Discover the crucial role title insurance plays in safeguarding your most valuable investment – your home! In today’s ever-evolving real estate landscape, the importance of title insurance cannot be overstated. This comprehensive guide delves into the world of title insurance, revealing how it protects you from unforeseen legal and financial pitfalls, and ensures a smooth and secure property ownership experience. Join us as we unravel the mysteries of title insurance and arm you with the knowledge you need to confidently navigate the home-buying process with peace of mind. Don’t let title troubles stand in the way of your dream home – read on to learn more!

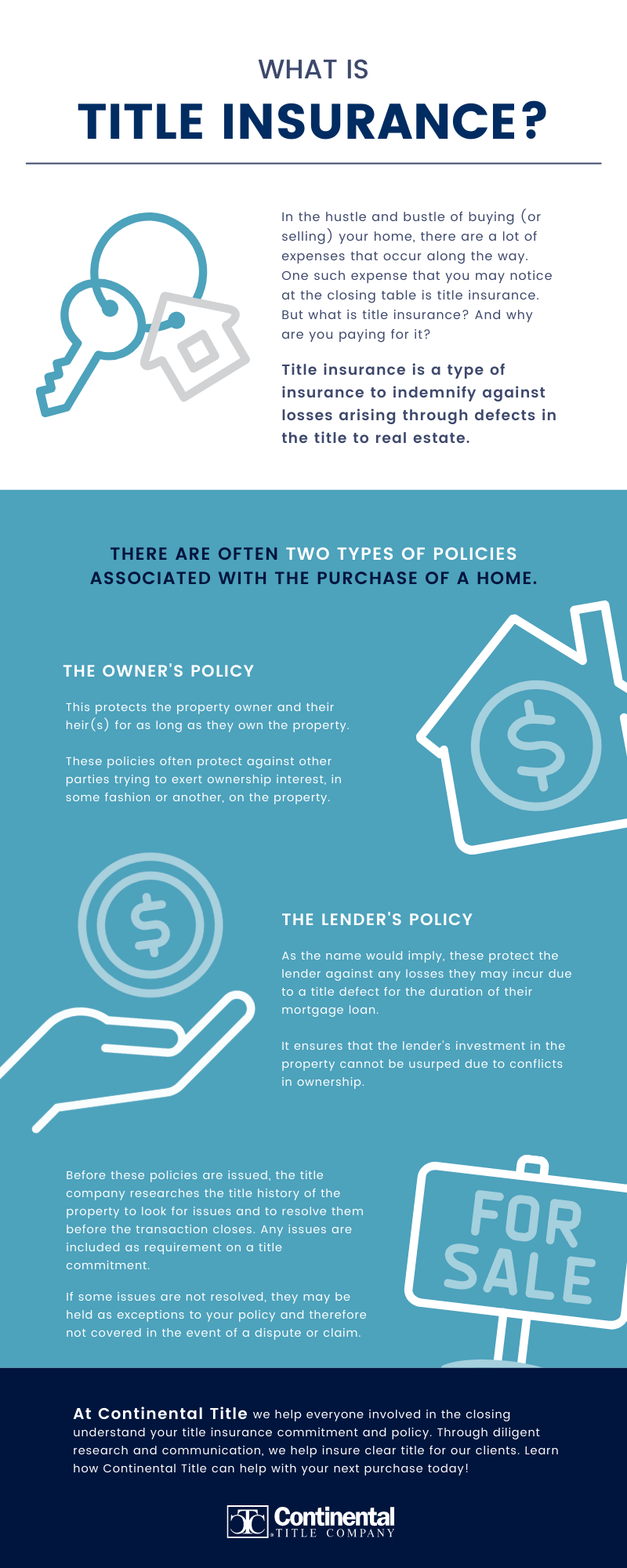

Protection against legal claims and disputes: Title insurance is essential as it provides protection to the property owner and the lender against any legal claims or disputes that may arise due to issues related to the property title

Title insurance plays a crucial role in safeguarding property owners and lenders from potential risks associated with legal claims and disputes over property title. With the ever-increasing complexities in real estate transactions, having title insurance ensures that your investment is secure against unforeseen issues such as fraud, liens, and defects in the title. This not only provides peace of mind to all parties involved in the transaction but also helps in maintaining the integrity of the real estate market. By investing in title insurance, you are securing a smooth and worry-free property ownership experience, making it an essential component of any real estate transaction.

