Are you considering buying a home but are worried that you won’t be able to afford the payments? Private mortgage insurance (PMI) is a great way to help lower your monthly payments and make buying a home more affordable. In this article, we’ll explore how much PMI costs and how it works to help you decide if it’s the right choice for you.

What is Private Mortgage Insurance and How is it Calculated?

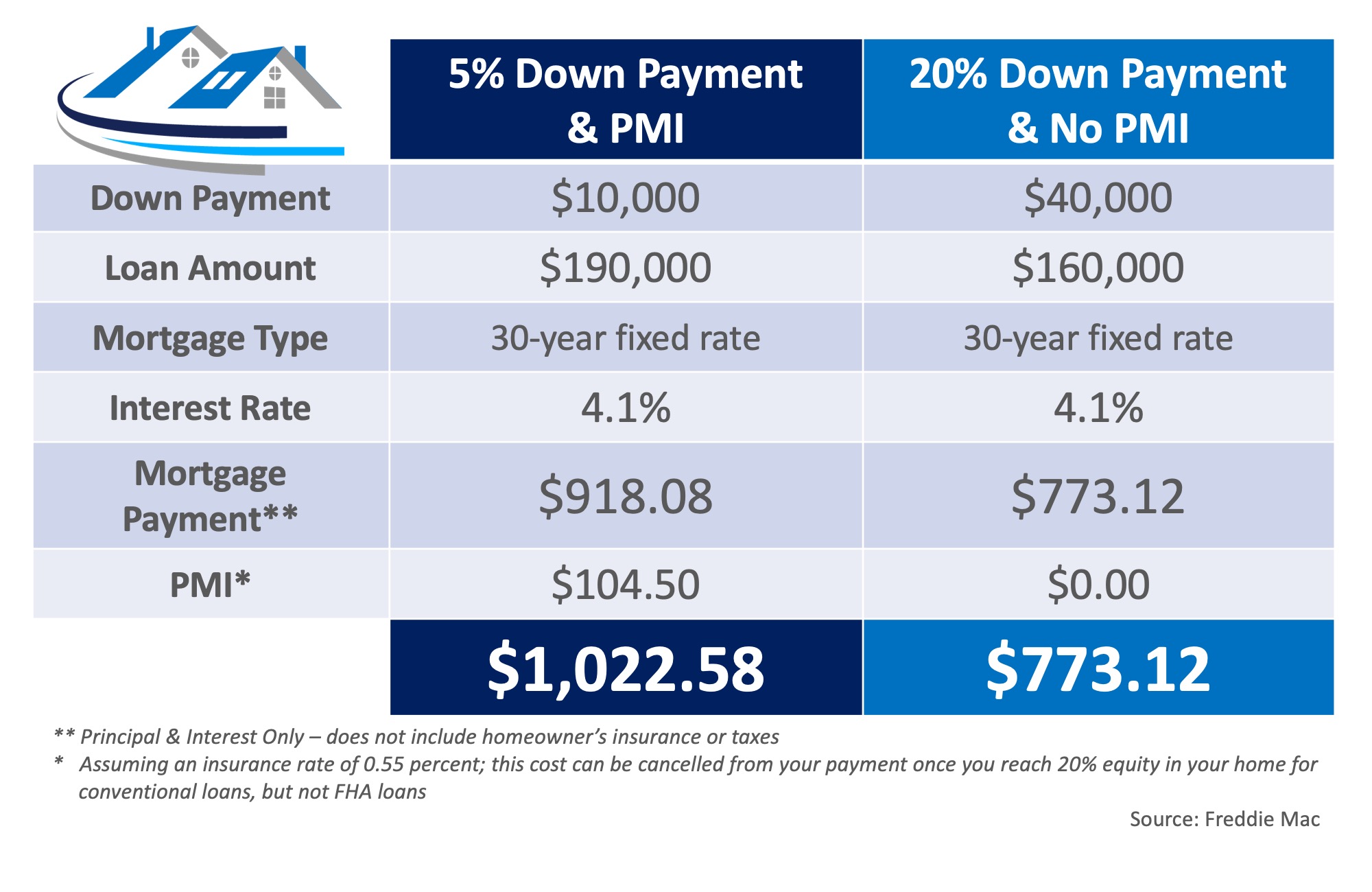

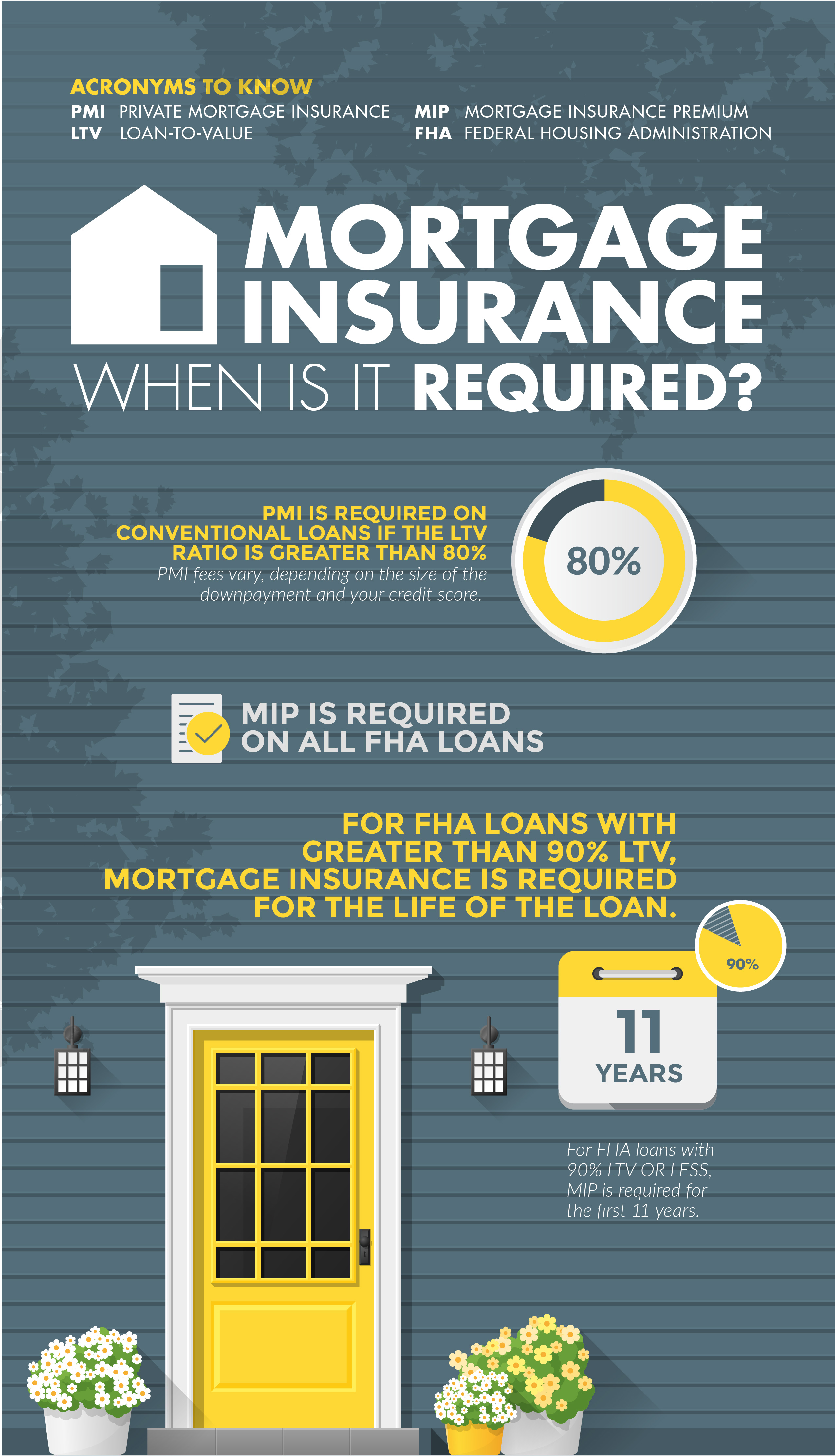

Private Mortgage Insurance (PMI) is one of those extra costs that come with buying a home. It’s a fee that’s paid to insure the lender in case the borrower defaults on their loan. PMI is usually required for mortgage loans with a loan-to-value ratio greater than 80%. That means if you make a down payment of less than 20%, you’ll likely be required to pay for PMI. So how much is PMI? Well, that depends on a few factors. The amount of PMI you’ll pay is based on the size of your mortgage loan, your credit score, and the amount of your down payment. Generally, the higher your credit score and the more you can put down, the lower the PMI rate you’ll pay. So if you can save up for a larger down payment and keep your credit score in shape, you can lower the amount you’ll have to pay for PMI. Additionally, the lender will usually factor in the length of the loan when determining the PMI rate. The shorter the loan, the lower the PMI will be.

Factors that Impact the Cost of Private Mortgage Insurance

