Discover the crucial role student loan servicers play in helping borrowers navigate the often-complex world of loan forgiveness programs. As a key player in managing your education debt, these servicers hold the key to unlocking financial relief through various forgiveness options. In this comprehensive guide, we’ll delve into their responsibilities, how they can affect your journey towards debt freedom, and the essential steps you should take to maximize your benefits. Don’t let confusion and misinformation hold you back – empower yourself with the knowledge to make informed decisions and achieve a brighter financial future.

Navigating the Complex World of Student Loan Servicers: Key Players in Loan Forgiveness Programs

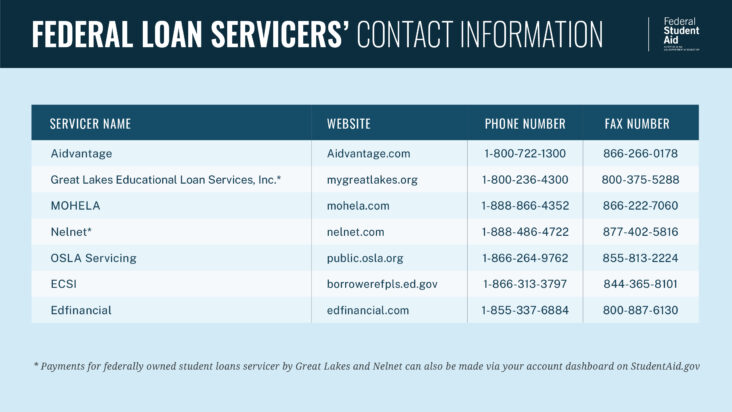

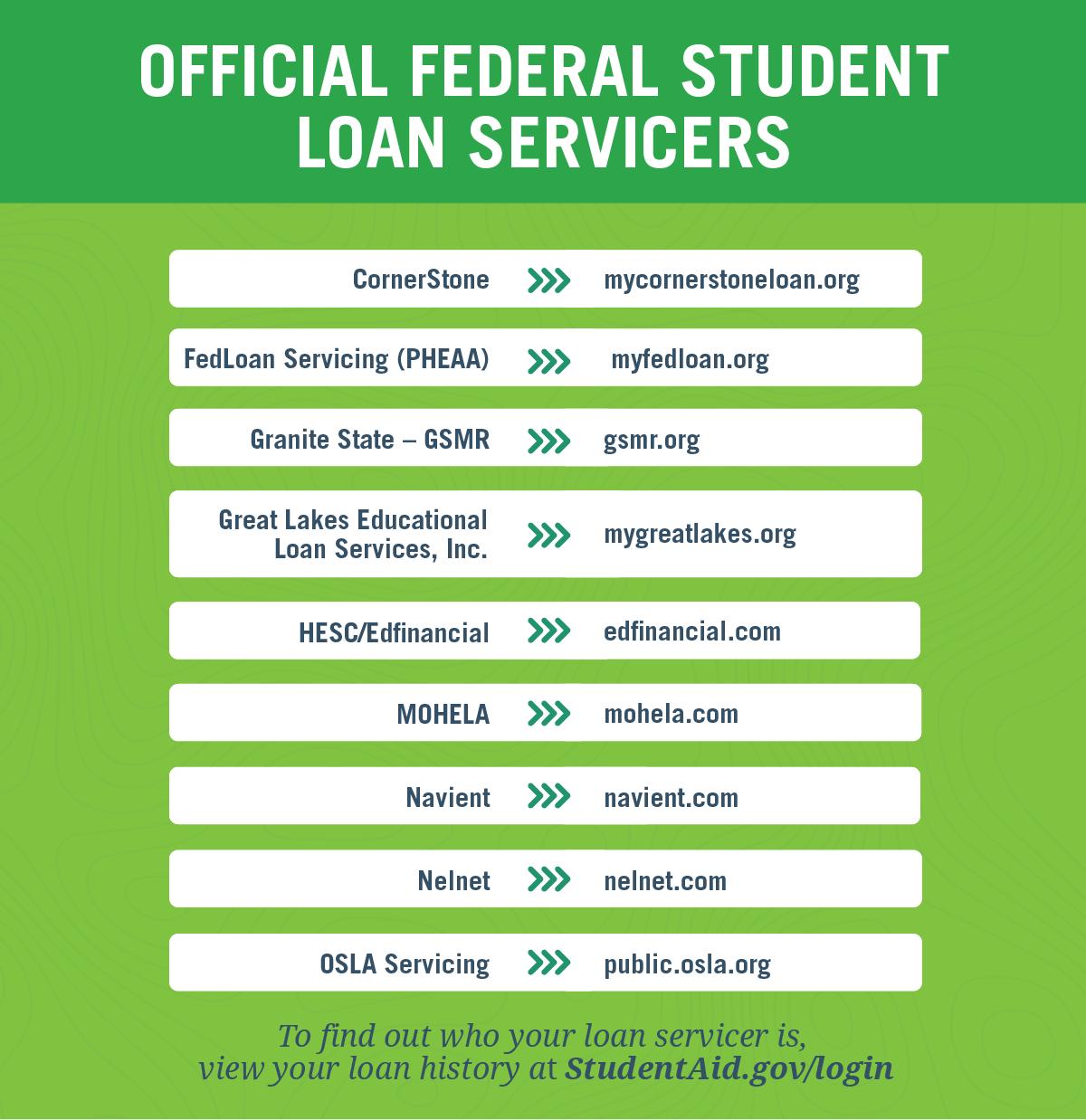

Navigating the complex world of student loan servicers is an essential aspect of understanding loan forgiveness programs. These key players act as intermediaries between borrowers and the federal government, playing a vital role in managing repayment plans, processing payments, and providing essential guidance on forgiveness options. By keeping up to date with the latest industry developments and regulatory changes, borrowers can make informed decisions about their student loan repayment strategy. Harnessing the expertise of loan servicers is crucial in maximizing the benefits of forgiveness programs and ensuring a smoother journey towards financial freedom.

