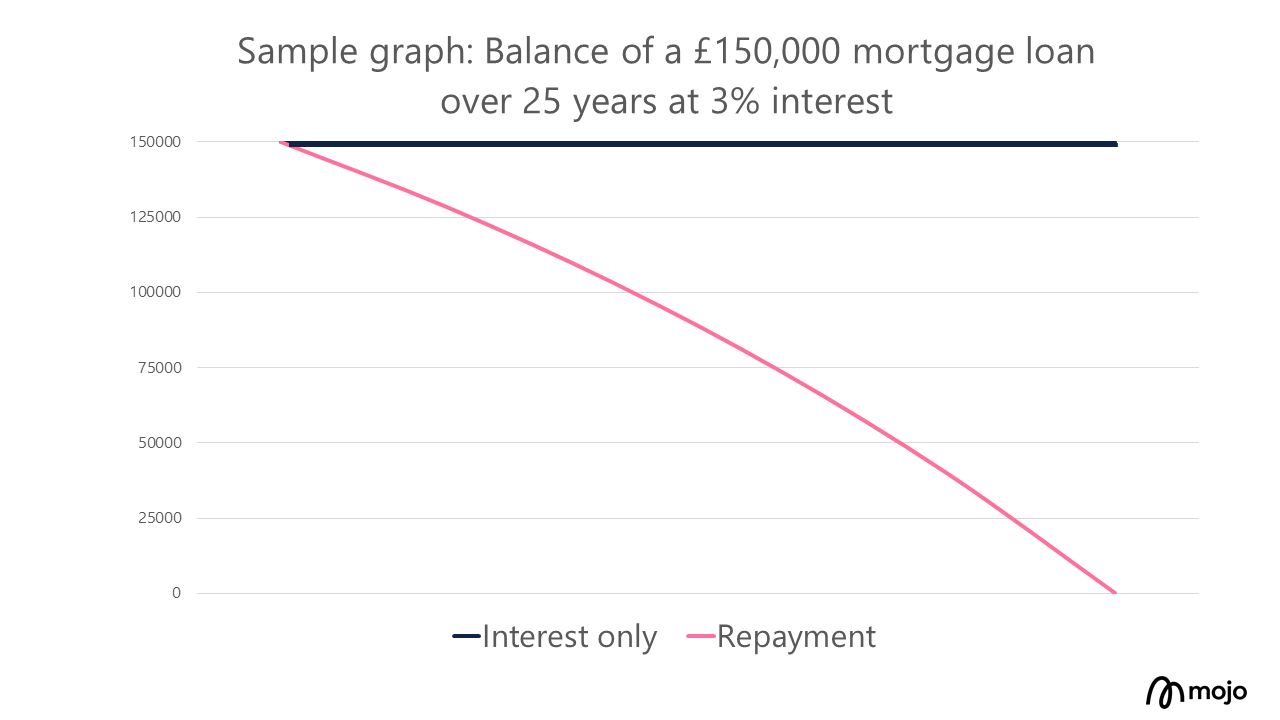

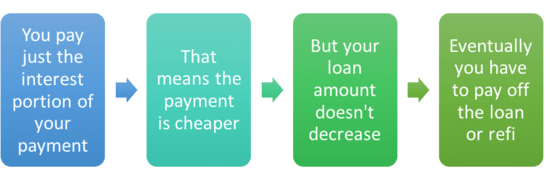

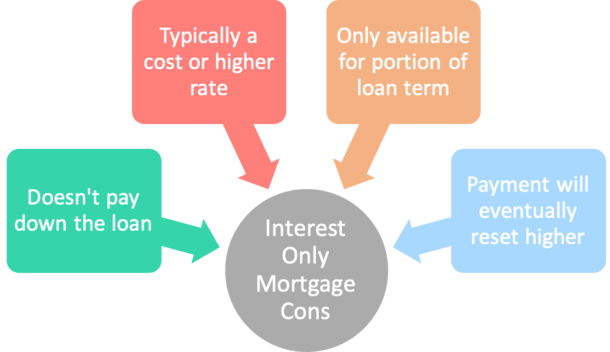

If you’re an 18-year-old student looking to purchase your first home, an interest-only mortgage might be the perfect way to help you get there. An interest-only mortgage is a type of loan that allows you to pay only the interest on the loan for a set period of time, usually five to ten years. After the initial period, the loan will then convert to a regular mortgage. In this article, we’ll explain what an interest-only mortgage is and how you can get one.

Gather financial documents.

Gathering financial documents is essential when applying for an interest-only mortgage. As a 18-year-old, you’ll need to prove your income, savings history, and credit report. Make sure you have all the paperwork ready and in order, so you can show the lender that you’re a responsible borrower. Take your time to go through all the documents and check for any mistakes, it could make the difference in getting approved or not.

Shop lenders.

When it comes to getting an interest-only mortgage, shopping around for lenders is key. A great way to get the best deal is to compare rates from multiple lenders. As an 18-year-old, it’s important to shop around, research your options, and be sure to read the fine print. Look for lenders that offer competitive rates and flexible repayment plans.

Compare options.

Comparing options is key when it comes to getting an interest-only mortgage. Shopping around and looking at multiple lenders can help you get the best rates. I looked at a few different lenders and compared the different interest rates they were offering. It was really helpful in making sure I got the best deal on my mortgage.

Choose lender.

When it comes to choosing a lender for an interest-only mortgage, make sure to shop around and compare rates. Research different lenders online, talk to friends and family who have gotten a mortgage, and ask your bank for advice. Don’t be afraid to shop around and negotiate to get the best rate possible. Remember, this is your future and you want to make sure you’re making the best decision.

Submit application.

Submitting your application for an interest-only mortgage can be daunting, especially as an 18-year-old. It’s important to go into the process prepared, with all of the necessary documents, such as proof of income, credit history and other financial information. Make sure to read the fine print and ask questions when you’re unsure of something to ensure you’re making the best decision for your financial future.

Receive approval.

Receiving approval for an interest-only mortgage can be a challenge, especially for those under 21. To get the best shot at being approved, make sure you have a good credit score and a steady job. Additionally, you’ll want to focus on showing lenders that you have the resources to pay back the loan, such as savings and investments. Being honest and organized with your finances will give you the best chance at getting the loan you need.