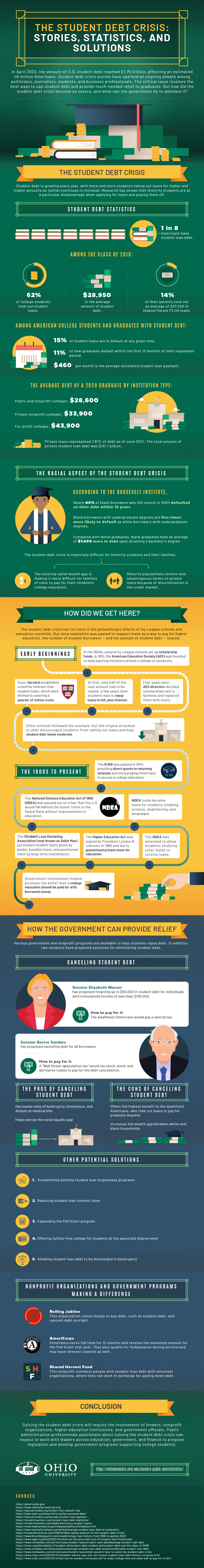

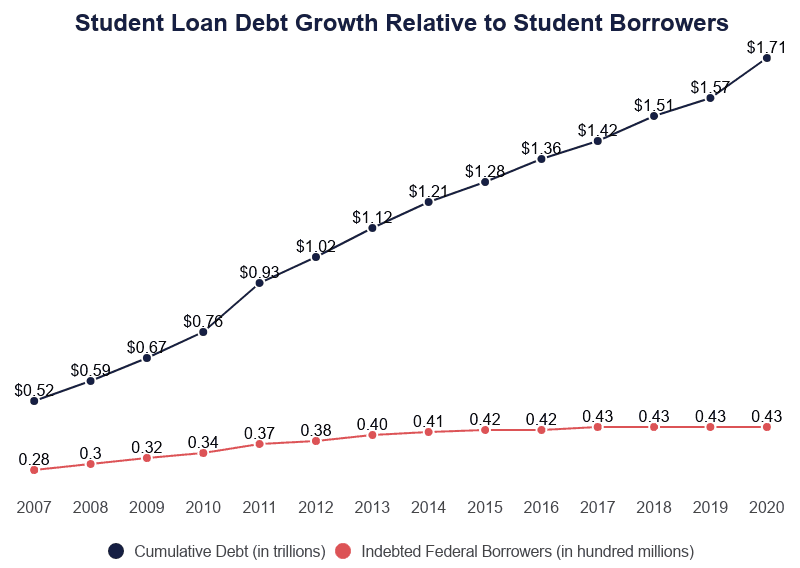

Are you drowning in a sea of student loan debt? You’re not alone. The student debt crisis has reached astronomical heights, with millions of borrowers struggling to stay afloat. But there’s hope on the horizon: student loan forgiveness programs can offer a lifeline to those sinking under the weight of staggering loan balances. Dive into our comprehensive guide to explore how student loan forgiveness can not only rescue individuals but also contribute to alleviating the national student debt crisis. Discover the options, eligibility criteria, and how these programs can pave the way to financial freedom for countless graduates. Get ready to breathe a sigh of relief and embark on the path to a debt-free future.

Exploring the Different Types of Student Loan Forgiveness Programs and Their Impact on the Debt Crisis

In order to understand how student loan forgiveness can alleviate the debt crisis, it’s essential to explore the various types of forgiveness programs available and their impact on borrowers’ financial situations. These programs, such as Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) forgiveness, target specific groups of borrowers with the aim of easing their debt burden. By offering debt relief to eligible individuals, these initiatives not only reduce the overall student loan debt but also provide a much-needed financial respite for hardworking professionals in public service, education, and other sectors. Ultimately, understanding and promoting these student loan forgiveness programs could be a crucial step in addressing the wider student debt crisis.

The Role of Income-Driven Repayment Plans in Reducing Student Loan Burdens and Promoting Forgiveness

Income-Driven Repayment (IDR) plans play a crucial role in alleviating student loan burdens and expediting forgiveness. These flexible alternatives adjust monthly payments based on borrowers’ income and family size, ensuring that repayment remains manageable while still progressively reducing debt. With options such as Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR), IDR plans empower borrowers to regain control over their financial future. Furthermore, after 20-25 years of consistent payments, any remaining balance is forgiven, providing a light at the end of the tunnel for those struggling with overwhelming student debt.

Public Service Loan Forgiveness: A Viable Solution to the Student Debt Crisis for Those in Public Service Professions

Public Service Loan Forgiveness (PSLF) presents a viable solution to the student debt crisis, specifically for those dedicated to public service professions. This program encourages graduates to pursue essential yet often lower-paying careers, such as teaching, nursing, or social work, by offering debt relief after 10 years of qualifying payments. By optimizing the accessibility and awareness of PSLF, more individuals can alleviate their financial burdens and contribute positively to society. With the student loan crisis reaching unprecedented levels, promoting PSLF is a crucial step in addressing this issue and fostering a workforce dedicated to serving their communities.

Analyzing the Economic Benefits of Student Loan Forgiveness in Stimulating Consumer Spending and Boosting the Economy

Analyzing the Economic Benefits of Student Loan Forgiveness in Stimulating Consumer Spending and Boosting the Economy is crucial in understanding its potential impact. When graduates are burdened with excessive student loan debt, their ability to contribute to the economy through consumer spending, homeownership, and entrepreneurship is significantly reduced. By implementing student loan forgiveness programs, a substantial portion of the population can redirect their finances toward stimulating economic growth. This increased spending power can lead to job creation, improved credit scores, and a healthier housing market, ultimately driving a more robust and sustainable economy. Addressing the student debt crisis through loan forgiveness can have far-reaching benefits for both individuals and the nation as a whole.

Addressing the Criticisms of Student Loan Forgiveness and Evaluating Alternative Solutions to the Student Debt Crisis

Addressing the Criticisms of Student Loan Forgiveness and Evaluating Alternative Solutions to the Student Debt Crisis, it’s essential to acknowledge the concerns surrounding the potential impact on taxpayers and moral hazard. Critics argue that forgiving student loans might encourage future borrowers to take on debt irresponsibly, expecting similar relief. However, by implementing targeted forgiveness programs, such as income-driven repayment plans and public service loan forgiveness, we can ensure that the benefits are directed towards those who truly need it. Furthermore, exploring alternative options like tuition-free college, employer-sponsored repayment assistance, and financial literacy education can help alleviate the student debt crisis in a more comprehensive and sustainable manner.