Are you ready to embark on the exciting journey of purchasing your dream home? Look no further! Our comprehensive guide on Tips for Buying a House will provide you with invaluable insights and expert advice to ensure a seamless and rewarding experience. From choosing the perfect location to negotiating the best deal, we’ve got you covered. So, whether you’re a first-time homebuyer or an experienced investor, dive into our treasure trove of tips and secure the keys to your perfect abode. Don’t miss out on this essential read to unlock the door to your future haven!

Determine your budget: Before you start looking for a house, it’s essential to assess your financial situation and determine your budget

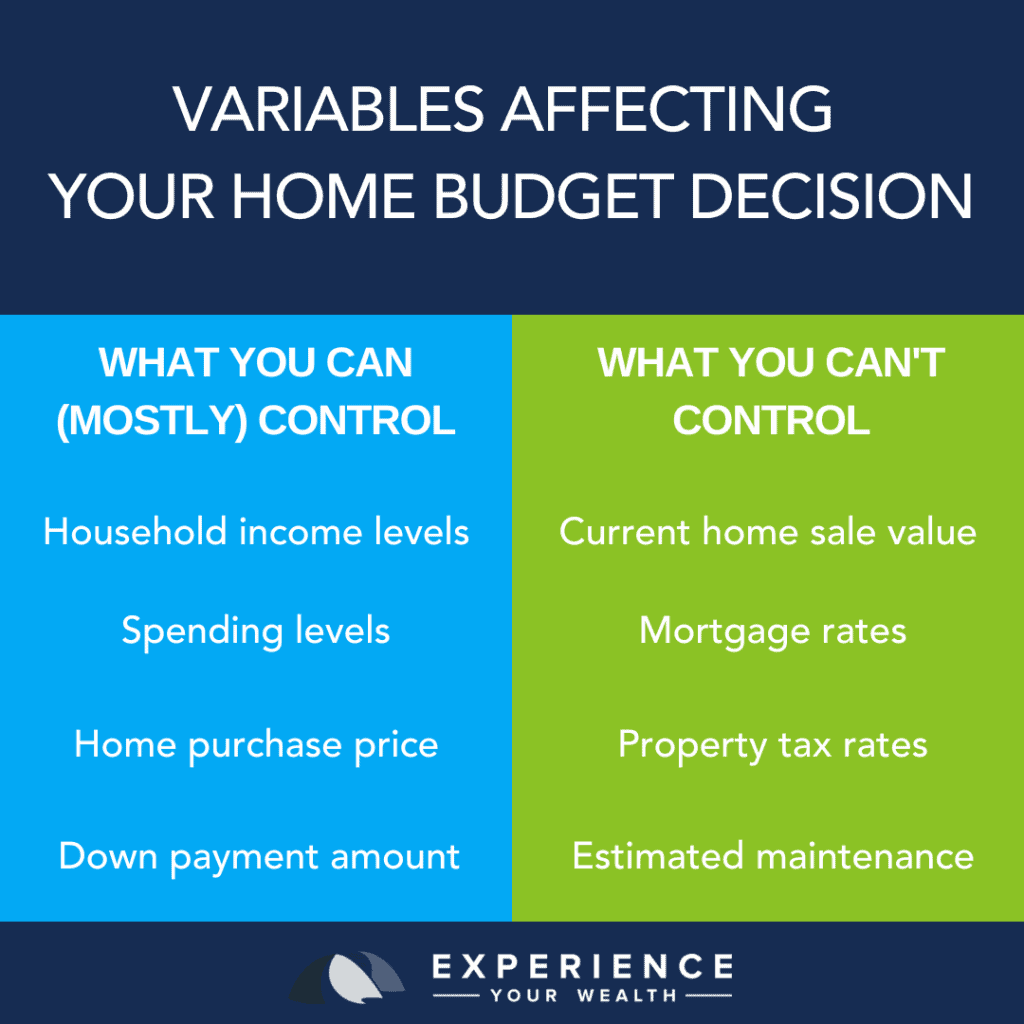

When embarking on the journey to homeownership, establishing your budget is a crucial first step. To accurately determine your financial capabilities, consider your monthly income, savings, expenses, and debt obligations. Evaluate your debt-to-income ratio to ensure you can comfortably manage mortgage payments alongside other financial commitments. Additionally, research various mortgage options and interest rates to identify a suitable loan that aligns with your financial goals. By carefully assessing your budget, you can confidently narrow down your search and avoid the stress of falling in love with a home outside your affordability range.

This includes calculating your monthly income, expenses, savings, and debts

When embarking on the journey to homeownership, it’s crucial to have a clear understanding of your financial situation. This begins with calculating your monthly income, expenses, savings, and debts. By evaluating these factors, you’ll be able to determine how much you can realistically afford and avoid potential financial strain. Start by listing all sources of income, including your salary, investments, and any side hustles. Next, itemize your monthly expenses such as rent, utilities, groceries, and entertainment. Don’t forget to account for any outstanding debts, like student loans or credit card balances. Lastly, assess the amount you’re able to save each month. This comprehensive financial analysis will streamline the home-buying process, ensuring you find a property that suits both your needs and budget.

This will help you determine the price range of a house you can afford, keeping in mind the additional costs such as down payment, closing costs, and ongoing expenses like property taxes, insurance, and maintenance.

