Welcome to the ultimate guide on Public Service Loan Forgiveness (PSLF): Your Path to Debt Relief! In today’s world, pursuing higher education often comes with the hefty burden of student loan debt. But fear not, as PSLF may hold the key to unlocking financial freedom for those dedicated to making a difference in public service careers. This comprehensive article will explore the ins and outs of PSLF, providing you with valuable insights and practical tips to help you successfully navigate your way towards a debt-free future. Join us as we unravel the secrets of this life-changing program, and discover how you can transform your passion for public service into the ultimate ticket to financial peace of mind.

Navigating the Public Service Loan Forgiveness Program: Essential Steps to Achieve Debt Relief

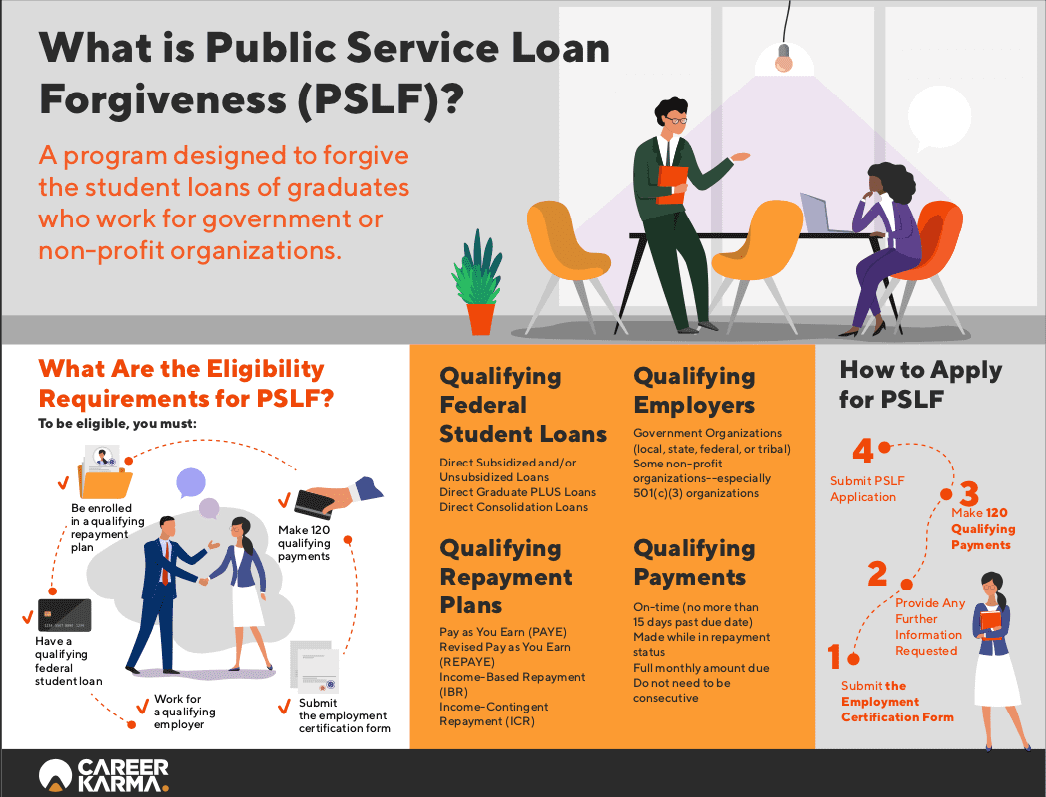

Navigating the Public Service Loan Forgiveness (PSLF) program can be a challenging path to debt relief, but by following essential steps, you can simplify the process and maximize your benefits. Begin by ensuring you have qualifying loans, enrolling in an income-driven repayment plan, and working in a qualifying public service job. Stay organized by submitting the Employment Certification Form (ECF) annually, tracking your qualifying payments, and staying informed about any program updates. By diligently adhering to these steps, you can successfully navigate the PSLF program and achieve the ultimate goal of debt relief through loan forgiveness.

Maximizing the Benefits of PSLF: Tips for Successfully Meeting Eligibility Requirements

Maximizing the benefits of Public Service Loan Forgiveness (PSLF) is crucial for achieving debt relief and financial freedom. To successfully meet eligibility requirements, it’s essential to have a clear understanding of the program’s guidelines and prerequisites. Begin by selecting a qualifying repayment plan, such as Income-Driven Repayment (IDR), to ensure affordable monthly payments aligned with your financial situation. Consistently maintain full-time employment with a qualifying public service organization, and diligently submit the required PSLF Employment Certification Form annually or whenever you change employers. By adhering to these best practices, you’ll be on the path to maximizing your PSLF benefits and achieving long-term debt relief.

Public Service Careers That Qualify for Loan Forgiveness: Exploring Your Options for Debt-Free Living

Public Service Careers that qualify for Loan Forgiveness offer a range of opportunities for individuals seeking a path to debt-free living. Through the Public Service Loan Forgiveness (PSLF) program, you can pursue rewarding careers in government, non-profit, and educational sectors while effectively managing your student loan debt. Some popular options include teaching, social work, public health, and emergency management services. By understanding the eligibility criteria, you can strategically plan your career, contribute to society, and achieve financial freedom. Explore the diverse options available under PSLF, and embark on a fulfilling journey towards a debt-free future.

Debunking Common Myths Surrounding Public Service Loan Forgiveness: Separating Facts from Fiction

In this section, we’ll debunk common myths surrounding Public Service Loan Forgiveness (PSLF) and provide clarity by separating facts from fiction. Misconceptions about eligibility requirements, qualifying payments, and forgiveness timelines can deter potential applicants from pursuing the benefits of PSLF. By dispelling these myths, we aim to educate borrowers on the correct information and encourage them to take advantage of this valuable debt relief option. Understanding the facts is crucial for those seeking a path to financial stability through Public Service Loan Forgiveness, and our goal is to help you navigate this journey with confidence.

The Future of PSLF: Staying Informed and Prepared for Changes in the Public Service Loan Forgiveness Program

As the Public Service Loan Forgiveness (PSLF) program continues to evolve, it is essential for borrowers to stay informed and prepared for potential changes. To ensure you are up-to-date with the latest PSLF news, consider subscribing to reputable financial blogs, government websites, and student loan servicers’ newsletters. Furthermore, actively engage in online forums and discussions surrounding PSLF to gain insight from fellow borrowers and professionals. By staying educated on the program’s developments and understanding how these changes may impact your eligibility, you can proactively navigate your path to debt relief and make informed decisions about your financial future.