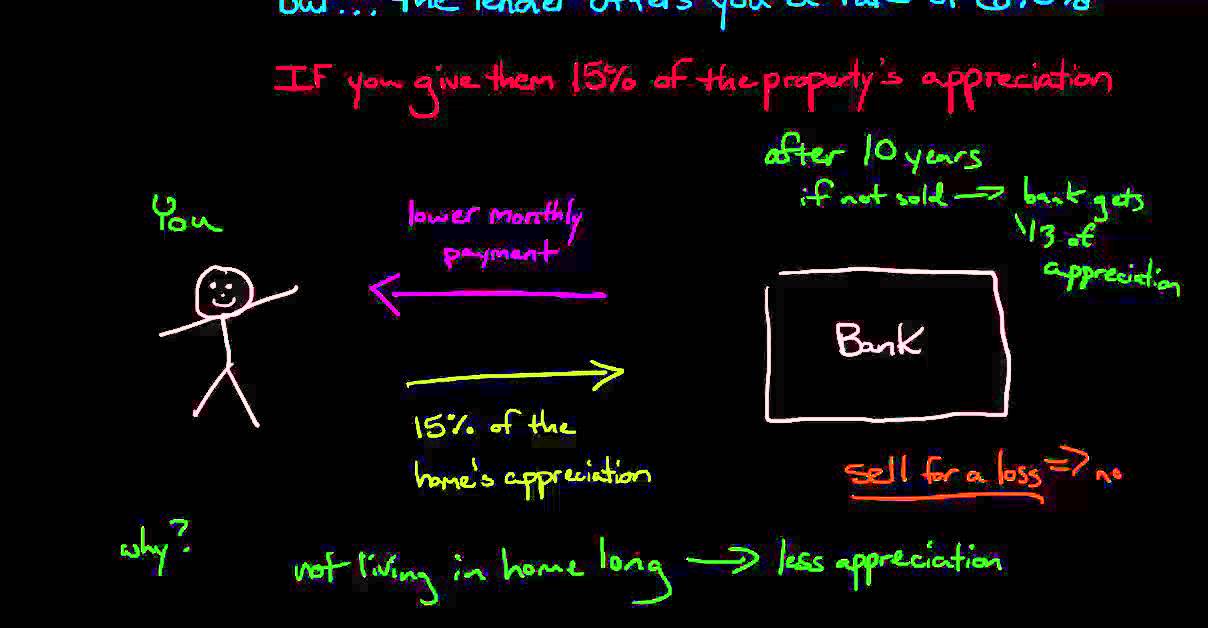

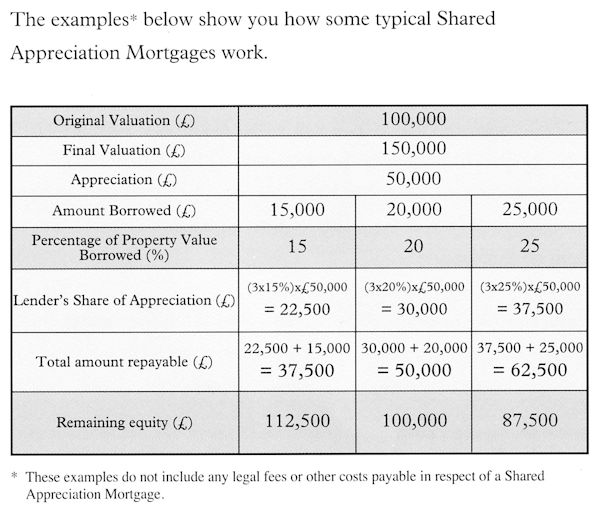

Are you looking for a way to get a shared appreciation mortgage? A shared appreciation mortgage (SAM) is a type of home loan that can help you reduce the amount of money you owe on your mortgage. It’s a great option for those who want to pay off their mortgage faster, but don’t have the extra cash to do so. With a SAM, you can reduce your mortgage balance while still retaining some equity in your home. In this article, we’ll discuss how to get a shared appreciation mortgage, the benefits it offers, and the steps you need to take to get started. So, if you’re ready to start saving money and paying off your mortgage faster, keep reading!

Research eligibility requirements

Researching eligibility requirements for Shared Appreciation Mortgages (SAMs) can be a bit tricky. As an 18 year old student, I made sure I did my research to understand the requirements and if I was eligible. I checked the requirements for age, credit score, income, and any other criteria the lender might need. This was important to make sure I had the best chances for getting approved for the mortgage.

Contact lender/broker

If you’re looking to get a Shared Appreciation Mortgage, then contacting a lender or broker is the best way to go. With their expertise and experience, they can give you the best advice on how to get the best deal. I’m an 18 year old student and my friends have all used lenders and brokers to get their mortgages and they’ve all been really happy with the outcome. It’s definitely worth looking into.

Confirm available programs

Confirming available programs is essential when it comes to getting a Shared Appreciation Mortgage. The best way to do this is to research online and compare different programs. You can also contact banks and lenders directly to find out which ones offer Shared Appreciation Mortgages. It’s important to understand the terms and conditions of each program before deciding which one is best for you. With the right information, you can find the program that best fits your needs.

Gather financial info

Getting a shared appreciation mortgage (SAM) is one of the best ways to finance a home purchase if you’re a first-time homebuyer. Before you start the process, it’s important to gather all the financial info you’ll need. Make sure to have your credit score, income and expenses, debt-to-income ratio, and other financial documents prepared. This will make the process of applying for a SAM much easier and quicker.

Submit application

Submitting an application for a Shared Appreciation Mortgage (SAM) can be intimidating, but it doesn’t have to be. All you need is an idea of what you’re looking for and some basic information. Start by researching potential lenders and their SAM criteria. Once you have an idea of what you’re looking for, fill out the application and submit it. Make sure to include all the necessary details and documents to get the process started. With a little bit of effort, you can get the SAM you need.

Receive approval/denial

Getting approved or denied for a Shared Appreciation Mortgage is a huge process. You’ll have to fill out a lot of paperwork, provide financial statements, and other documents. You also need to make sure your credit score is in good standing. The best thing to do is to get pre-approved before you start the process, so you know where you stand. It’s also important to shop around for the best interest rates and terms.