Student Loan Servicers: Your Essential Guide to Maximizing Forgiveness Benefits

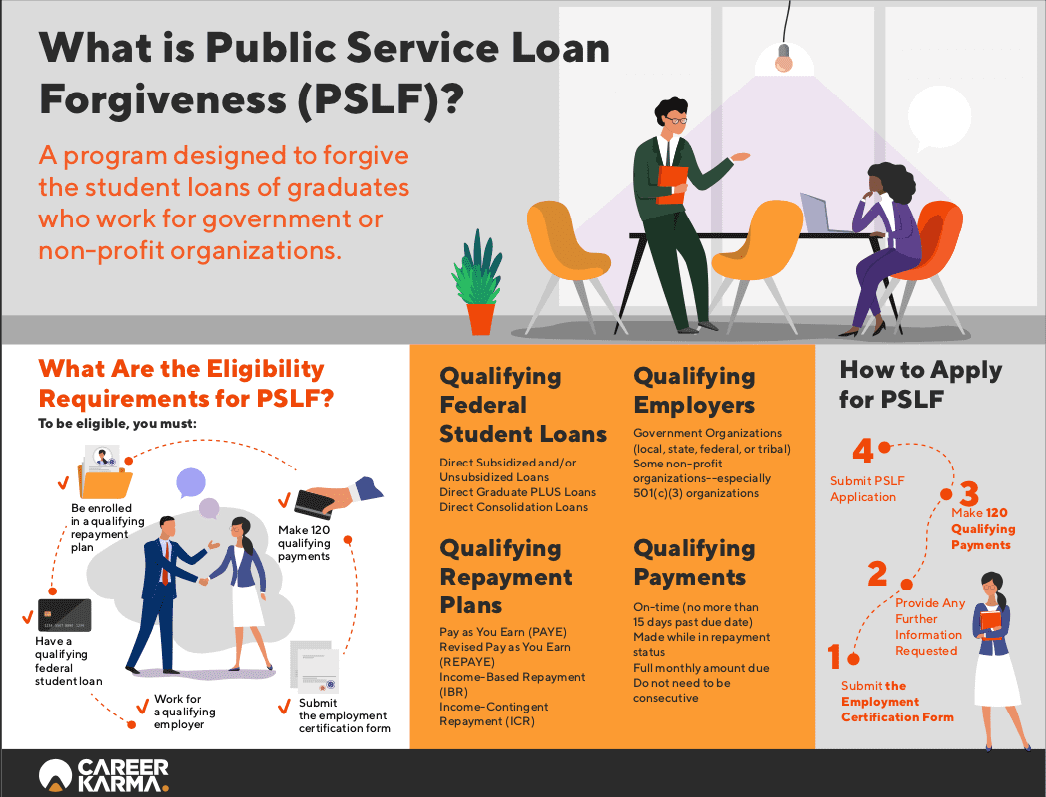

Student Loan Servicers play a crucial role in managing and navigating forgiveness programs for borrowers. Maximizing your forgiveness benefits requires a comprehensive understanding of your servicer’s responsibilities, which include processing payments, handling deferments, and providing essential guidance on various forgiveness options. To optimize the potential for loan forgiveness, stay well-informed about your servicer’s role, maintain clear communication, and proactively seek assistance in evaluating your eligibility for programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. By effectively engaging with your student loan servicer, you can efficiently work towards reducing your debt and securing a financially stable future.

Demystifying the Role of Student Loan Servicers in Federal Forgiveness Programs

In order to effectively navigate the complexities of student loan forgiveness programs, it is essential to understand the role of student loan servicers. These entities act as intermediaries between borrowers and the federal government, managing loan accounts and providing key information on repayment options, including forgiveness programs. Demystifying the role of student loan servicers in federal forgiveness programs is crucial in order to alleviate stress and confusion surrounding eligibility, application processes, and program requirements. By gaining a comprehensive understanding of their functions and responsibilities, borrowers can make informed decisions and maximize the benefits of these valuable financial relief programs.

Unlocking the Secrets to Successful Student Loan Forgiveness: How Servicers Can Help or Hinder Your Progress

Unlocking the secrets to successful student loan forgiveness can be a game-changer in reducing your debt burden. However, the role of student loan servicers in facilitating these programs is often overlooked. Servicers are your go-to resource for information, guidance, and support in navigating forgiveness options. Unfortunately, not all servicers are created equal, and some may hinder your progress through misinformation or lack of assistance. To optimize your chances of loan forgiveness, it’s crucial to understand the role of servicers, maintain open communication, and diligently research your options. By doing so, you can work collaboratively with your servicer and maximize your potential for debt relief.

The Critical Connection between Student Loan Servicers and Forgiveness Programs: What Every Borrower Needs to Know

The Critical Connection between Student Loan Servicers and Forgiveness Programs is an essential aspect every borrower should comprehend. Student loan servicers play a pivotal role in managing your loans, assisting with repayment strategies, and guiding you through the process of obtaining forgiveness. It is crucial to maintain an open line of communication with your servicer and stay informed on the latest updates and requirements for forgiveness programs. By understanding their role, you can effectively navigate your way towards a financially stable future and maximize the benefits of loan forgiveness programs, ultimately reducing the burden of student debt.