Are you drowning in student loan debt and seeking a lifeline? Fear not, as student loan forgiveness programs could be your ultimate salvation. These programs can wipe away a significant portion of your debt, allowing you to breathe easy and focus on building a brighter future. Our comprehensive guide on how to qualify for student loan forgiveness offers essential tips to help you navigate the complex world of debt relief options. Get ready to dive into the world of loan forgiveness, as we unravel the secrets to unlocking the door to financial freedom. Say goodbye to overwhelming debt, and hello to a fresh start!

Understanding the Different Types of Student Loan Forgiveness Programs: A Comprehensive Guide

Dive into our comprehensive guide on understanding the various types of student loan forgiveness programs available to borrowers. To optimize your chances of loan forgiveness, it’s vital to know which program aligns best with your career goals and financial needs. Explore Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, Income-Driven Repayment (IDR) Forgiveness, and more, to determine the most suitable option for your unique situation. By familiarizing yourself with these programs’ eligibility requirements and application processes, you’ll be one step closer to alleviating your student loan debt and achieving financial freedom. Stay informed and take control of your future today!

Meeting the Eligibility Criteria: Essential Steps to Secure Your Student Loan Forgiveness

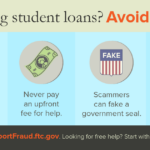

In order to secure your student loan forgiveness, it’s crucial to meet the eligibility criteria set forth by federal programs. Start by understanding the essential steps involved: first, determine if you have a qualifying loan, such as a Direct Loan, and ensure you’re enrolled in the right repayment plan, like Income-Driven Repayment (IDR). Next, work in a qualifying public service job, as forgiveness is typically granted to those who serve their community. Additionally, make timely, consistent payments for the required number of years. Ultimately, staying informed about the specific requirements and diligently adhering to them will greatly increase your chances of qualifying for student loan forgiveness.

Navigating the Public Service Loan Forgiveness (PSLF) Path: Key Strategies for Success

Navigating the Public Service Loan Forgiveness (PSLF) Path can be a crucial step towards achieving student loan forgiveness. To ensure success, begin by understanding the eligibility criteria, which include working full-time for a qualifying employer and making 120 qualifying monthly payments under a qualifying repayment plan. Stay organized by regularly updating your employment certification form and submitting it to your loan servicer, ensuring a seamless tracking process. Additionally, consider consolidating your loans for a hassle-free PSLF journey. Lastly, stay informed about any updates or changes to the PSLF program, and seek guidance from professionals to maximize your chances of student loan forgiveness.

Income-Driven Repayment Plans and Their Impact on Student Loan Forgiveness: What You Need to Know

Income-Driven Repayment Plans (IDRs) can significantly impact your eligibility for student loan forgiveness, making it essential to understand their nuances. These plans adjust your monthly payment based on your income, family size, and loan type, often reducing the burden of hefty installments. By consistently making affordable payments under an IDR plan for 20 to 25 years, you become eligible for loan forgiveness on the remaining balance. However, it’s crucial to recertify your income and family size annually, or you risk losing the benefits of the IDR plan. Stay informed about your specific plan’s requirements, and diligently follow them to maximize your chances of attaining student loan forgiveness.

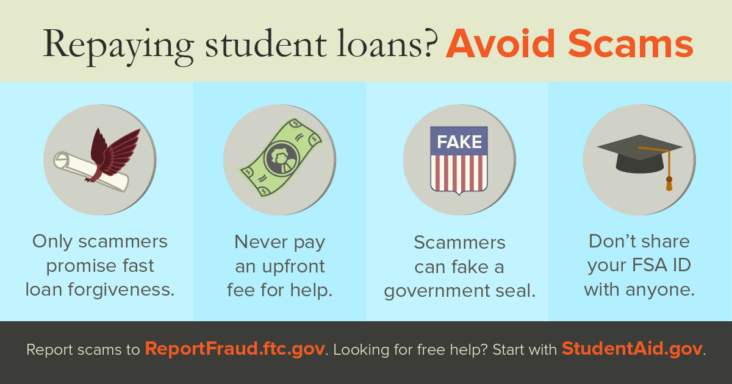

Making the Most of Your Student Loan Forgiveness Journey: Expert Tips to Maximize Your Benefits

Embarking on your student loan forgiveness journey requires a strategic approach to maximize the benefits you receive. By staying informed about the various forgiveness programs available, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, you can select the most suitable option for your career path. Additionally, ensure your loans are eligible for forgiveness by consolidating them under the Direct Loan Program. Keep track of your progress by regularly submitting Employment Certification Forms, and maintain a strong credit score to enhance your financial stability. By following these expert tips, you can optimize your loan forgiveness journey and alleviate the burden of student debt.