day-to-day management of a mortgage loan. It is responsible for collecting payments from borrowers, processing the payments, and managing the loan’s escrow account. Understanding the role of a mortgage servicer is essential for homeowners looking to purchase a home or refinance their current mortgage. In this article, we’ll explain what a mortgage servicer is and why it’s important.

An Overview of Mortgage Servicers

A mortgage servicer is a financial institution that handles the day-to-day management of a mortgage loan. This can include collecting payments from the borrower, paying taxes and insurance, and responding to customer service inquiries. The servicer is responsible for maintaining the loan in accordance with the terms of the loan agreement, as well as any applicable laws and regulations. The servicer may also provide loss mitigation services, such as loan modifications, to help borrowers stay in their homes. Mortgage servicers play an important role in the mortgage lending industry, as they are responsible for ensuring that loans are managed in a timely and efficient manner. By leveraging their expertise and experience, mortgage servicers are able to help borrowers stay on track with their loan payments and avoid foreclosure.

The Benefits of Using a Mortgage Servicer

A mortgage servicer can provide a variety of benefits for homeowners. One of the most beneficial aspects of using a mortgage servicer is that they can make the process of obtaining a loan much simpler and more streamlined. They can negotiate with lenders on behalf of the borrower, helping to ensure that the borrower receives the best possible terms and interest rate. Additionally, a mortgage servicer can handle the day-to-day tasks associated with the loan, such as collecting payments, sending out monthly statements, and processing escrow payments. This can help homeowners stay on track with their loan payments and avoid any potential late fees or penalties. Finally, a mortgage servicer can provide borrowers with personalized customer service, ensuring that all of their questions are answered quickly and efficiently. This can help borrowers feel more confident in their loan and the process of obtaining it.

The Responsibilities of a Mortgage Servicer

A mortgage servicer is responsible for a variety of tasks related to the management of a mortgage loan. The primary responsibility of a mortgage servicer is to collect payments from the borrower and distribute them to other parties. This includes processing payments, disbursing funds to investors, and maintaining records of payments. Mortgage servicers may also assist borrowers in resolving delinquent accounts and offer loan modifications. It is also the servicer’s responsibility to respond to inquiries from borrowers, as well as manage collections and foreclosures. In addition, mortgage servicers must follow all applicable laws and regulations related to mortgage servicing, such as the Real Estate Settlement Procedures Act (RESPA). By carrying out all of these duties, the mortgage servicer helps to ensure that the loan is properly serviced and managed throughout its life.

How to Choose a Mortgage Servicer

Choosing the right mortgage servicer is an important decision. You’ll want to make sure the servicer is reputable and provides the services you need. Here are some tips on how to choose the best mortgage servicer for your needs:First, consider the servicer’s reputation. Look for reviews online, as well as customer feedback. This will help you get a clear picture of the servicer’s reliability. Additionally, you can look for third-party ratings of the servicer. These ratings help to give you a comprehensive understanding of the servicer’s services.Next, consider the servicer’s fees. Look for fees associated with the mortgage servicing. This includes late fees, origination fees, and other applicable fees. Make sure the fees are reasonable and in line with what other servicers are charging.Finally, look for customer service. The best mortgage servicers will have customer service representatives available 24/7. This will ensure that you can get help whenever you need it. Additionally, look for a servicer that offers a variety of contact options, such as phone, email, and chat. This will help ensure that you can get help quickly and easily. By following these tips, you can make sure that you

Common Mistakes to Avoid When Working with Mortgage Servicers

Common mistakes to avoid when working with mortgage servicers include not understanding the loan terms, not knowing the foreclosure process, not understanding the payment options, and not asking questions. It is important to understand the terms of the loan and the foreclosure process in order to be aware of the risks and obligations involved. Additionally, it is important to understand the payment options available and to ask questions to the servicer if there is confusion. Not understanding the loan terms, the foreclosure process, or payment options can lead to missed payments or difficulty in resolving disputes. Asking questions to the servicer is the best way to ensure that all information is clear and both parties are on the same page. Furthermore, it is important to make sure all paperwork is filled out completely and accurately, and to make sure to keep copies of all documents. Doing so can help to avoid delays or issues with payment processing. Taking the time to understand the loan terms, the foreclosure process, payment options, and asking questions to the servicer can help make the process of working with a mortgage servicer smoother and less stressful.