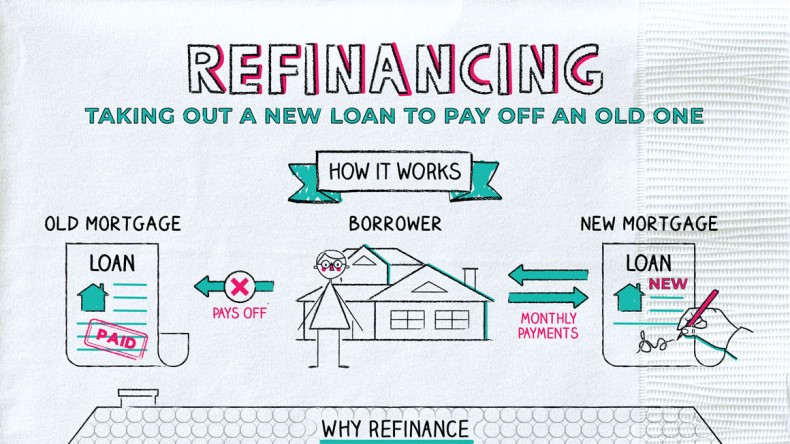

Refinancing your mortgage can be a great way to save money on your monthly payments and reduce your interest rate. It can also help you pay off your loan faster and potentially save you thousands of dollars in the long run. In this article, you’ll learn what a mortgage refinance is, how it works, the pros and cons of refinancing, and if it’s the right move for you. So, if you’re looking to save on your mortgage, read on to learn more about refinancing your mortgage!

What Are the Benefits of Refinancing a Mortgage?

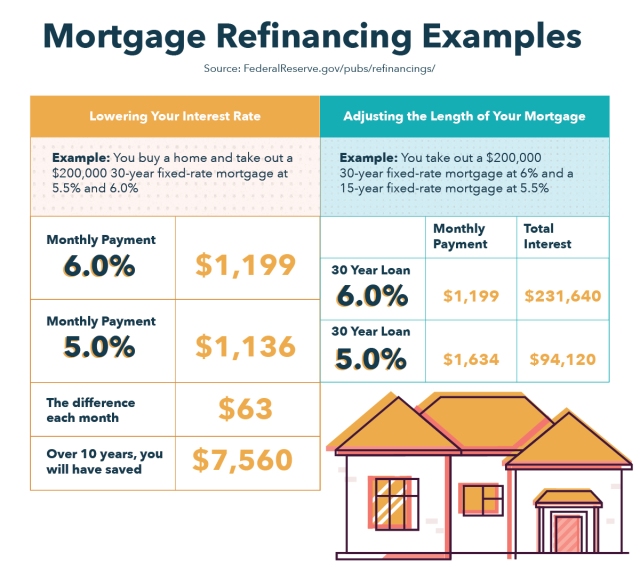

Refinancing a mortgage can provide a range of benefits to homeowners. One of the most significant is the potential to save money. By refinancing, borrowers can reduce their monthly payments by replacing their current mortgage with one with a lower interest rate. This can help to free up cash flow for other expenses. Another benefit is the potential to shorten the term of the loan, which can ultimately lead to lower interest payments over the term of the loan. Furthermore, refinancing can be used to access the equity in a home, which can be used for home improvement projects or other large purchases. Refinancing can also be used to consolidate existing debt into a single loan. This can help to save money by reducing the overall amount of interest paid on the loan. Ultimately, the decision to refinance a mortgage can be a beneficial one that helps to save money and improve financial stability.

What Are the Costs and Risks Involved in Refinancing?

Refinancing a mortgage can be a great way to save money, but it is important to be aware of the costs and risks involved. The costs associated with refinancing a mortgage can include closing costs, appraisal fees, title fees, and other fees. Additionally, if you’re refinancing from an adjustable-rate mortgage to a fixed-rate mortgage, you may pay a higher rate than you’d pay if you stayed with your current loan. It is important to consider the total costs of refinancing, as they may outweigh the potential savings. In addition to costs, there are also risks to consider. Refinancing a mortgage can result in a longer repayment period and additional interest payments. This can be beneficial if you’re looking to lower your monthly payments, but it can also mean paying more in interest over the life of the loan. Additionally, if you end up in a situation where you can’t make the payments on the refinance, you could end up with a foreclosure or a short sale. It is important to consider all of the risks and costs associated with refinancing before making a decision.

What Are the Different Types of Refinancing?

There are several different types of refinancing options available to homeowners. The most common type of refinance is a rate and term refinance, which replaces an existing loan with one at a lower interest rate and/or a longer repayment term. This type of refinancing is typically used to reduce monthly payments and/or shorten the length of the loan. Cash-out refinancing is another popular option, which allows homeowners to borrow against their home’s equity to get cash for home improvements, debt consolidation, or other expenses. The borrower receives the difference between their existing loan balance and the new loan amount in cash. Lastly, a streamline refinance is a special type of refinance program offered by the Federal Housing Administration (FHA) that helps homeowners who are current on their mortgage payments reduce their interest rate and monthly payments without having to provide additional documentation or extensive paperwork. No matter which type of refinancing you choose, it’s important to understand the terms and conditions of your new loan to ensure you’re getting the best deal possible. Before you commit to any refinancing option, make sure to shop around and compare rates and terms from different lenders. Additionally, you may want to consider consulting a financial advisor to help you evaluate the potential costs and benefits of

What Factors Should I Consider Before Refinancing?

When considering whether to refinance your mortgage, there are several important factors to keep in mind. Your current financial situation, including your credit score and debt-to-income ratio, should be taken into account. It’s also important to know what type of loan you currently have and what type of loan you’re considering. Additionally, you should compare the interest rate, fees, and term length of the new loan with your current loan. Knowing the total cost of the new loan, including closing costs, is essential. Finally, it’s important to consider your overall financial goals and the length of time you plan to stay in your home. With all of these factors in mind, you can make an informed decision about whether refinancing your mortgage is right for you.

What Are the Steps Involved in Refinancing a Mortgage?

Refinancing your mortgage is a complex process that requires careful research and consideration. It’s important to understand the steps involved in refinancing, so you can make an informed decision about whether or not it’s the right move for you. The first step in refinancing is to assess your current financial situation and determine if it makes sense to refinance. You’ll need to take a look at your current mortgage rate and compare it to the rates available in the market. You’ll also need to consider any fees associated with refinancing, such as closing costs. Once you’ve decided to move forward with refinancing, you’ll need to decide on the type of loan you want. You’ll need to compare different loan types and lenders, to ensure you’re getting the best terms and rate. Once you’ve selected a lender and loan, you’ll need to submit an application and provide all of the necessary documents. Once everything is approved, you’ll need to sign all of the paperwork and wait for your loan to be funded. Once you’ve completed all of these steps, you’ll be ready to start enjoying the benefits of a lower interest rate and