When it comes to the cost of private mortgage insurance, there are a few key factors that can have an impact. One of the most important is the amount of your down payment. The larger your down payment, the lower your cost for PMI will be. Your credit score is also a factor, as lenders use it to assess the risk associated with your loan. A higher score will often result in lower insurance premiums. The type of loan you choose is also a factor, as some lenders offer lower rates for certain loans, such as FHA loans. Lastly, the amount of the loan itself can impact the cost of PMI, as lenders will increase the cost for higher loan amounts. Understanding all of these factors can help you determine the cost of your PMI, and help you make the best decision for your financial situation.

Advantages and Disadvantages of Private Mortgage Insurance

Private mortgage insurance, also known as PMI, is a type of insurance that homeowners must pay when they take out a mortgage. It protects lenders from losses if the borrower defaults on their loan. Although there are some advantages to having PMI, there are also some disadvantages. The primary advantage of PMI is that it can help you qualify for a mortgage loan when you would not otherwise be able to. It also allows borrowers to put down a smaller down payment than what is usually required for a conventional loan. Another benefit is that it can help you save money over the life of the loan, since you’ll have to pay less interest. On the other hand, there are some disadvantages to PMI. The most obvious is that it adds an additional cost to your monthly mortgage payments. Additionally, it can take a long time to cancel the policy, even if you have built up enough equity in your home. Overall, private mortgage insurance can be a great way to help you qualify for a mortgage loan, but it’s important to weigh the advantages and disadvantages before deciding if it’s the right choice for you.

How to Avoid Having to Pay Private Mortgage Insurance

If you’re looking to buy a home, you may want to avoid having to pay private mortgage insurance (PMI) by putting down at least 20% of your loan. This will help to ensure that you have a lower monthly payment and won’t have to pay the added cost of PMI. If you can’t afford to put down 20%, you could also consider a loan with a lender credit or look into an “80-10-10” loan, which is when you borrow 80% of the home’s value, put 10% down, and then the lender contributes the other 10%. Another option is to look into an FHA loan, which only requires a 3.5% down payment and doesn’t require PMI. Taking the time to research your options and shop around for the best deal can help you save money and prevent you from having to pay PMI.

How to Shop Around for the Lowest Cost Private Mortgage Insurance

Shopping around for the lowest cost private mortgage insurance is a great way to save money when buying a home. It’s important to compare prices and coverage from different companies to make sure you’re getting the best deal. Start by researching the various companies that offer PMI and read reviews of their services. Also, look into any discounts or incentives they may offer. Ask your lender for recommendations, or speak to a financial advisor for advice. It’s also a good idea to contact the insurance companies directly for more information about their policies. With a bit of effort, you can find the best policy for your needs at an affordable price.