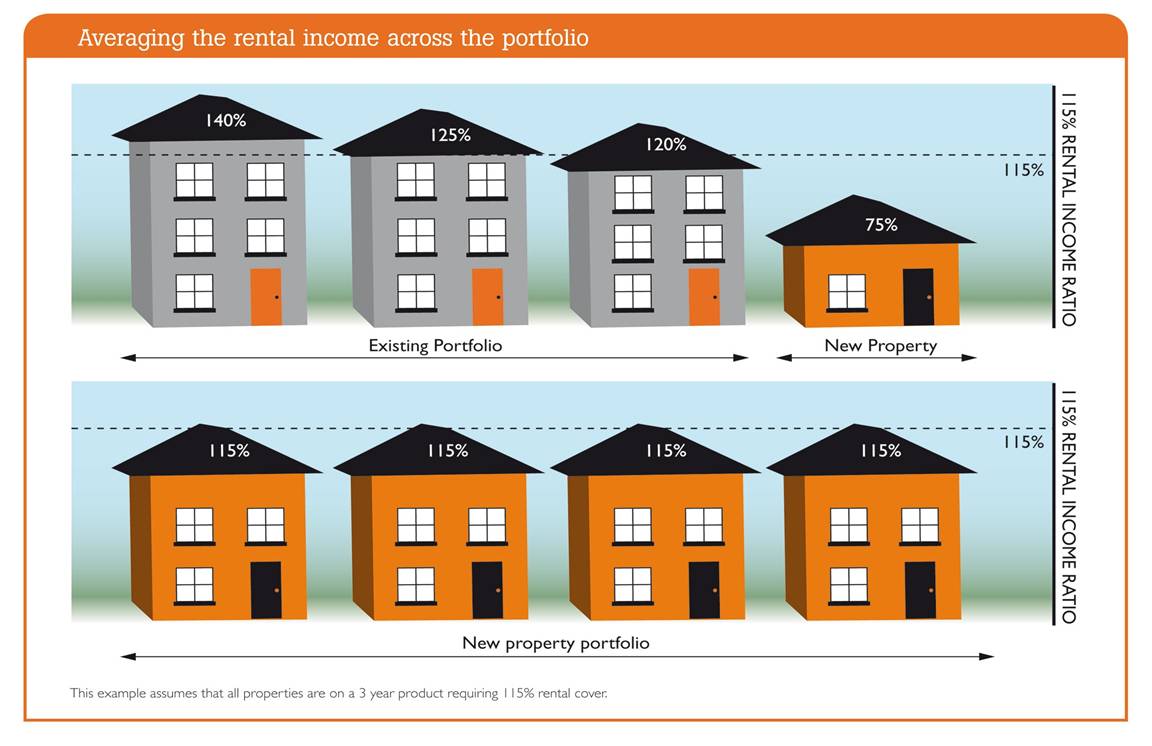

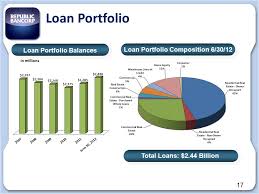

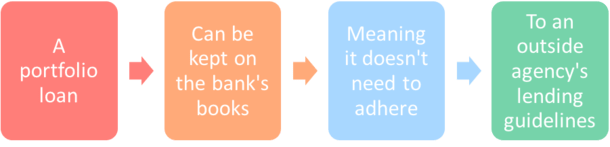

Are you ready to take the plunge and buy your first home but don’t have the 20% down payment usually required to secure a traditional mortgage? Don’t worry, a portfolio mortgage may be the answer you’re looking for. A portfolio mortgage is a loan that is held and serviced by a lender and not sold on the secondary market. This type of loan can be a great option for people who don’t have the traditional 20% down payment but still want to become homeowners. In this article, we’ll discuss how to get a portfolio mortgage, the benefits of this type of loan, and tips for making it a smoother process. So, let’s get started!

Research lenders & criteria.

Do your research and compare lenders to find the best portfolio mortgage for you. Review each one’s criteria and make sure it meets your needs and budget.

Gather financial documents.

Gathering the necessary financial documents is an important step in getting a portfolio mortgage. It is essential that you provide the lender with accurate and up-to-date records of your income and assets to ensure the best possible outcome. Be sure to take the time to review and organize all of your documents before submitting them.

Calculate debt-to-income ratio.

.Calculating your debt-to-income ratio is an important step to determine if you’re eligible for a portfolio mortgage. It requires calculating your total monthly debt payments, such as credit cards and student loans, and dividing them by your gross monthly income. This number can help you decide if you can take on additional debt.

Choose lender & product.

Choosing the right lender and product for your portfolio mortgage can be a daunting task. With so many different options available, it can be difficult to narrow down the best choice for you. Do your research, compare rates and terms, and ask questions to make sure you make the best decision.

Submit application & documents.

When applying for a portfolio mortgage, make sure you have all your documents and forms ready to submit. This can include your credit score, income, and other financial information. Make sure to double check all the information is correct to ensure a smooth process.

Receive loan approval.

Once you have applied for a portfolio mortgage, the next step is to receive loan approval. It is important to have all the necessary documents and be prepared to answer any questions your lender may have to ensure your loan is approved.