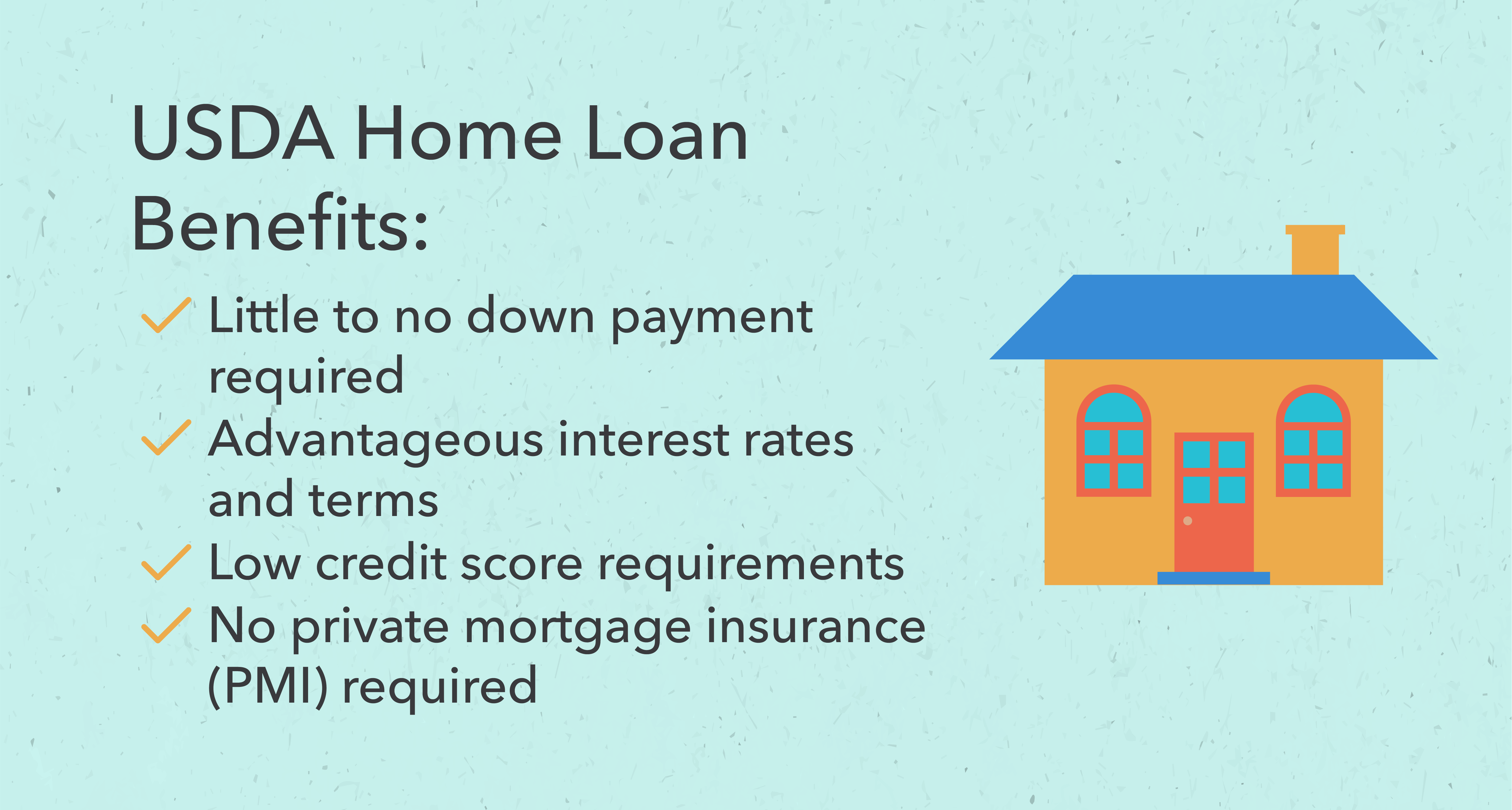

Are you ready to purchase a home but have limited funds? A USDA mortgage might be the perfect solution for you! USDA mortgages offer great benefits for those looking to buy a home without breaking the bank. This article will provide you with tips on how to get a USDA mortgage, so you can make your dream of home ownership a reality!

Contact USDA-approved lender.

Once you have decided that you would like to look into USDA mortgage options, it is important to contact a USDA-approved lender. This is key, as it will ensure that you receive the best rates and the most accurate advice for your individual situation. A USDA-approved lender will also be able to answer any questions you may have about the different mortgage options and help make the process as easy as possible.

Verify income eligibility.

Verifying income eligibility for a USDA mortgage can be tricky for a 18-year-old student. You’ll need to provide proof of your income, such as pay stubs or tax returns, to determine if you qualify. Additionally, you’ll need to make sure your total household income falls within the USDA’s guidelines. It’s important to do your research and make sure you meet all the requirements before applying.

Meet credit requirements.

