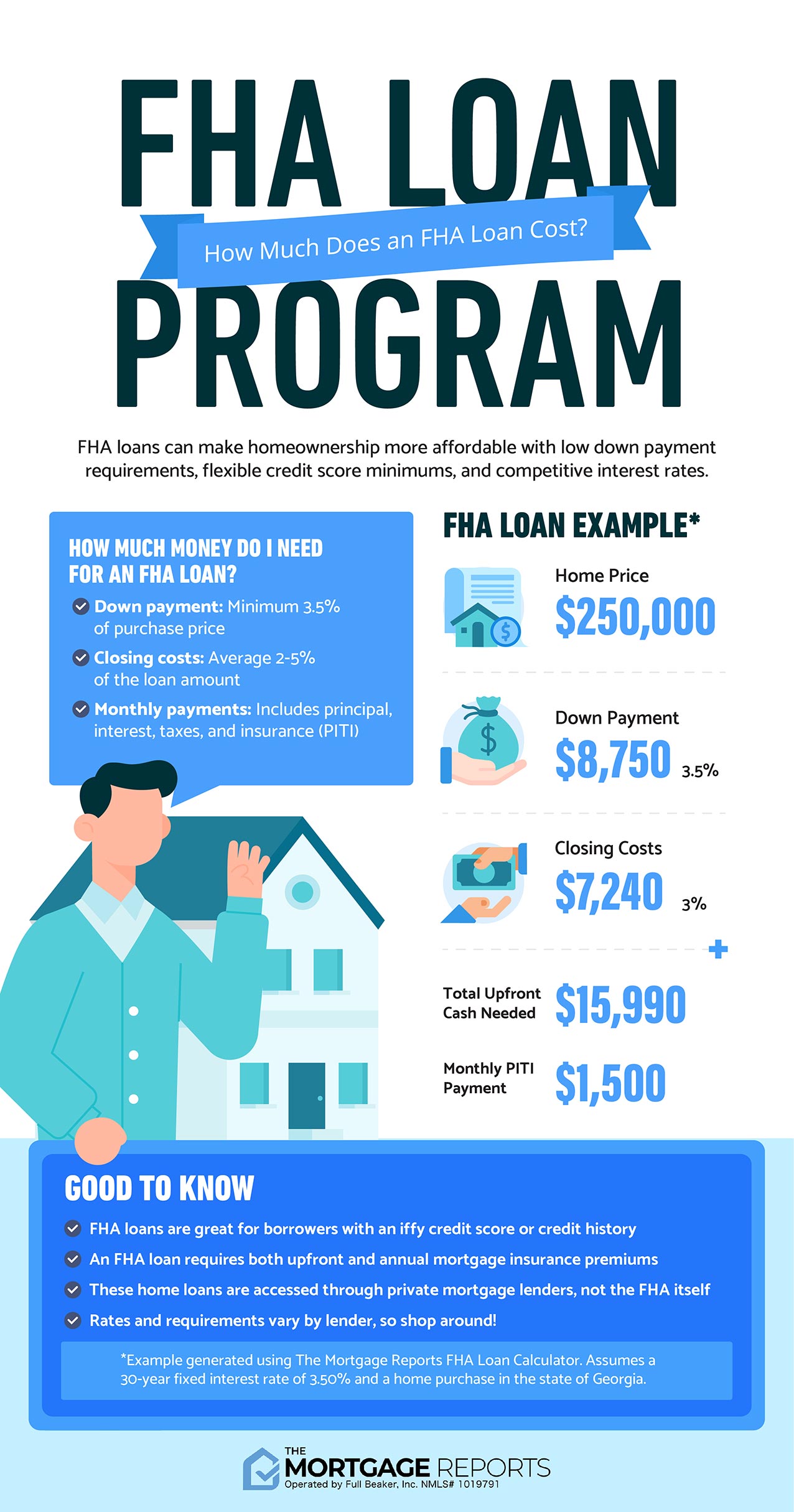

Welcome to the Ultimate Guide to FHA Loans – your one-stop destination for mastering the ins and outs of these incredible home financing options! As you embark on the exciting journey of homeownership, it’s crucial to understand the benefits, requirements, and process of securing an FHA loan. With lower down payments and more lenient credit requirements, FHA loans have helped millions of Americans achieve their dream of owning a home. Whether you’re a first-time homebuyer or looking to refinance, our comprehensive guide will walk you through everything you need to know about FHA loans, unlocking the doors to a brighter financial future. Let’s dive in and explore the world of FHA loans together!

Understand FHA Loans: Benefits, Basics

Dive into the world of FHA loans and discover their incredible benefits! These government-backed beauties are perfect for first-time homebuyers, offering a low down payment option, flexible credit score requirements, and competitive interest rates. Don’t miss out on this game-changing opportunity; learn the basics and start your journey towards homeownership today!

Determine Eligibility: Credit, Income, Employment

Kickstart your FHA loan journey by assessing your eligibility! Keep your credit score in check (aim for 580+), ensure a stable income stream, and flaunt that employment history. Knowing where you stand helps you navigate the FHA process with ease, bringing you closer to your dream home. #AdultingGoals

Gather Required Documents: Proof, Information

Ready to dive into the world of FHA loans? Hold up, you’ll first need to gather some essential documents! Prep yourself by having proof of income, employment, and credit score handy. Also, gather information on your debts and assets. Stay organized, and you’ll be one step closer to snagging that dream home!

Choose FHA-Approved Lender: Research, Compare

Ready to dive into the world of FHA loans? Start by choosing an FHA-approved lender! Do your research and compare lenders to find the best fit for your needs. Keep your eyes open for competitive rates, top-notch customer service, and a seamless application process to score the ultimate home financing deal. Get ready to make your homeownership dreams a reality!

Complete Loan Application: Assistance, Accuracy

Nailing your FHA loan application can be a breeze with the right assistance and attention to accuracy. This ultimate guide will be your BFF, helping you avoid common pitfalls and up your chances of getting approved. So, let’s dive into the deets and make sure you’re on the right track to secure that dream home!

Close Loan: Inspection, Appraisal, Finalize

Seal the deal with your FHA loan by acing the final steps – inspection, appraisal, and finalizing! Get your future home professionally inspected to uncover any hidden issues. Nail the appraisal process by ensuring the property’s value meets FHA standards. Finally, gather all necessary documents and prepare to celebrate your dream home! 🎉🏠💯