Discover the ultimate secrets to staying active and energized all day long with our definitive guide to The Best Ways to Stay Active Throughout the Day! We’ve scoured the globe, spoken to experts, and compiled a comprehensive list of tips, tricks, and strategies to help you maintain an active lifestyle – no matter how busy your schedule may be. Say goodbye to afternoon slumps, burnout, and a sedentary lifestyle as we reveal the game-changing habits that will transform your daily routine and boost your overall health and well-being. So, buckle up and get ready to experience an exhilarating journey towards a more active and fulfilling life!

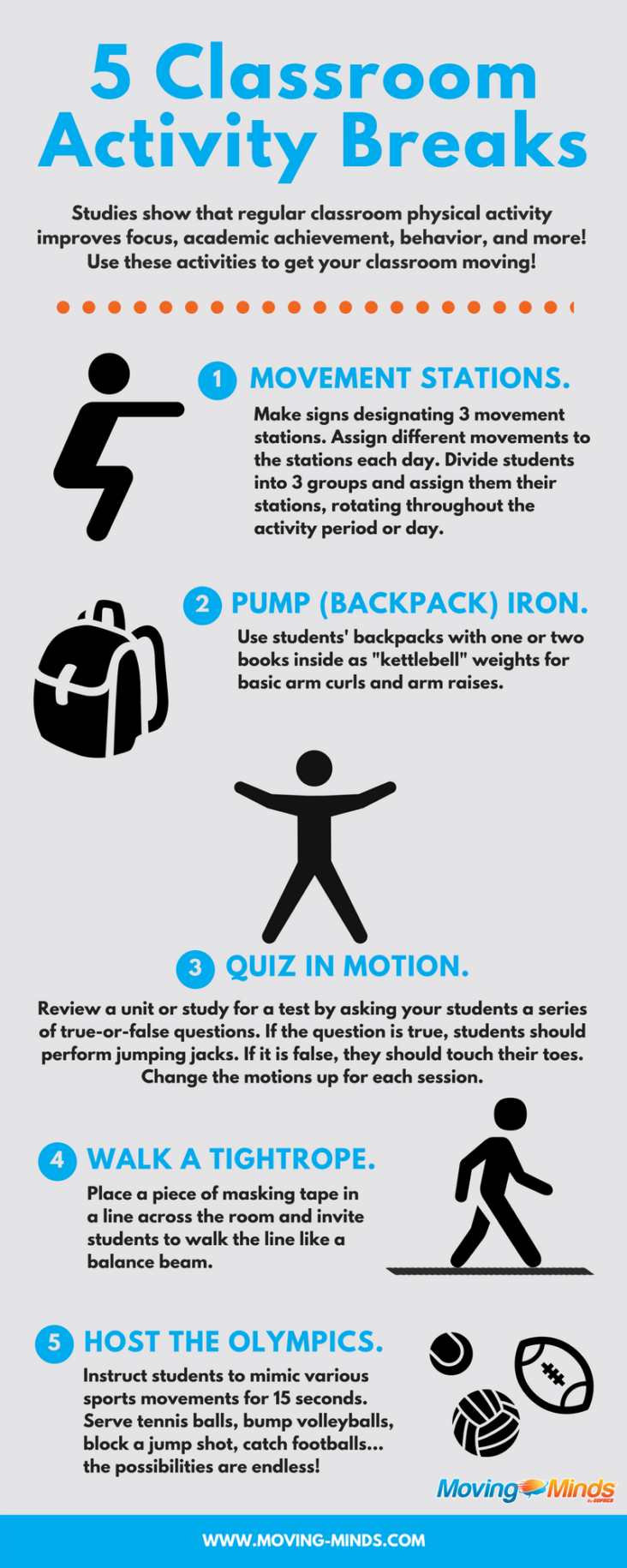

Incorporate regular physical activity breaks: Set reminders on your phone or computer to take short breaks every hour or two to stretch, walk around, or do a quick exercise routine

Incorporating regular physical activity breaks is an effective strategy to maintain an active lifestyle throughout the day. By setting reminders on your phone or computer, you can ensure that you take short breaks every hour or two for stretching, walking, or engaging in a quick exercise routine. These frequent intervals of movement not only help in breaking the monotony of sedentary work but also contribute to improved physical and mental well-being. Moreover, incorporating such breaks can boost productivity levels and help prevent the long-term health risks associated with prolonged sitting. Remember to make these breaks a priority for a healthier, more active daily routine.

This can help keep your energy levels up and break up long periods of sitting.

Incorporating regular movement into your daily routine is essential for maintaining optimal health and productivity. Breaking up long periods of sitting with short bursts of activity can significantly boost your energy levels, improve focus, and prevent the negative effects of a sedentary lifestyle. To make the most of your day, consider setting reminders to stand up and stretch every hour, taking short walks during breaks, and incorporating exercises like jumping jacks or squats during work intervals. These simple yet effective strategies can make a substantial difference in your overall well-being and help you stay active throughout the day.

Use active transportation: Whenever possible, choose to walk or cycle instead of using a car or public transportation

Embrace active transportation as a fun and effective way to incorporate daily physical activity into your routine. Opting for walking or cycling instead of relying on a car or public transportation not only boosts your overall fitness levels but also contributes to reducing your carbon footprint. Additionally, active commuting can help you save money on gas and parking fees while reducing stress levels. To make the most of these eco-friendly and health-promoting alternatives, plan your routes to include safe, well-lit paths, and ensure you have the appropriate gear for various weather conditions. Integrating active transportation into your daily schedule will keep you energized and contribute to a healthier lifestyle.

This can be a great way to integrate exercise into your daily routine and can help you achieve the recommended 30 minutes of moderate exercise per day.

Incorporating exercise into your daily routine is essential for maintaining overall health and well-being. One effective method is to engage in short bursts of physical activity throughout the day, gradually accumulating the recommended 30 minutes of moderate exercise. This not only keeps you active but also helps improve cardiovascular health, boost energy levels, and enhance mood. Simple activities such as taking the stairs instead of the elevator, walking or biking to work, or even performing desk exercises can significantly contribute to achieving your daily fitness goals. Remember to stay consistent and find enjoyable activities that seamlessly blend into your everyday life, ensuring long-lasting healthy habits.

Choose active hobbies and social activities: Find activities you enjoy that involve movement, such as dancing, gardening, or playing sports

Incorporating active hobbies and social activities into your daily routine is essential for maintaining a healthy lifestyle. Engaging in enjoyable pastimes that involve movement, such as dancing, gardening, or playing sports, not only boosts your physical health but also fosters social connections and mental wellbeing. By choosing activities that align with your interests, you’re more likely to stay committed and consistent in your efforts to stay active throughout the day. So, explore various options and embark on new experiences to keep your body moving, your mind engaged, and your social life thriving.

Engage in these activities with friends or family members to make them more enjoyable and to help

Engaging in physical activities with friends or family members can significantly enhance your daily dose of exercise while making it more enjoyable and sustainable. These shared experiences not only strengthen bonds but also promote a healthy lifestyle for everyone involved. Opt for group activities such as going for walks, playing team sports, or participating in dance classes to keep each other motivated and accountable. By incorporating socialization into your fitness routine, you’re more likely to create lasting habits and maintain an active lifestyle throughout the day. Don’t forget to share your progress and achievements with your loved ones for an extra boost of encouragement and support.