Are you caught in the whirlwind of student loans and eager to know what the future holds for loan forgiveness? Look no further, as we delve into the ever-evolving landscape of student loan forgiveness programs and their potential transformations. From policy changes to new proposals, our comprehensive guide will shed light on what you can expect in the coming years. Stay ahead of the curve and discover the future of student loan forgiveness that could revolutionize your journey to financial freedom!

The Evolution of Student Loan Forgiveness Programs: A Brief History and Key Milestones

The Evolution of Student Loan Forgiveness Programs has seen remarkable growth and transformation over the years, adapting to the changing landscape of higher education and student debt. A Brief History and Key Milestones illustrate the continuous efforts to alleviate the burden of student loans, starting from the inception of the National Defense Education Act (NDEA) in 1958, progressing through the Teacher Loan Forgiveness Program in 1998, and culminating in the current Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans. As the future unfolds, it is crucial to monitor the evolving policies and potential reforms to ensure that student loan forgiveness remains a viable and accessible option for millions of borrowers in need.

Navigating the Changing Landscape of Federal Student Loan Forgiveness Options

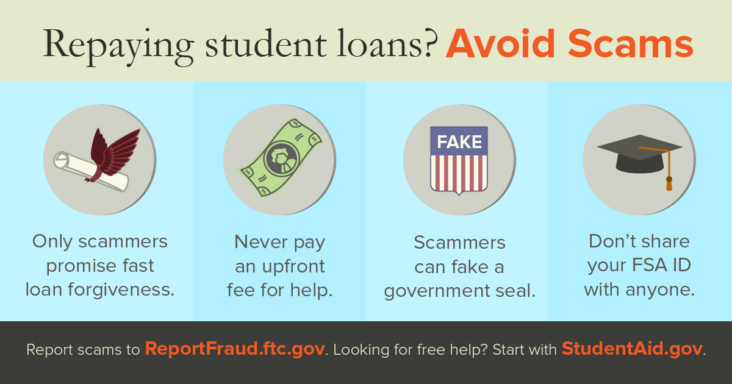

As we look ahead, navigating the changing landscape of federal student loan forgiveness options becomes crucial for borrowers seeking relief. With potential policy shifts and program updates, it is essential to stay informed and adapt to new opportunities. Ensuring you’re aware of the qualifications, requirements, and application processes for various forgiveness programs can help maximize your chances of benefiting from these initiatives. By regularly monitoring the latest developments and engaging with trusted resources, you can effectively strategize your loan repayment journey and secure a brighter financial future amidst the evolving world of student loan forgiveness.

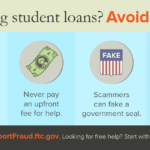

The Impact of Proposed Legislation on the Future of Student Loan Forgiveness Programs

The Impact of Proposed Legislation on the Future of Student Loan Forgiveness Programs will be significant as lawmakers, educators, and borrowers eagerly await the outcome. With the potential for broad-reaching changes, it’s crucial to understand how these legislative proposals may affect the accessibility and eligibility of loan forgiveness opportunities. The Biden administration’s proposal of expanding forgiveness programs, targeting high-need professions, and simplifying the application process is expected to greatly benefit those burdened with student loan debt. However, the final outcome will depend on the successful implementation of these policies, ultimately shaping the future landscape of student loan forgiveness.

The Role of Income-Driven Repayment Plans in Shaping the Future of Student Loan Forgiveness

Income-Driven Repayment (IDR) plans will play a pivotal role in shaping the future of student loan forgiveness. As college tuition costs continue to rise, borrowers are increasingly turning to IDR plans to help ease the financial burden. These plans allow graduates to make monthly payments based on their income, potentially leading to loan forgiveness after 20-25 years of consistent payments. With the Biden administration discussing potential changes to federal student loan programs, it’s essential for borrowers to stay informed about possible adjustments to IDR plans and their eligibility for loan forgiveness. Ultimately, IDR plans will remain a key component of the student loan forgiveness landscape.

Balancing Personal Finance Strategies with Anticipated Changes in Student Loan Forgiveness Policies

As we navigate the ever-evolving landscape of student loan forgiveness, it’s crucial to strike a balance between personal finance strategies and anticipated policy changes. By staying informed about potential shifts in student loan forgiveness programs, borrowers can better prepare for the future and make informed decisions about their finances. This includes creating a well-rounded budget, considering refinancing or consolidation options, and exploring alternative repayment plans. By proactively managing personal finances and staying updated on the latest student loan forgiveness news, borrowers can safeguard their financial well-being and adapt to any changes that may come their way.