Are you drowning in a sea of student loan debt and considering the life raft of student loan forgiveness? You’re not alone. With millions of Americans grappling with the financial burden of sky-high tuition fees, student loan forgiveness programs have become a hot topic. In this comprehensive guide, we’ll explore the pros and cons of student loan forgiveness, delve into the various programs available, and help you determine if it’s the right choice for you. So, buckle up and let’s embark on this financial journey together, as we demystify the world of student loan forgiveness and empower you to make informed decisions for your future.

Understanding the Basics of Student Loan Forgiveness: A Comprehensive Guide

In this comprehensive guide, we delve into the intricacies of Student Loan Forgiveness, a potential financial lifesaver for those burdened by student debt. As the cost of education continues to rise, more borrowers are seeking ways to manage their loans effectively. Student Loan Forgiveness programs offer a viable solution for eligible borrowers, by either reducing or eliminating their loan balance. However, it’s crucial to understand the various forgiveness options, eligibility criteria, and potential drawbacks before embarking on this journey. This guide will provide you with essential insights to help you make an informed decision, ensuring you choose the right path for your financial future.

Evaluating the Benefits of Student Loan Forgiveness: How Can It Impact Your Financial Future?

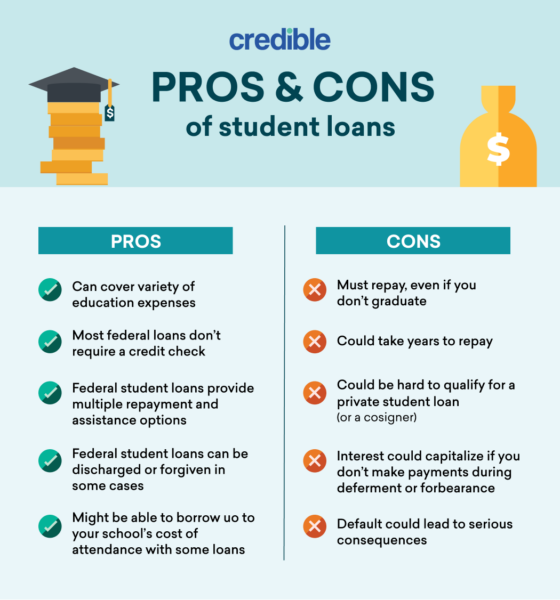

When evaluating the benefits of student loan forgiveness, it’s crucial to consider the long-term impact on your financial future. By alleviating the burden of student debt, loan forgiveness programs can open up opportunities for financial growth, such as investing in a home or starting a family. Moreover, this financial relief can significantly improve your mental well-being and overall quality of life. However, it’s important to note that not all forgiveness programs are the same, and eligibility requirements vary. Therefore, conducting thorough research and understanding how different forgiveness options align with your career goals and financial plans is essential in making an informed decision that benefits your future.

The Potential Drawbacks of Student Loan Forgiveness: What You Need to Know Before Making a Decision

The Potential Drawbacks of Student Loan Forgiveness: What You Need to Know Before Making a DecisionStudent loan forgiveness, while beneficial for many, may have its downsides as well. Before deciding if it’s right for you, it’s essential to weigh the potential drawbacks. For instance, forgiveness programs often require a long-term commitment to a specific job or field, which could limit your career flexibility. Additionally, the forgiven amount may be considered taxable income, potentially increasing your tax liability. Furthermore, relying on forgiveness might also discourage responsible borrowing habits and financial planning. Understanding these potential pitfalls is crucial in determining if student loan forgiveness aligns with your financial goals and future aspirations.

Exploring the Different Types of Student Loan Forgiveness Programs: Which One Fits Your Needs?

Delve deeper into the realm of student loan forgiveness by examining the various programs available, tailored to suit diverse needs and preferences. Some popular options include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) Forgiveness. Each program caters to different professions and financial situations, ensuring a well-rounded approach to debt relief. Conduct thorough research and compare eligibility requirements, loan types, and forgiveness timelines to make an informed decision. By understanding the nuances of each program, you can confidently choose the best path towards a debt-free future and attain financial stability.

Weighing Your Options: How to Determine if Student Loan Forgiveness is the Ideal Solution for Your Debt Management

When weighing your options for student loan forgiveness, it’s essential to carefully consider the potential benefits and drawbacks to determine if it’s the right debt management solution for you. Start by assessing your current financial situation, career goals, and your ability to meet the program requirements. Analyze the long-term impact of student loan forgiveness on your finances, such as the tax implications and the time it takes to qualify for forgiveness. Additionally, explore alternative repayment plans and debt relief options that may better suit your circumstances. By thoroughly evaluating these factors, you can make an informed decision on whether student loan forgiveness is the ideal solution for managing your debt.