Mortgage closing costs can be overwhelming and confusing, especially if you’re a first-time homebuyer. As a student, it’s important to understand what closing costs are and how they affect you when taking out a mortgage loan. In this article, I’m going to break down the basics of mortgage closing costs and explain how they work in an easy-to-understand format. By the end, you’ll be able to make more informed decisions when it comes to your mortgage loan. Let’s get started!

Research mortgage types

Doing research on different types of mortgages can help you understand which one will be the best for you. Talk to a financial advisor or look up reviews online to find out the details of each type. There are different terms and conditions for each, so it’s important to weigh your options carefully. Knowing what to look for can help you save money and make the right decision.

As a young adult, understanding mortgage closing costs can be daunting. There are a lot of moving parts to consider, from loan origination fees to taxes and insurance. It’s important to do your research and understand the different fees associated with a mortgage before you sign on the dotted line. Doing so will help you be better prepared and less likely to be taken advantage of in the long run.

Calculate closing costs

Calculating closing costs can be tricky. To get an accurate estimate of your closing costs, you should use online calculators or talk to a mortgage broker. These tools can help you compare different loan options and estimate closing costs, so you can make an informed decision about the best loan for you.

Understanding mortgage closing costs can be intimidating for a young adult. The best way I’ve found to understand them is to do research and ask questions. I’ve been an 18 year old student navigating the mortgage process and I’ve found that asking as many questions as possible to my mortgage lender has been the best way to understand what I’m signing up for. Doing this helps me feel more comfortable and informed about the process.

Compare quotes

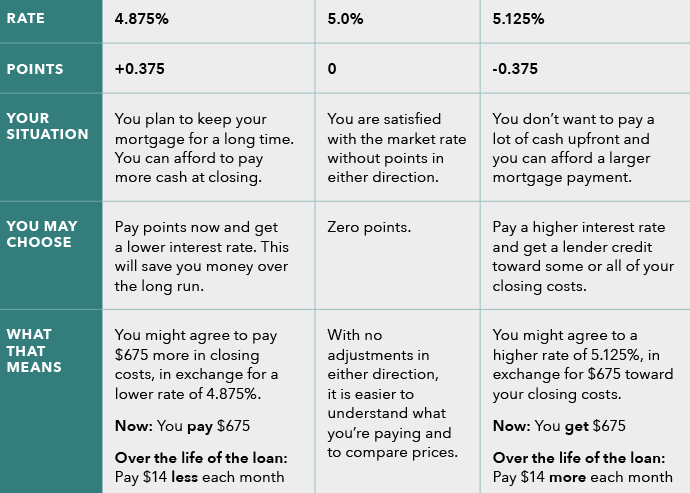

Comparing mortgage quotes is a great way to ensure you get the best deal on your closing costs. It’s important to shop around to make sure you’re getting the most bang for your buck. Look at different lenders and compare their interest rates, fees, and other services to make sure you’re getting the best deal possible. Don’t forget to factor in the length of the loan and other details to make sure you understand all the costs associated with your mortgage.

As a college student, understanding mortgage closing costs can be daunting. With so many fees and terms, it’s hard to know what to expect and prepare for. Thankfully, there are resources available to make understanding and budgeting for closing costs easier. Doing research and exploring different mortgage options can help you understand the fees associated and make sure you’re getting the best deal.

Ask lenders questions

If you’re confused about mortgage closing costs, don’t be afraid to ask lenders questions. Get a detailed breakdown of each cost and understand what services you’re paying for. Ask about the interest rate and any fees associated with the loan. It’s better to be informed than to be left in the dark.

Understanding mortgage closing costs can be overwhelming, especially for first-time home buyers. The best way to make sense of it all is to break it down into smaller chunks. Start by researching the different fees, taxes, and other expenses related to closing on a home. Ask your lender or real estate agent questions to get a better understanding. Finally, make sure to get an estimate of your closing costs in writing so you know exactly what to expect.

Negotiate costs

Negotiating closing costs can save you money on your mortgage. Ask your lender if they can waive or reduce certain fees, like the application fee, administrative fee, or appraisal fee. Don’t be afraid to negotiate – you could end up saving hundreds of dollars! Be sure to compare offers to make sure you’re getting the best deal.

As a young adult, it can be daunting to try and understand all the mortgage closing costs. From points to title insurance, it can all seem like a lot to take in. But with a little research and some help from a financial advisor, you’ll be able to gain a better understanding and make an informed decision.

Read all documents.

Reading all documents is key to understanding mortgage closing costs. It’s important to go through all the details of the loan agreement and take your time in understanding all the fees associated with the loan. Doing this will save you from any hidden costs that could be added to your loan amount in the future. It’ll also help you understand the terms of the loan and make sure you’re getting the best deal.