Are you considering a Financial Risk Management (FRM) certification to elevate your career prospects? If so, our comprehensive guide on the pros and cons of pursuing an FRM is a must-read for you! As one of the most sought-after credentials in the world of finance, the FRM certification can open doors to lucrative opportunities and help you stand out in a competitive job market. However, before you dive headfirst into this challenging journey, it’s crucial to weigh the benefits and drawbacks to make an informed decision. Join us as we dissect the advantages and potential pitfalls of obtaining an FRM, and determine whether this esteemed certification is the right move for your professional growth.

Global Recognition: The FRM certification is recognized and respected worldwide by employers, institutions, and clients

Global Recognition: One of the most significant advantages of obtaining a Financial Risk Manager (FRM) certification is its global recognition. Employers, institutions, and clients around the world view the FRM certification as a testament to an individual’s expertise and dedication to the field of risk management. As the demand for skilled risk professionals continues to rise, holding an FRM certification can significantly enhance your career prospects and marketability. It also enables you to build a professional network with like-minded peers, further expanding your opportunities in the ever-evolving financial landscape. This global recognition sets the FRM certification apart, making it an invaluable asset for finance professionals worldwide.

It signifies a professional who has demonstrated in-depth knowledge and expertise in financial risk management.

An FRM, or Financial Risk Manager, is a prestigious designation that signifies an individual who possesses in-depth knowledge and expertise in the field of financial risk management. This title is highly sought after by professionals in the finance and banking industries, as it showcases their ability to effectively navigate the complex world of risk management. Obtaining the FRM designation requires dedication, hard work, and a commitment to staying updated on the latest trends and developments in the financial landscape. As a result, hiring professionals with this credential can significantly enhance your organization’s risk management capabilities, ensuring the financial stability and long-term success of your business.

Career Advancement: FRM holders are sought after by banks, investment firms, and other financial institutions for their specialized skills in assessing and managing financial risks

Career Advancement Opportunities: FRM certification significantly boosts your career prospects as it is highly valued by top financial organizations globally. Banks, investment firms, and other financial institutions actively seek FRM holders for their expertise in identifying, analyzing, and mitigating financial risks. This prestigious designation sets you apart from your peers, providing a competitive edge in the job market. Furthermore, the FRM network offers excellent opportunities for professional growth, networking, and knowledge sharing with industry experts, ensuring you stay ahead in the rapidly evolving field of risk management.

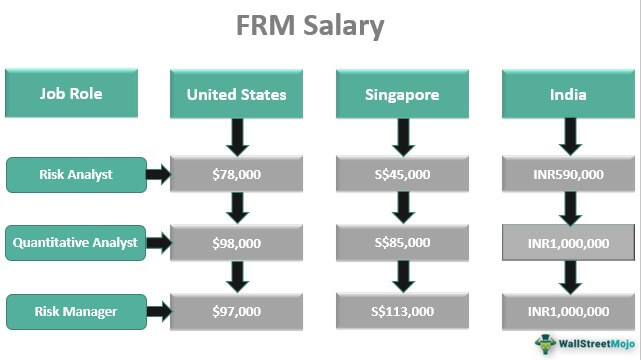

Earning the FRM certification can open doors to new job opportunities, promotions, and higher salaries.

Earning the FRM certification not only enhances your risk management skills, but also significantly boosts your career prospects in the finance industry. With this globally recognized credential, professionals can unlock a plethora of new job opportunities, ascend the corporate ladder through promotions, and command higher salaries compared to their uncertified peers. In today’s highly competitive job market, an FRM designation can set you apart from the crowd, showcasing your expertise and commitment to staying abreast of the latest trends in financial risk management. Moreover, FRM holders often enjoy an extensive professional network and access to exclusive resources, further bolstering their career growth.

Comprehensive Knowledge: The FRM curriculum covers a wide range of financial risk management topics, including market risk, credit risk, operational risk, liquidity risk, and risk management techniques

Comprehensive Knowledge: Pursuing a Financial Risk Management (FRM) certification provides an in-depth understanding of various financial risk domains, ensuring a robust skillset for professionals. The extensive FRM curriculum delves into critical aspects such as market risk, credit risk, operational risk, and liquidity risk, equipping individuals with the knowledge to navigate the complex financial landscape. Additionally, the program covers advanced risk management techniques, empowering professionals to implement effective strategies and mitigate potential threats. This all-encompassing knowledge not only enhances career prospects but also enables FRM-certified individuals to drive informed decision-making in the dynamic world of finance.

This comprehensive knowledge base enables FRM holders to

The FRM certification equips finance professionals with a comprehensive knowledge base, empowering them to effectively identify, assess, and manage potential risks within an organization. This in-depth understanding of financial risk management enables FRM holders to proactively mitigate risks, devise strategic solutions, and safeguard the company’s financial stability. As a result, organizations that employ certified FRM professionals can benefit from enhanced decision-making processes, improved risk management strategies, and strengthened financial performance. Consequently, pursuing an FRM certification can significantly boost one’s career prospects, making it an invaluable investment for finance professionals seeking to excel in the risk management domain.