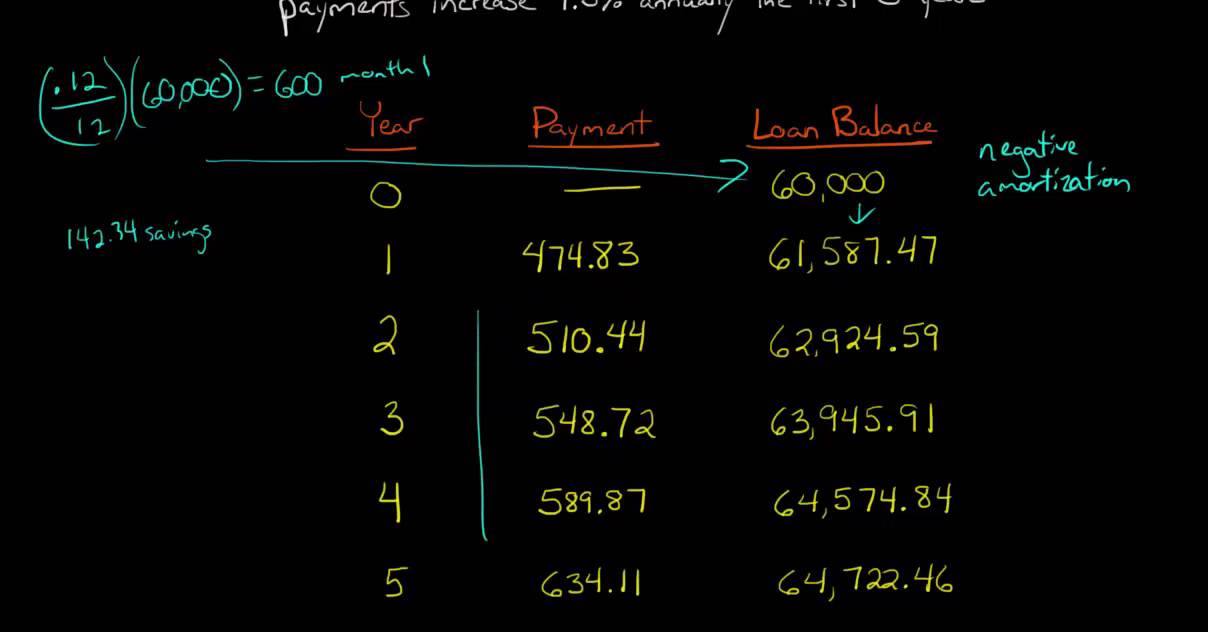

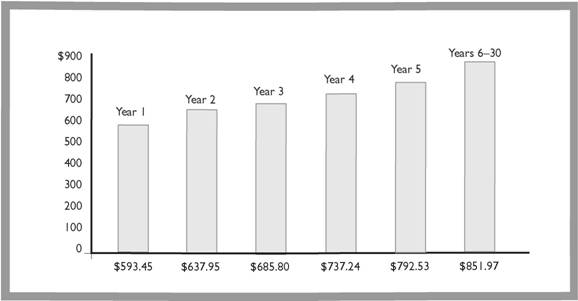

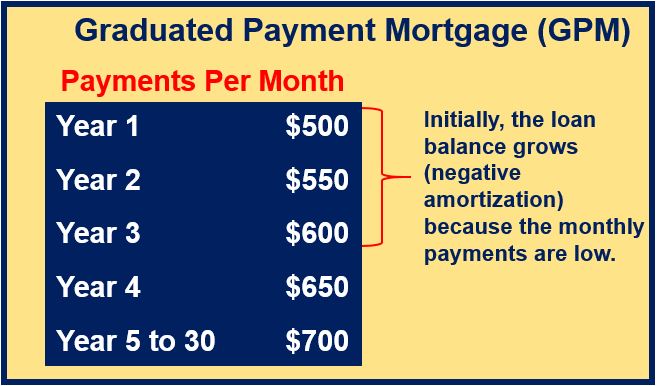

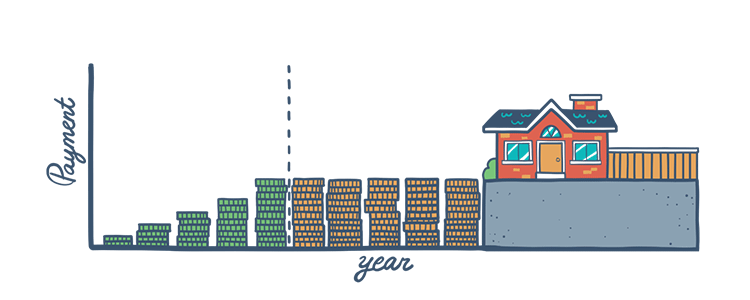

As an 18-year-old student, I’m sure you’re already aware of the importance of having a good credit score. But did you know that you can get a Graduated Payment Mortgage (GPM) to help you build your credit and save money? GPMs are a great option for young adults and students because they allow you to make lower payments at the beginning and increase over time. In this article, I’m going to show you how to get a Graduated Payment Mortgage so you can start building your credit and save for your future.

Research lenders/rates

Doing research on lenders and their rates is an important part of the process of getting a graduated payment mortgage. I recommend that you compare different lenders, their rates, and terms to make sure you get the best deal possible. Don’t forget to check online reviews to get an idea of what other people have experienced with the lenders you are considering. It’s also a good idea to reach out to people you know who have had a graduated payment mortgage to get their input.

Compare requirements

If you’re considering a Graduated Payment Mortgage (GPM) loan, it’s important to compare the requirements of different lenders. GPM loans typically require a larger down payment and a higher credit score than other loans. Additionally, you may be asked to provide documentation such as income and asset statements. Make sure to shop around and compare rates to get the best deal.

Calculate affordability

Calculating affordability for a graduated payment mortgage can be tricky. As a young adult, it’s important to know your financial situation and goals before diving in. Consider your current income and expenses, as well as any potential changes to your circumstances that may affect your ability to pay back the loan. It’s also important to consider additional costs that may be associated with the loan, such as closing costs and insurance. Taking the time to do the math can help you make the best decision when it comes to your finances.

Gather documents

Gathering the documents you need to apply for a Graduated Payment Mortgage (GPM) can seem like a daunting task. But don’t worry – it’s not as difficult as it may seem! Before you get started, make sure to have all the necessary documents on hand, such as proof of income, credit score, bank statements, and other financial documents. With these documents in hand, you can easily apply for a GPM and have the peace of mind you need.

Submit application

Submitting an application for a graduated payment mortgage is relatively simple. All you need to do is gather all the necessary documents, fill up the application form, and submit it to the respective lender. Make sure you include accurate information about your current financial situation, so that the lender can offer you the best rate and terms for your loan.

Monitor approval process

Monitoring the approval process of a graduated payment mortgage can be intimidating. I’m 18 years old, and it’s taken me a while to understand the process, but I’m here to help! Make sure to stay organized and keep track of all your paperwork so you can stay on top of the process. Doing this will help ensure you get the best mortgage for your needs.