Are you looking for a way to get a hard money mortgage and don’t know how to start? Don’t worry, you’ve come to the right place! In this article, I’ll be taking you through a step-by-step guide on how to get a hard money mortgage. I’m an 18-year-old student and I’ve been through the process myself, so you can trust that these tips will help you get the money you need. With the right information, you’ll be able to get a loan fast, with minimal paperwork and stress. Keep reading to find out how to get a hard money mortgage the right way!

Research Local Lenders

When researching local lenders for a hard money mortgage, it’s important to check reviews, ask around, and make sure they have competitive rates. Look for a lender who has experience in hard money mortgages and has a good track record. Make sure they have a good reputation and that they are reliable. It’s also important to check in with your local real estate agents and see who they recommend.

Compare Terms & Rates

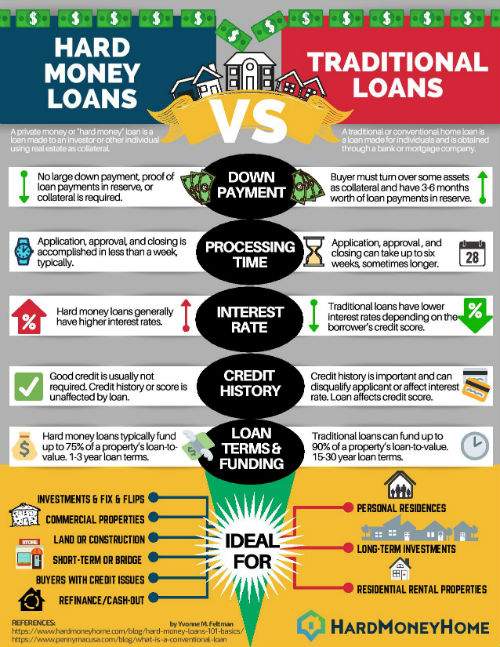

Comparing terms and rates for a hard money mortgage can save you a lot of money in the long run. Shop around for the best deals and don’t just go for the first one you find. Look for competitive interest rates and favorable repayment terms. Ask for advice from your friends, family, or professionals in the field if you’re feeling overwhelmed. Don’t be afraid to negotiate as there are often better deals to be found.

Gather Financial Info

Gathering financial information is an important step when applying for a hard money mortgage. To get started, you need to know your current credit score and how much money you have saved up. You’ll also need to provide proof of income, such as pay stubs or tax returns, and documents showing any assets you have. Being prepared with this information can help make the process of getting a hard money mortgage smoother.

Fill Out Application

Filling out an application for a hard money mortgage can seem intimidating, especially for a young person like me. But I’ve found that it’s actually a lot easier than I thought. All I need to do is gather some information about my credit score, income, and assets, fill out the forms, and submit the application. With a little time and effort, I’m confident I can get the mortgage I need.

Submit Supporting Docs

After you have completed the application, you will need to submit supporting documents to get a hard money mortgage. These documents may include proof of your income, bank statements, tax returns, and other documents. It is important to have all the documents ready, as this will make the process faster and easier. Make sure to double-check everything before submitting your documents, as any mistakes could lead to delays in the process.

Receive Approval/Denial

Getting a hard money mortgage is a tricky process. After submitting all necessary paperwork and documents, you’ll receive either an approval or denial. If approved, the lender will provide you with a loan agreement and the terms of the mortgage. If denied, the lender will provide an explanation of why you were declined. It’s important to take the time to understand why you were denied, and find the right loan for you.