Are you a student trying to figure out how to get biweekly mortgage payments? It can be a daunting task to figure out the best way to get a biweekly mortgage, but don’t worry – I’m here to help! In this article, I will show you the best way to get a biweekly mortgage payment and make sure you are paying the lowest amount of interest possible. With this guide, you’ll have all the information you need to get the most out of your biweekly mortgage payments. So, buckle up and let’s get started!

Research mortgage lenders

If you’re looking for a biweekly mortgage, it’s important to do your research and find the best mortgage lender for you. Start by comparing rates, fees, and other services from multiple lenders. Make sure you understand their terms and ask questions if something isn’t clear. Don’t be afraid to negotiate and shop around until you find the right deal.

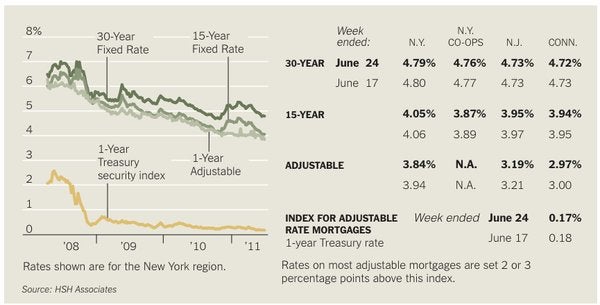

Compare interest rates

If you want to get a biweekly mortgage, it’s important to compare different interest rates. Many lenders offer different rates, so it’s important to do some research. Shop around to find the best offer that fits your budget and financial goals. Don’t forget to check out online lenders and credit unions, as they can often have even better rates than traditional banks.

Submit loan application

Submitting a loan application for a biweekly mortgage can be daunting, especially if you’re a young adult. But don’t worry, the process is easier than it looks! You’ll need to make sure you have all your financial documents ready, such as your income statements, credit score, bank statements, and other documents. After that, you just need to fill out an application and submit it – it’s that easy!

Negotiate terms

If you’re looking to get a biweekly mortgage, you should definitely try to negotiate the terms. You may be able to get a lower interest rate or a lower monthly payment. Don’t be afraid to ask questions and get the best deal possible. And remember, if you don’t feel comfortable with the terms, don’t sign anything. You have the power to get what’s best for you.

Sign paperwork

Signing paperwork for a biweekly mortgage can be a daunting task for someone just starting out. Being 18, I’m still learning the ropes of managing finances, so having to sign a contract that could potentially affect my future in a big way was intimidating. Thankfully, I had help from an experienced professional who guided me through the process, making sure everything was in order before I put my signature on the dotted line.

