Discover the incredible advantages of pre-qualification and unlock the door to your dream home with ease! In the competitive world of real estate, pre-qualification emerges as a game-changer that not only streamlines the home-buying journey but also boosts your credibility as a potential buyer. Delve into the world of pre-qualification benefits and learn how this crucial process can give you an upper hand, save you time, and ultimately, help you secure the perfect home. Don’t miss out on this valuable insight that’s tailored to help you triumph in today’s fast-paced housing market!

Time-saving: One of the significant benefits of pre-qualification is that it saves time for both the buyer and seller

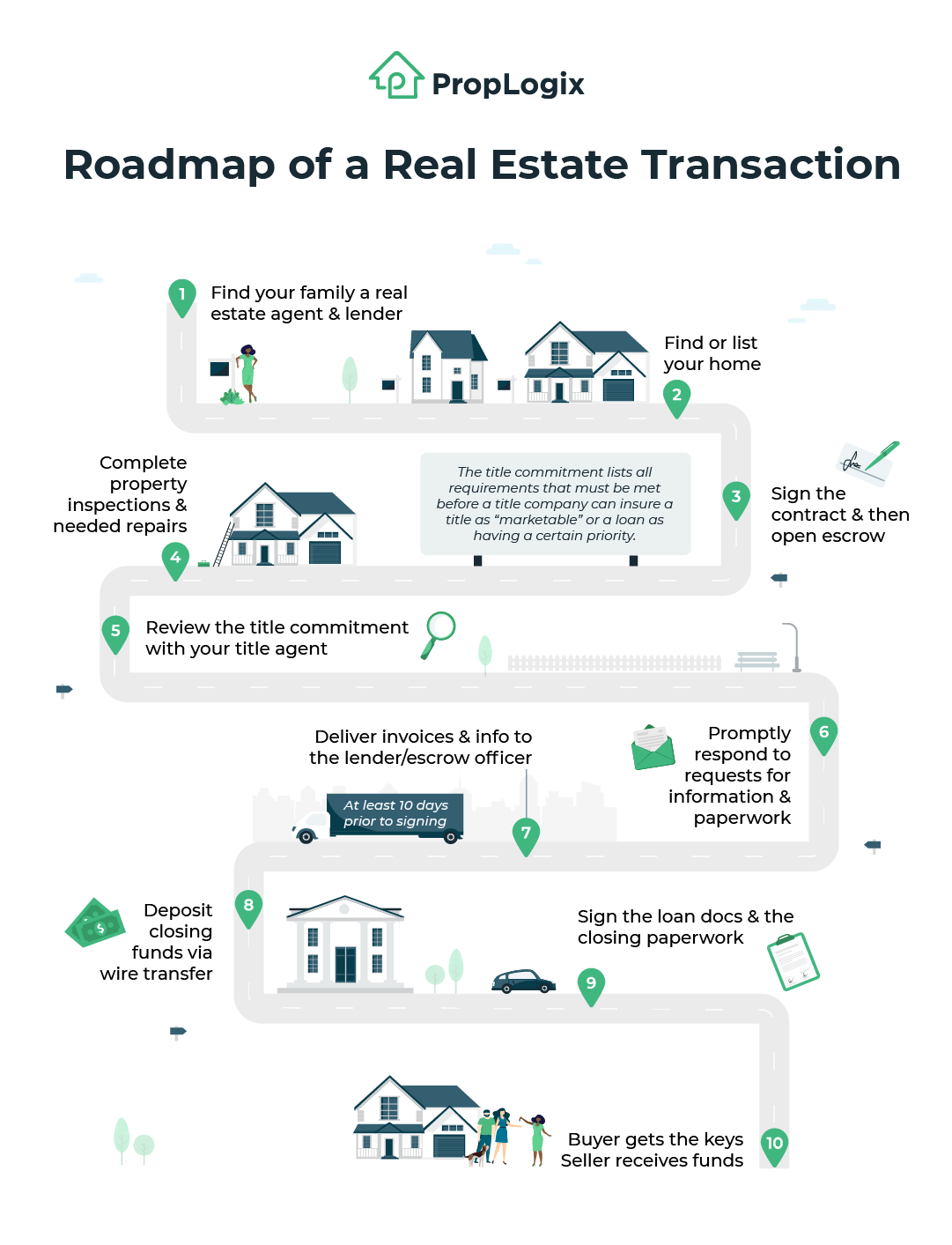

Time-saving is a crucial advantage of pre-qualification, streamlining the homebuying process for both buyers and sellers. By determining a buyer’s eligibility for a mortgage beforehand, pre-qualification reduces the likelihood of encountering financing issues down the road. Not only does this expedite the property search, but it also enables sellers to focus on serious buyers, ultimately accelerating the transaction process. In today’s competitive real estate market, saving time is invaluable, and pre-qualification simplifies the journey for all parties involved, ensuring a smoother, more efficient home buying experience.

It helps potential buyers to quickly identify properties within their budget and financial capacity, allowing them to focus on the most suitable options

Pre-qualification serves as a financial compass for potential homebuyers, guiding them towards properties that align with their budget and financial capacity. By acquiring a pre-qualification, buyers can effortlessly filter through countless listings and concentrate on the most suitable options. This not only saves time and energy but also prevents the disappointment of falling in love with a property beyond their reach. Furthermore, this streamlined process aids in optimizing the home search, ensuring that buyers invest their resources wisely and efficiently. By prioritizing pre-qualification, homebuyers can embark on a focused and fruitful home-buying journey.

Sellers also benefit from pre-qualification, as it enables them to filter out potential buyers who may not be able to secure financing for the purchase.

Sellers can greatly benefit from pre-qualification by streamlining the home-selling process and attracting serious buyers. A pre-qualified buyer is more likely to secure financing, reducing the chances of last-minute issues during the closing process. This not only saves time for the seller, but also helps them avoid the inconvenience and potential financial loss associated with a failed sale. By focusing on pre-qualified buyers, sellers can be confident in their pool of potential purchasers, leading to a smoother and more efficient transaction. Additionally, this targeted approach can result in a quicker sale, allowing sellers to move forward with their plans in a timely manner.

