Are you considering buying a home with a loved one? If so, a shared mortgage may be a great financing option for you! A shared mortgage is a joint loan that two or more people take out together to purchase a home. This type of mortgage allows multiple borrowers to share the costs associated with home ownership, such as the down payment and monthly payments. In this article, we will discuss everything you need to know about shared mortgages, including the benefits, drawbacks, and requirements.

Overview of Shared Mortgage

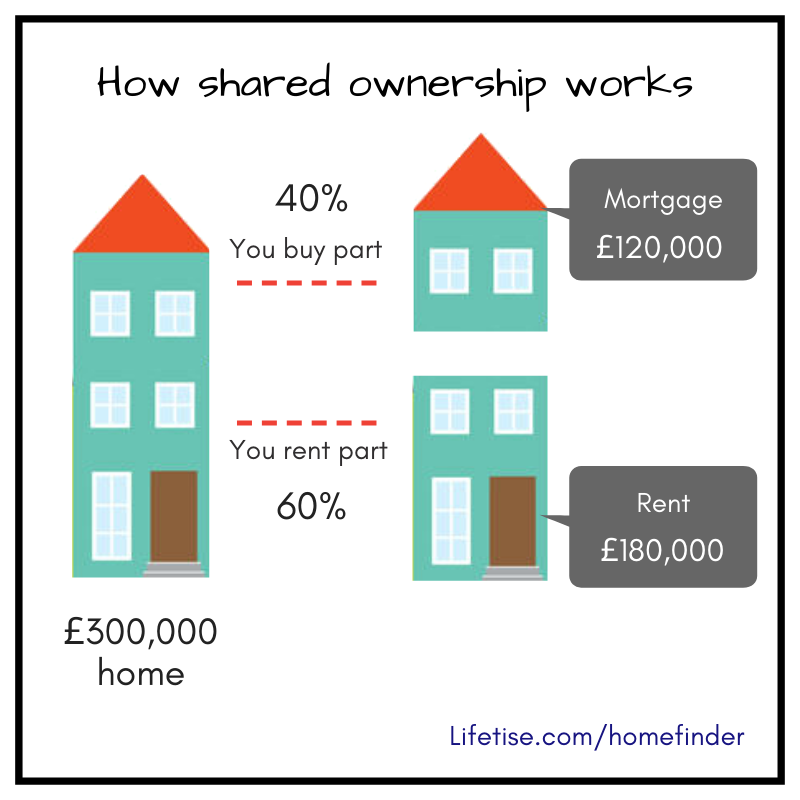

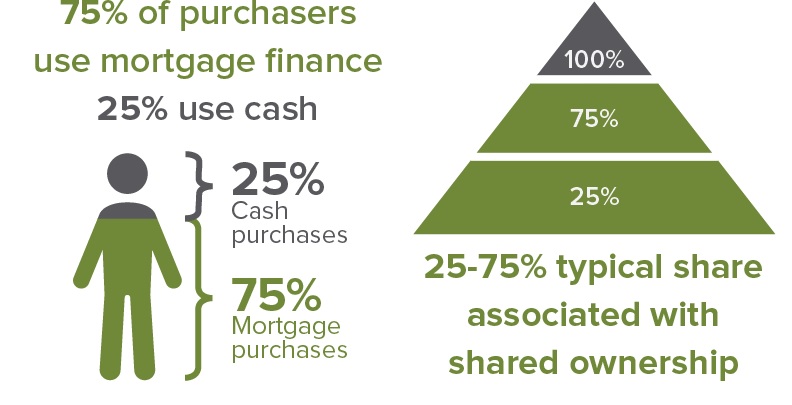

Shared mortgages are a great way to get into homeownership. They are an arrangement between two or more people who are agreeing to share the costs associated with buying a home. This type of arrangement may be beneficial for those who do not have the full amount for a downpayment or those who may not be able to get approved for a traditional mortgage loan. With a shared mortgage, there is more flexibility in terms of who is responsible for the payments, and the amount of money each person is responsible for. This can be beneficial for those who are not able to afford a traditional mortgage on their own. Additionally, shared mortgages can be easier to qualify for than a traditional loan, as the multiple people involved can reduce the amount of risk associated with the loan. Shared mortgages can be a great option for those who want to get into homeownership without having to worry about the financial burden of a traditional loan.

Benefits of Shared Mortgage

Shared mortgages are a great way to get into the property market without risking it all. With a shared mortgage, you can get into the property market, without having to worry about taking on all the risk. You can split the mortgage, the interest rate, and the payment responsibility with another person. This way, you can enjoy the benefits of owning a property without taking on all the financial burden. Shared mortgages can also be beneficial for those who are looking to buy a property that may otherwise be out of their budget. By splitting the cost of the property, they can make it more affordable. Another benefit of shared mortgages is that they can help build credit. If both people involved in the mortgage are responsible with their payments, it can help build both of their credit scores. This can be especially beneficial for those who are looking to buy a home in the future.

Potential Drawbacks of Shared Mortgage

Shared mortgages can be a great way to make homeownership more accessible, but there are some potential drawbacks to consider. One major drawback of shared mortgages is the fact that all parties involved must agree to the terms of the loan. If one party decides to no longer be part of the shared mortgage, the other parties must find a way to make up for the missing payments. Additionally, if one party fails to make payments on time, it could negatively affect the credit scores of all parties involved. Another drawback of shared mortgages is the risk of foreclosure. If one party defaults on payments, all parties involved could face the possibility of foreclosure. Finally, shared mortgages may not be available in certain areas or with certain lenders, making it difficult to find the right fit for your situation. Taking the time to do your research and understand the potential risks and rewards of shared mortgages is essential before taking the plunge.

How to Qualify for a Shared Mortgage

If you’re looking to get into shared mortgage ownership, it’s important to know how to qualify. Generally speaking, most lenders will require applicants to have a good credit score and steady income. Additionally, you’ll need to provide proof of savings or other assets that can be used to cover a down payment or other fees. It’s also important to have a steady job and a good credit history, as these two factors are key to getting approved for a shared mortgage. Additionally, you’ll need to show that you can afford the monthly payments and that you can pay off the mortgage in a timely manner. Lastly, you’ll want to make sure that both parties involved in the shared mortgage are financially responsible and have a good relationship with each other. Qualifying for a shared mortgage can be complex, but with the right preparation and research, you can be on your way to shared mortgage ownership.

Strategies for Making Shared Mortgage Work for You

When it comes to making shared mortgage work for you, it’s important to take the time to develop a strategy. First, you’ll want to make sure that you have a clear understanding of how much money each of you can contribute each month. This will help you determine how much you can afford to spend on your mortgage and help you avoid any potential financial problems. Additionally, it’s important to discuss how you will handle additional expenses such as property taxes and insurance, as these can vary greatly from one location to another. Finally, make sure to communicate regularly and openly with your partner to ensure that you’re both on the same page and that your shared mortgage is a success. With the right strategy, shared mortgage can be a great way to purchase a home and save some money in the process.