When embarking on the exciting journey of buying a house, it is crucial to evaluate your financial capabilities and ascertain a realistic price range you can afford. This not only includes factoring in the initial costs, such as the down payment and closing costs, but also the ongoing expenses that come with homeownership. Remember to account for property taxes, insurance premiums, and routine maintenance costs in your budget. By diligently assessing your financial situation and considering these additional expenses, you will be well-equipped to find a home that aligns with your long-term financial goals, ensuring a smooth and stress-free home-buying experience.

Get pre-approved for a mortgage: A mortgage pre-approval is a written commitment from a lender stating the maximum loan amount they are willing to offer you

Obtaining a mortgage pre-approval is a crucial step in the home buying process, as it provides you with a clear understanding of your budget and showcases your financial credibility to sellers. By getting pre-approved, you’ll have a better idea of the price range you can afford, which will help you narrow down your property search efficiently. Moreover, this will strengthen your negotiating position and increase your chances of securing your dream home. To enhance your chances of getting pre-approved, maintain a good credit score, provide accurate financial documentation, and approach multiple lenders to compare the best mortgage rates and terms.

This process involves checking your credit score, verifying your income and employment, and assessing your debt-to-income ratio

When preparing to purchase a house, it’s essential to assess your financial health to ensure a smooth and successful home-buying experience. One crucial aspect involves reviewing your credit score, as this number can significantly impact the mortgage rates and terms you’ll be offered. Additionally, lenders will verify your income and employment to determine your financial stability and ability to repay the loan. Lastly, evaluating your debt-to-income ratio (DTI) is vital, as this percentage showcases your monthly debt payments compared to your gross monthly income. A favorable DTI ratio suggests responsible borrowing habits, increasing your chances of securing an attractive mortgage offer. By taking these steps, you’ll be well-prepared for the exciting journey of homeownership.

Getting pre-approved not only shows sellers that you are a serious buyer

Securing a pre-approval for your mortgage is a crucial step in the home buying process, as it demonstrates to sellers that you are a serious and qualified buyer. By getting pre-approved, you not only provide a clear indication of your financial readiness, but also gain a competitive edge in the fast-paced real estate market. Moreover, a pre-approval helps streamline your house hunting experience by narrowing down your options to properties within your budget, thereby saving you time and effort. Overall, obtaining a mortgage pre-approval is a smart move that enhances your credibility, strengthens your negotiation power, and ultimately, brings you closer to your dream home.