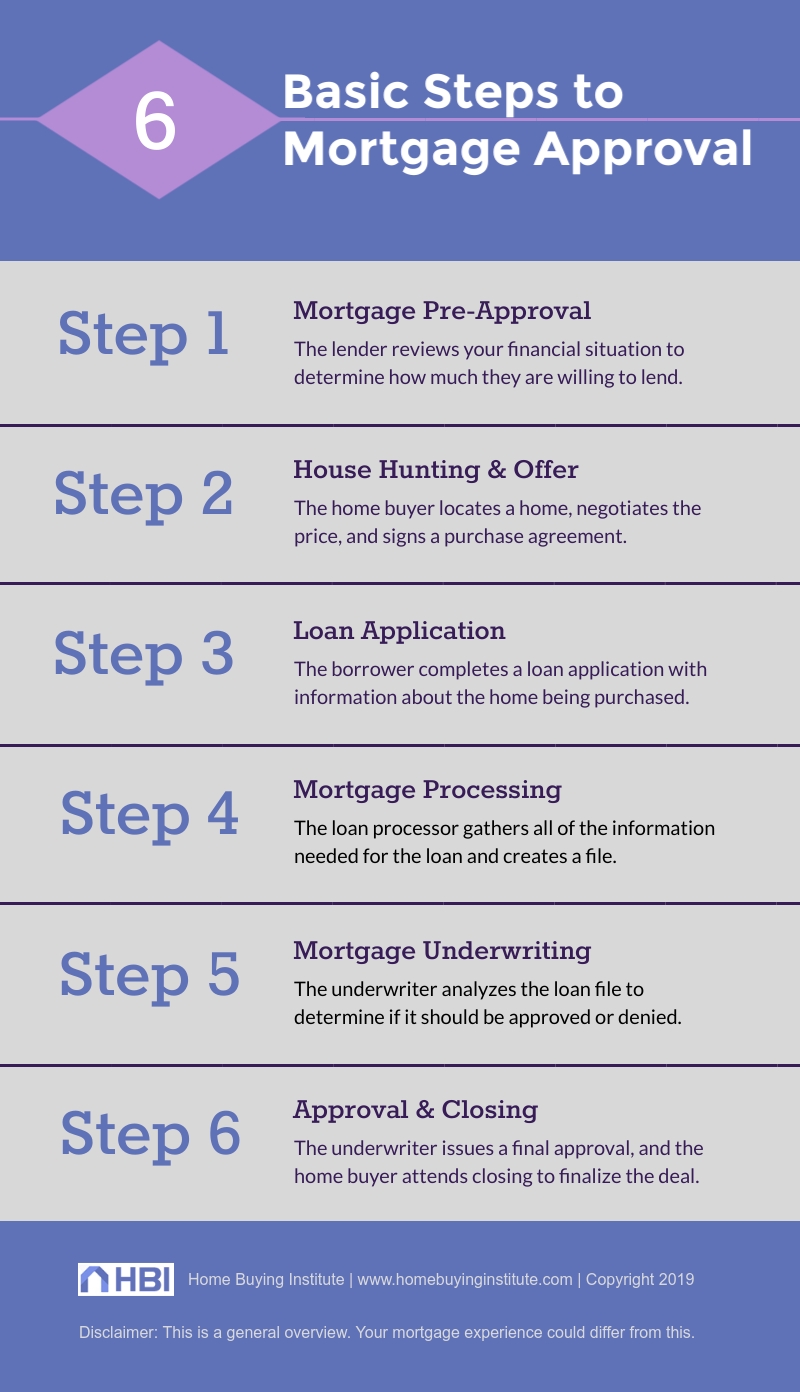

Embark on the exciting journey of homeownership with confidence by mastering the mortgage pre-approval process! Our comprehensive guide provides the essential know-how to seamlessly navigate through this crucial phase, ensuring you’re one step closer to securing your dream home. From understanding key terminologies to decoding lender requirements, we’ve got you covered with invaluable insights, expert advice, and strategic tips to help you ace the pre-approval process and unlock the door to your future home. Don’t let mortgage jargon intimidate you—dive into our easy-to-follow guide and pave the way to a successful pre-approval today!

Assess financial standing and credit.

Embark on your mortgage pre-approval journey by evaluating your financial health and credit score. A solid credit standing paves the way for better loan offers, so keep tabs on your credit report and strive for a debt-to-income ratio below 43% to increase your chances of securing that dream home.

Research mortgage types and lenders.

Get ready to dive into the world of mortgage types and lenders! It’s crucial to understand the differences between fixed-rate, adjustable-rate, or government-backed loans to find the perfect fit for your needs. Plus, comparing various lenders such as banks, credit unions, and online mortgage providers will help you score the best deal. Keep it savvy and smart, folks!

Gather necessary documentation and paperwork.

Kickstart your mortgage pre-approval journey by assembling all essential documents beforehand. This crucial step fast-tracks the process and showcases your reliability as a borrower. Compile paperwork like pay stubs, tax returns, bank statements, and credit reports, ensuring you’re well-prepared to ace the mortgage pre-approval game.

Submit pre-approval application to lender.

Ready to kickstart your home-buying journey? Start by submitting your mortgage pre-approval application to your chosen lender. This crucial step will give you a clear idea of your budget, showcase your serious intent to sellers, and ultimately, speed up the home-buying process. So, get pre-approved and take a confident leap towards homeownership!

Review received pre-approval letter thoroughly.

Don’t overlook the importance of your mortgage pre-approval letter! This crucial document reveals vital info about your loan terms and conditions. To avoid any unpleasant surprises, examine it thoroughly and ensure you fully comprehend every detail. Being well-informed will make your home-buying journey smoother and more enjoyable.

Begin house hunting within budget.

Embark on your house hunting adventure with confidence, knowing your budget is on point! With a mortgage pre-approval, you’ll have a clear understanding of your spending power, making it easier to find your dream home within your price range. Happy hunting, savvy homebuyers! #PreApproved #BudgetFriendlyHomeSearch