Are you looking to secure the perfect home loan for your dream property? With so many mortgage lenders in the market, finding the right one can be an overwhelming task. Fear not, as we have carefully curated a list of the Top 10 Best Mortgage Lenders: A Comprehensive Comparison to simplify your search. In this article, we will dive deep into the unique features, competitive rates, and exceptional customer service each lender offers, ensuring that you make an informed decision that suits your needs. So, let’s unlock the door to your ideal mortgage lender and turn your homeownership dreams into reality!

Quicken Loans: Quicken Loans is the largest online mortgage lender in the United States

Quicken Loans, the largest online mortgage lender in the United States, has consistently been a top choice for homebuyers seeking an efficient and convenient loan experience. With their cutting-edge technology and streamlined loan process, Quicken Loans offers a hassle-free approach to securing a mortgage. Their user-friendly website and intuitive mobile app make it easy for borrowers to compare loan options and complete the application process from the comfort of their own homes. As a testament to their exceptional customer service, Quicken Loans has earned the highest overall satisfaction rating among primary mortgage originators for 11 consecutive years, according to the J.D. Power U.S. Primary Mortgage Origination Satisfaction Study.

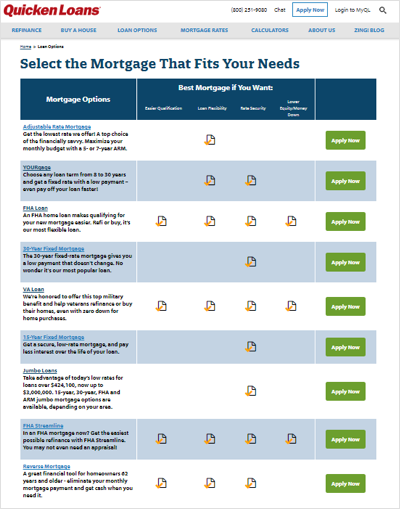

They offer a variety of loan options, including conventional, FHA, and VA loans

Discover the top 10 best mortgage lenders in our comprehensive comparison, where we delve into their diverse loan offerings, such as conventional, FHA, and VA loans. These mortgage lenders cater to a variety of borrowers, including first-time homebuyers, veterans, and those with a lower credit score. By providing a wide range of loan options, these lenders make homeownership more accessible to various income levels and financial backgrounds. Explore our in-depth analysis of these mortgage lenders to find the perfect fit for your unique home-buying journey. Boost your chances of securing the best mortgage rate and terms by comparing the top lenders in the industry.

They are known for their excellent customer service and their ability to close loans quickly

When searching for the perfect mortgage lender, exceptional customer service and speedy loan closings are key factors to consider. Our Top 10 Best Mortgage Lenders list highlights those who excel in these areas, ensuring a seamless and stress-free home buying experience. These top-notch lenders understand the importance of meeting your individual needs and providing personalized solutions. With their dedicated teams, streamlined processes, and advanced technology, they consistently deliver quick closings without compromising on service quality. Choose one of these top mortgage lenders for a hassle-free home buying journey, and enjoy the peace of mind knowing you’re in capable hands.

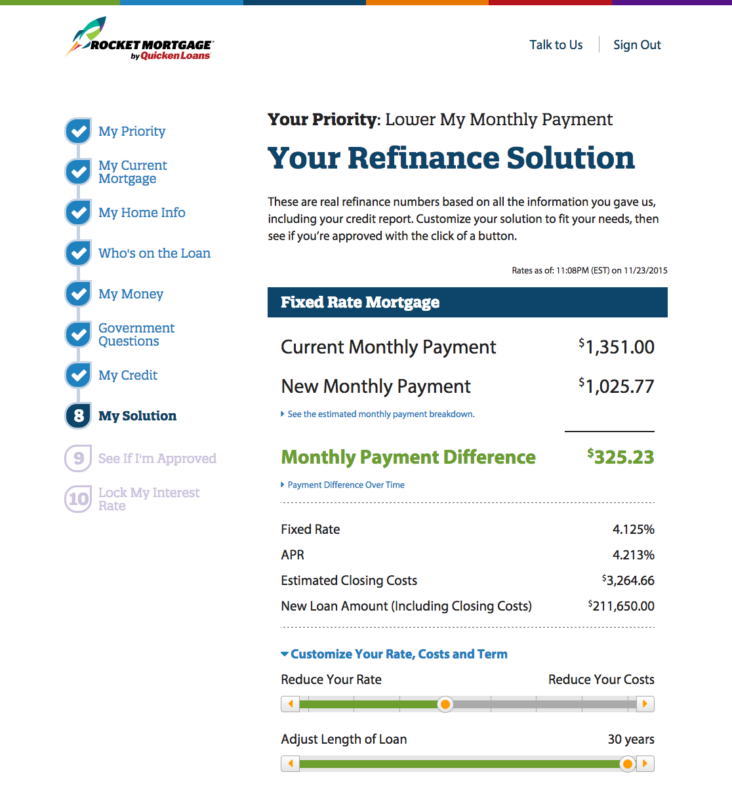

Some of the benefits of choosing Quicken Loans include their online application process, competitive interest rates, and flexible loan terms.

Quicken Loans, a renowned mortgage lender, is known for its seamless online application process that simplifies and speeds up the home loan experience. Their competitive interest rates and flexible loan terms make them a top choice for borrowers seeking an affordable mortgage tailored to their needs. Additionally, Quicken Loans is reputed for its outstanding customer service and innovative technology-driven solutions, which have earned them a leading position in the mortgage industry. By choosing Quicken Loans, you can be assured of a hassle-free, personalized, and efficient mortgage process.

Bank of America: Bank of America is one of the largest banks in the country and offers a wide range of mortgage options, including fixed-rate mortgages, adjustable-rate mortgages, FHA loans, and VA loans

Bank of America, a renowned financial institution in the United States, provides an extensive selection of mortgage solutions catering to diverse homebuyers’ needs. As a top mortgage lender, they deliver competitive fixed-rate mortgages, adjustable-rate mortgages, and government-backed FHA and VA loans. By leveraging their expertise and top-tier customer service, Bank of America ensures a seamless borrowing experience for potential homeowners. With user-friendly online tools and personalized guidance, they simplify the mortgage application process, empowering borrowers to make informed decisions on their homeownership journey. Discover the value of working with a trusted lender like Bank of America for your mortgage needs.

They also offer special programs for first-time homebuyers and affordable housing assistance programs

Discover the top 10 best mortgage lenders in our comprehensive comparison, catering to the unique needs of first-time homebuyers and those seeking affordable housing assistance programs. These lenders offer a wide range of mortgage options, competitive rates, and personalized guidance, ensuring a seamless homebuying experience. Whether you’re searching for low down payment options, reduced closing costs, or flexible credit score requirements, our in-depth analysis will help you find the perfect mortgage lender. Don’t let the complexities of home financing hold you back – let our expert insights guide you to the ideal mortgage solution for your dream home.

Some of the benefits of choosing Bank of America include their extensive branch

Bank of America stands out as one of the top mortgage lenders, offering numerous advantages to borrowers seeking diverse loan options. With an extensive branch network spread across the nation, customers can easily access in-person assistance to navigate through the mortgage process. Additionally, their comprehensive online platform provides valuable tools, such as an intuitive mortgage calculator and seamless application process, allowing borrowers to make informed decisions from the comfort of their homes. Furthermore, Bank of America’s competitive interest rates and diverse loan programs cater to the needs of various homebuyers, ensuring a tailored mortgage solution for each individual.