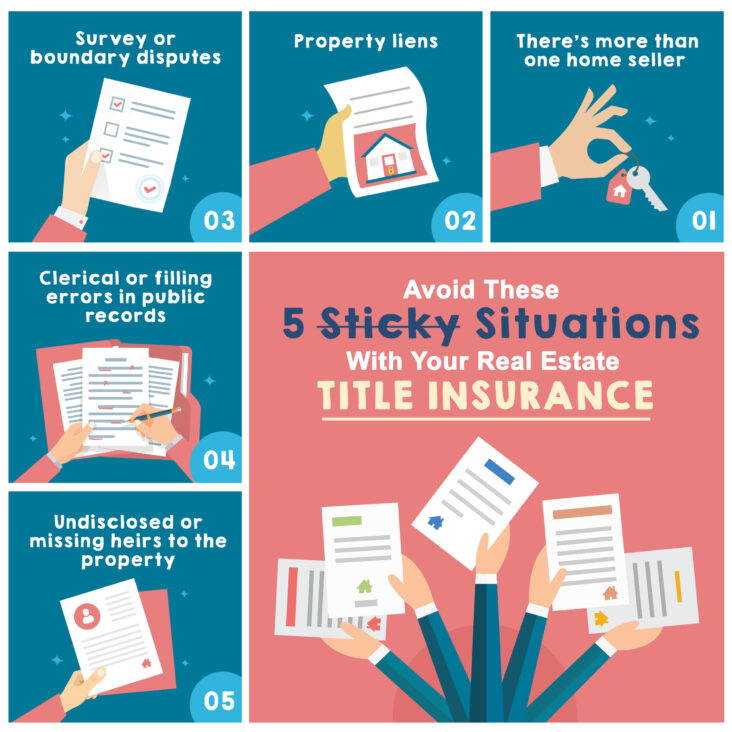

These issues can include liens, encumbrances, or defects in the title that were not discovered during the title search

Title insurance is crucial in safeguarding property owners from unforeseen issues that can arise from liens, encumbrances, or defects in the title that were not discovered during the title search. These hidden hazards can potentially disrupt the property transaction process and result in significant financial losses. By investing in title insurance, you protect yourself against any claims or legal fees that may emerge due to such discrepancies. Moreover, it bolsters the credibility of your property investment, ensuring peace of mind and long-term security. In today’s ever-evolving real estate landscape, title insurance is an indispensable tool in safeguarding your hard-earned assets.

Title insurance ensures that the property owner’s investment is secure and that they have a legal right to the property.

Title insurance plays a crucial role in safeguarding property owners from potential financial losses and legal disputes. This valuable coverage not only validates the legitimacy of the property owner’s claim to the land but also protects their hard-earned investment. By thoroughly examining public records and identifying any existing liens, encumbrances, or defects in the title, title insurance companies ensure that the property transfer process is seamless and risk-free. Consequently, acquiring title insurance is an essential step in the home buying journey, providing peace of mind and financial security to property owners in the face of unforeseen challenges.

Ensures a smooth and secure property transfer: Title insurance plays a crucial role in ensuring a smooth and secure transfer of property ownership

Title insurance is an essential component in facilitating a seamless and secure property transfer process. It not only safeguards the buyer’s investment but also provides peace of mind by minimizing potential risks associated with title defects. By thoroughly examining public records, title insurance companies identify and rectify any issues or discrepancies, ensuring that the property’s ownership history is accurate and up-to-date. This meticulous approach not only streamlines the property transfer process but also helps avoid costly disputes and legal entanglements down the road. In essence, investing in title insurance is a smart move for both buyers and sellers, as it guarantees a smooth, hassle-free, and secure property transaction.

It helps to identify and resolve any potential issues related to the property title before the transaction is completed

Title insurance plays a crucial role in identifying and resolving potential issues related to a property title before the transaction is finalized, ensuring a smooth and hassle-free process for both the buyer and the seller. This comprehensive examination of the property’s history uncovers any hidden problems such as liens, encumbrances, or ownership disputes that might otherwise derail the deal or result in costly legal battles down the line. By securing title insurance, you can confidently invest in your dream property without the fear of unforeseen complications, ultimately saving you time, money, and stress. Stay protected and safeguard your investment with this indispensable component of real estate transactions.

By doing so, it minimizes the risks associated with the

Title insurance plays a crucial role in safeguarding property buyers and lenders from potential risks associated with real estate transactions. By obtaining this essential coverage, you significantly reduce the likelihood of encountering issues such as ownership disputes, undisclosed liens, or fraudulent transfers. The protection offered by title insurance ensures that your investment is secure and your ownership rights are undisputed. Additionally, it provides peace of mind by minimizing potential legal troubles and financial losses in the future. Therefore, investing in title insurance is a smart decision that you should not overlook when purchasing property.