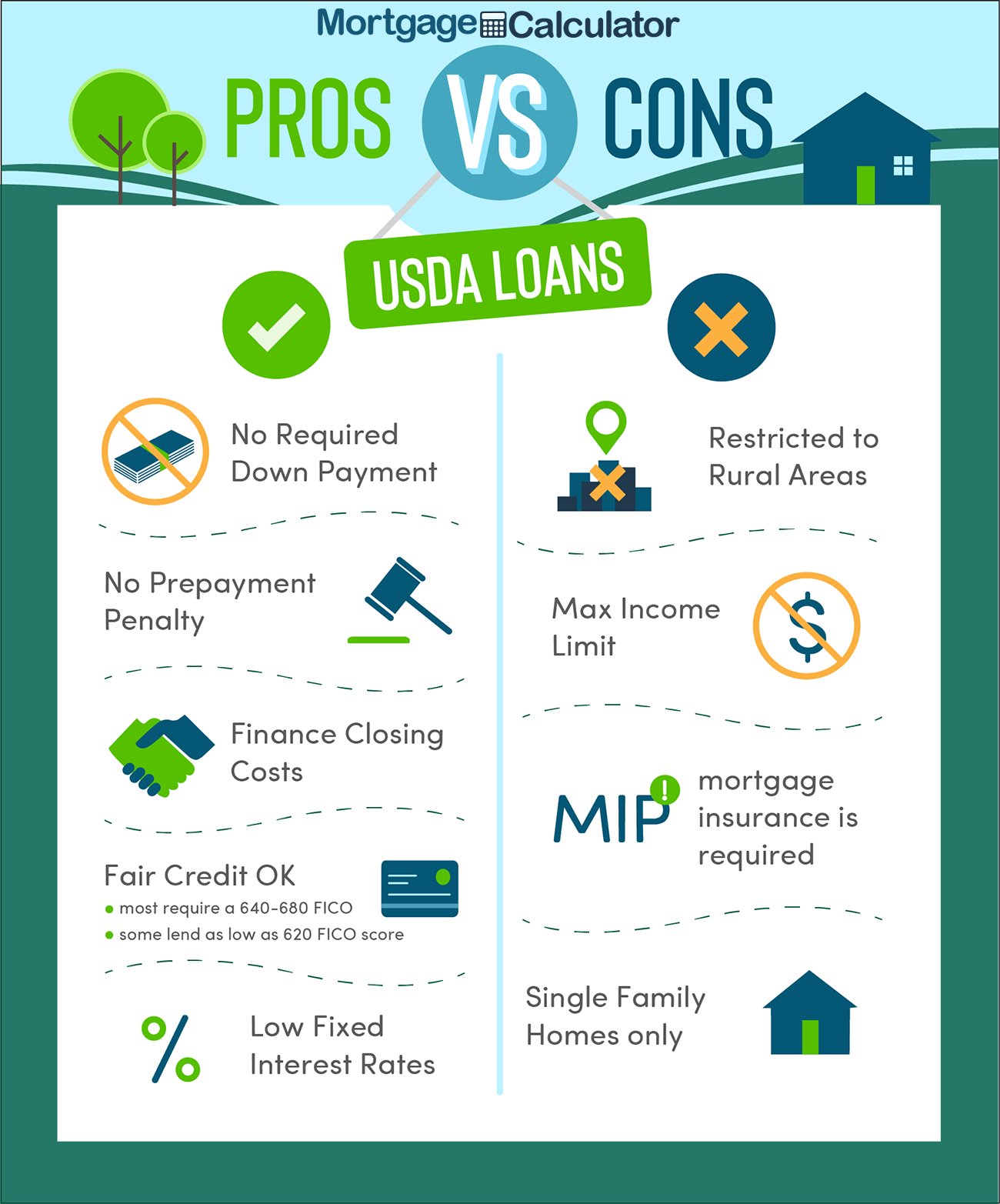

If you’re looking to get a USDA mortgage, you’ll need to meet some credit requirements. You’ll need to have a credit score of at least 620 to qualify, so start checking and building your credit if you haven’t already. Make sure you pay your bills on time and if you’re already in debt, work on paying it off as soon as you can. Good credit is key to qualify for a USDA mortgage.

Submit loan application.

Submitting a loan application for a USDA mortgage can be intimidating, but it doesn’t have to be. As an 18-year-old student, I found the process to be fairly easy. I collected all of my required documents, such as my tax returns, pay stubs, and bank statements. Then, I filled out the application and sent it off. All I had to do was wait for a response. It was surprisingly simple and stress-free.

Complete property appraisal.

Getting a USDA loan requires the completion of an appraisal of the property you are looking to buy. This appraisal is done by an independent appraiser, who will inspect the property and determine its value. The appraiser will look at the condition of the property and any upgrades or repairs that need to be done to bring it up to the standards of the USDA. He or she will also look at the local market values of similar properties in the area. The appraisal will help determine how much you can borrow from the USDA.

Receive USDA approval.

Getting USDA approval is not as hard as you think. You must be able to provide documentation that proves you are eligible, including income and citizenship information. Additionally, you must be able to prove that you have the ability to make the mortgage payments. To get approval, you must submit the appropriate paperwork to the USDA and they will review your application. The process can take a few weeks, so it’s important to be patient and prepare all the necessary paperwork.