Financial Awareness: Pre-qualification provides the buyer with a clear understanding of their financial standing and how much they can afford to spend on a property

Financial Awareness through Pre-qualification: The homebuying process can be overwhelming, but pre-qualification empowers potential buyers by enhancing their financial awareness. By obtaining a pre-qualification, buyers gain a comprehensive understanding of their financial capabilities and limitations, allowing them to make informed decisions when searching for a property. This crucial step not only prevents unnecessary stress but also helps buyers avoid the pitfalls of overextending their finances. Ultimately, pre-qualification serves as a valuable tool in ensuring a smooth and successful journey towards homeownership, as buyers can confidently navigate the property market with a clear understanding of their financial standing.

This knowledge helps prevent buyers from overextending themselves and taking on more debt than they can manage.

Gaining insights into one’s financial capabilities through pre-qualification is essential in preventing homebuyers from overextending themselves and accruing unmanageable debt. A thorough understanding of one’s borrowing power enables buyers to make informed decisions, focusing on properties that fit within their budget. This not only streamlines the home buying process but also helps maintain a healthy financial standing in the long run. By avoiding excessive debt, buyers can enjoy their new homes without the added stress of financial strain. Furthermore, pre-qualification fosters a sense of confidence and trust in buyers, making them more attractive to sellers and increasing the likelihood of a successful transaction.

Enhanced Credibility: Buyers who have undergone the pre-qualification process are often perceived

Enhanced Credibility: Buyers who have undergone the pre-qualification process are often perceived as more credible and reliable by sellers, real estate agents, and lenders. This added credibility can give potential homebuyers a competitive edge in the housing market, as it demonstrates their financial readiness and commitment to purchasing a property. Moreover, pre-qualification can help streamline the home buying process, as well-informed buyers are better equipped to make educated decisions and negotiate effectively. Overall, obtaining pre-qualification status can significantly boost a buyer’s chances of securing their dream home, while also instilling confidence in all parties involved.