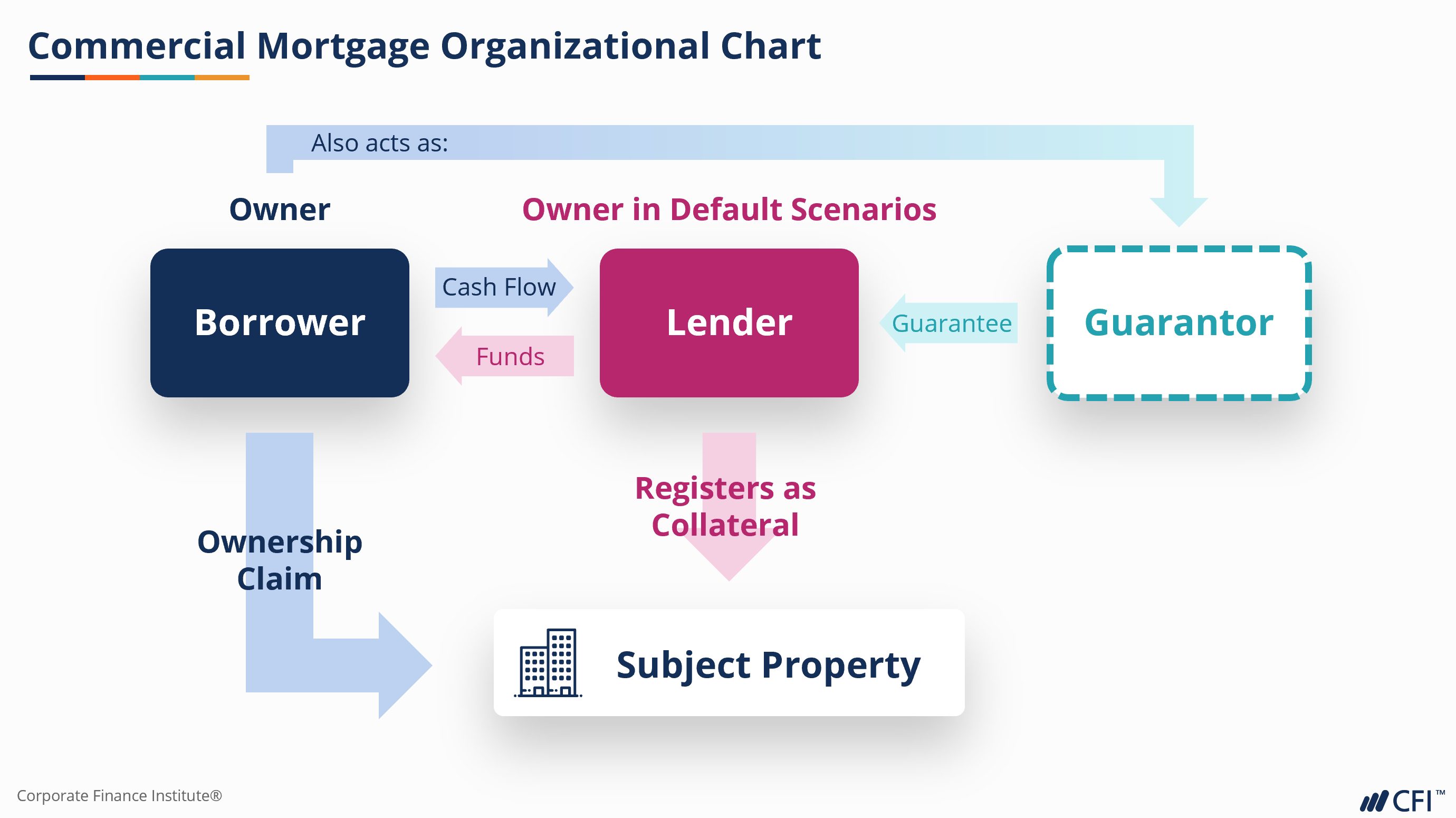

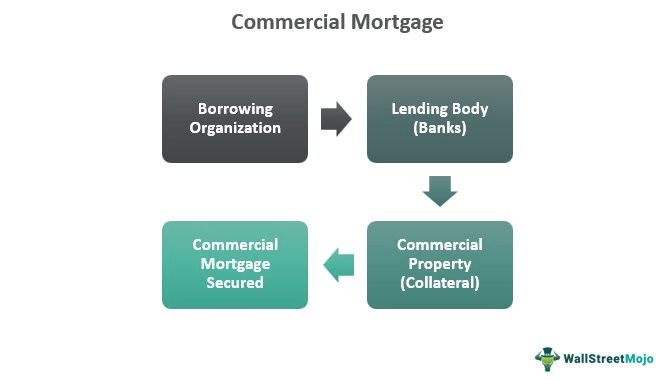

Are you looking to purchase commercial real estate but don’t have the capital? A commercial mortgage can help you finance your dream business purchase. A commercial mortgage is different from a residential mortgage in that it has different eligibility requirements and is typically more difficult to obtain. In this article, we’ll explore the process of getting a commercial mortgage, including what lenders look for, the application process, and how to maximize your chances of approval. Read on to learn how to get a commercial mortgage and make your business dreams come true.

Research lenders & rates.

Before selecting a lender, it is important to research the rates they offer, as well as the terms they set. Comparing different lenders and rates can help you find the best deal for you.

Calculate affordability.

When calculating affordability for a commercial mortgage, be sure to consider your income, expenses, debt and credit score. Make sure that you have enough money to cover the mortgage payments and other costs associated with the loan.

Gather documents.

Before applying for a commercial mortgage, it is important to gather all necessary documents such as proof of income and credit history. This will help the lender to understand your financial situation and make an informed decision.

Submit application.

Submitting an application for a commercial mortgage is an important step in the process of getting the financing you need for your business. It is important to make sure that all of the information you provide is accurate and up to date in order to maximize your chances of getting approved.

Negotiate terms.

Negotiating terms for a commercial mortgage can be a complicated process. It is important to have an experienced negotiator on your side who can help you get the best terms for your situation. Make sure you understand all the terms of the loan before signing any documents.

Sign contract.

Once you have found the right commercial mortgage for your business needs, it is important to make sure that all of the terms of the loan are outlined in the contract before signing. Make sure all parties understand and agree to all of the terms, as this can help to avoid any potential disputes down the line.