Are you a young adult looking to qualify for a mortgage but don’t have enough money saved for a down payment? Don’t worry, it’s still possible to get a great mortgage deal with a low down payment! Here are our tips on how to qualify for a mortgage with a low down payment, so you can get into your first home as a young adult.

Check credit score

Checking my credit score was an important step for me to qualify for a low down payment mortgage. It was a little intimidating but so worth it! I was able to monitor my credit score and make sure I was on track for the mortgage I wanted. It was easy to do and I highly recommend it to anyone looking to buy a house.

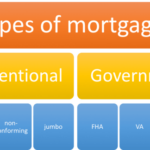

Choose low-down provider

Choosing a low-down payment mortgage provider has become easier than ever before. There are several lenders out there that offer mortgages with low down payments, making it accessible to more people than ever before. Before you start looking for a low-down payment mortgage provider, you should make sure you meet the qualifications, such as having a good credit score and a steady income. Once you’ve done that, you’ll be ready to start shopping around for the best provider for you.

Gather income documents

I’m 18 and trying to qualify for a mortgage with a low down payment. To do this, I need to gather income documents like my pay stubs, W2s, and tax returns. It’s important to be prepared for this process since it will help me get the best rate on my mortgage. It’s also a good idea to keep copies of all my documents for my own records.

Calculate DTI ratio

Figuring out your debt-to-income (DTI) ratio is a key factor when applying for a mortgage with a low down payment. To calculate your DTI ratio, add up your monthly bills and divide it by your gross monthly income. This number is your DTI and should be kept below 43%, otherwise you may not qualify for a loan. Keep in mind, other factors such as credit score and income play an important role too.

Compare mortgage rates

Comparing mortgage rates is an important factor when trying to qualify for a mortgage with a low down payment. Shopping around for the lowest rates is essential to ensure you’re getting the best deal possible. Finding out what lenders offer the best rates and doing your research will ensure you get the best rate for your needs.

Submit loan application

Submitting a loan application for a mortgage with a low down payment can feel intimidating. But with the right information and resources, you can make the process a lot easier. As an 18-year-old student, I’ve been able to qualify for a low down payment mortgage loan. I’ve gathered the necessary documents and had them verified by the lender. I’ve also taken steps to improve my credit score, which has helped me qualify for a better rate. With the right information and resources, you can do the same.