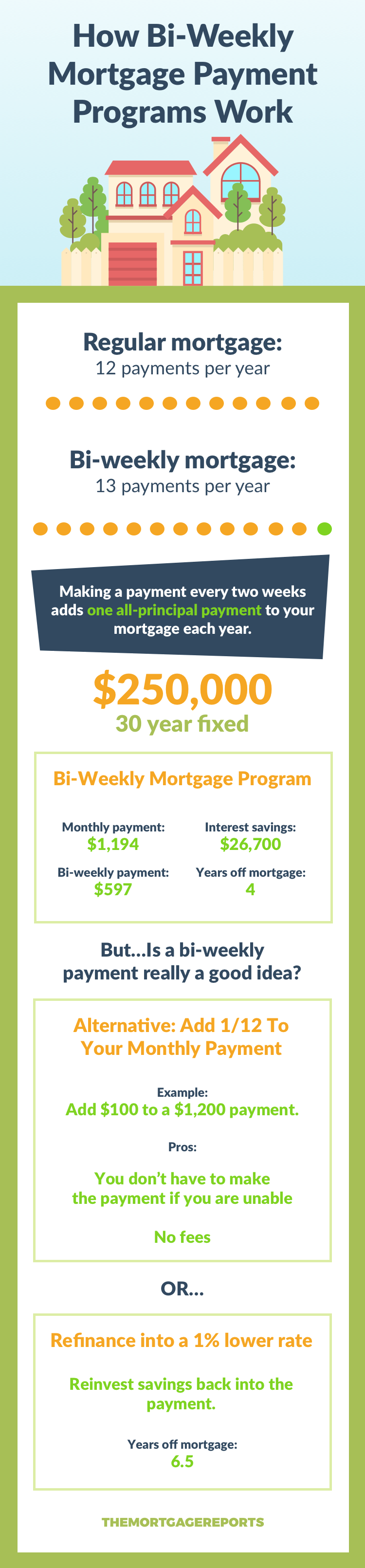

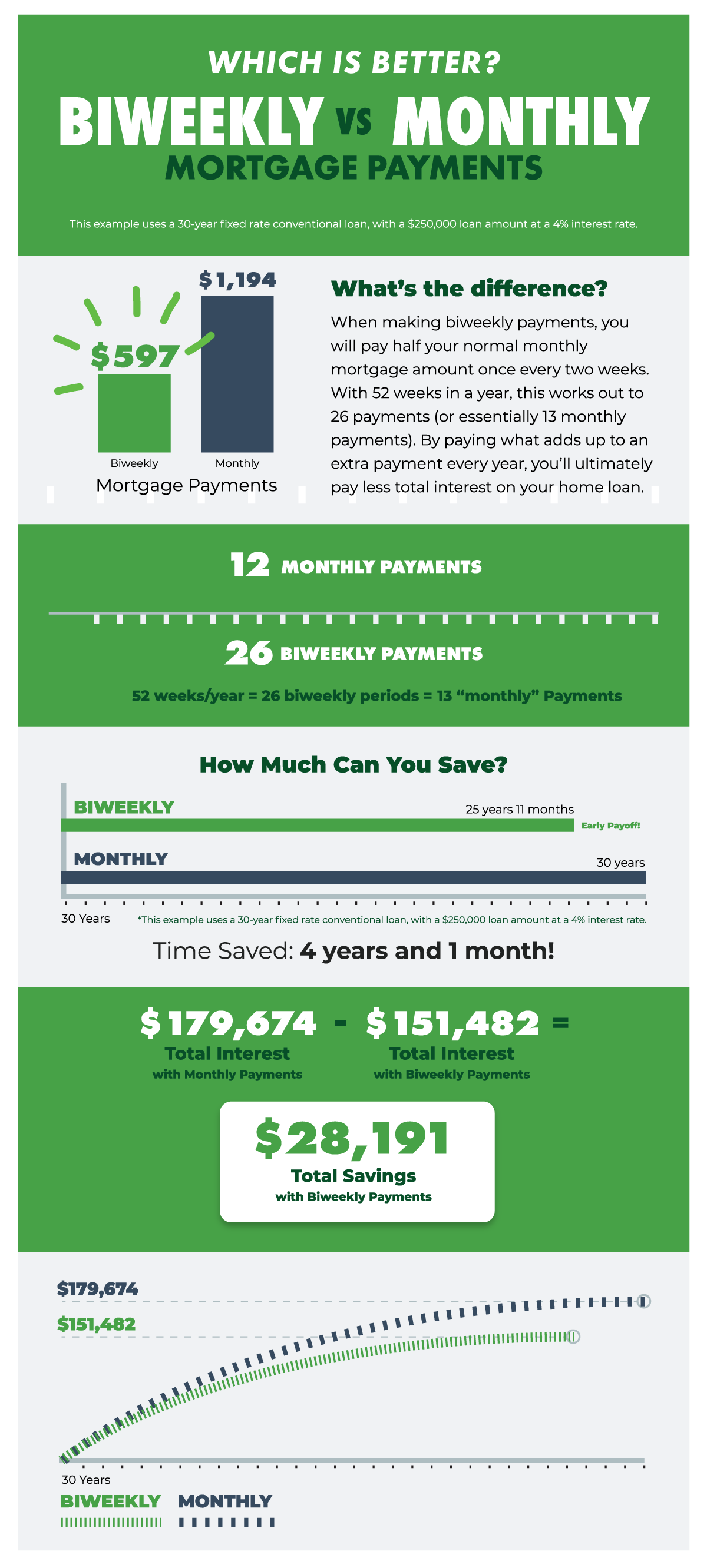

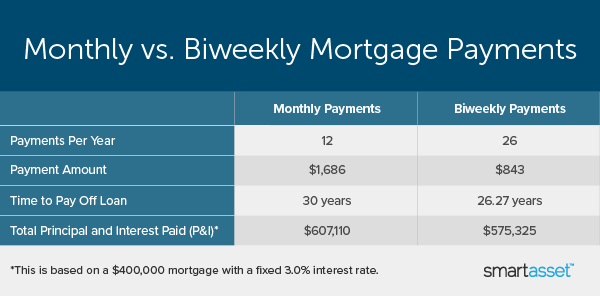

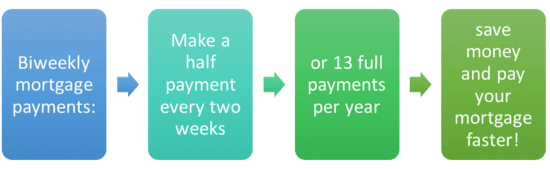

Make biweekly payments

Making biweekly payments for your mortgage is an excellent way to save money and pay off your loan faster. It’s easier than you think to set up biweekly payments; simply contact your mortgage lender and ask how you can make payments every two weeks. This technique can help you save hundreds of dollars in interest, as well as help you pay off your mortgage sooner. So get started today and enjoy the financial benefits of biweekly mortgage payments!