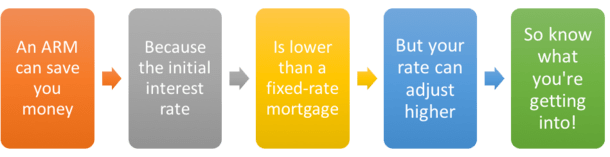

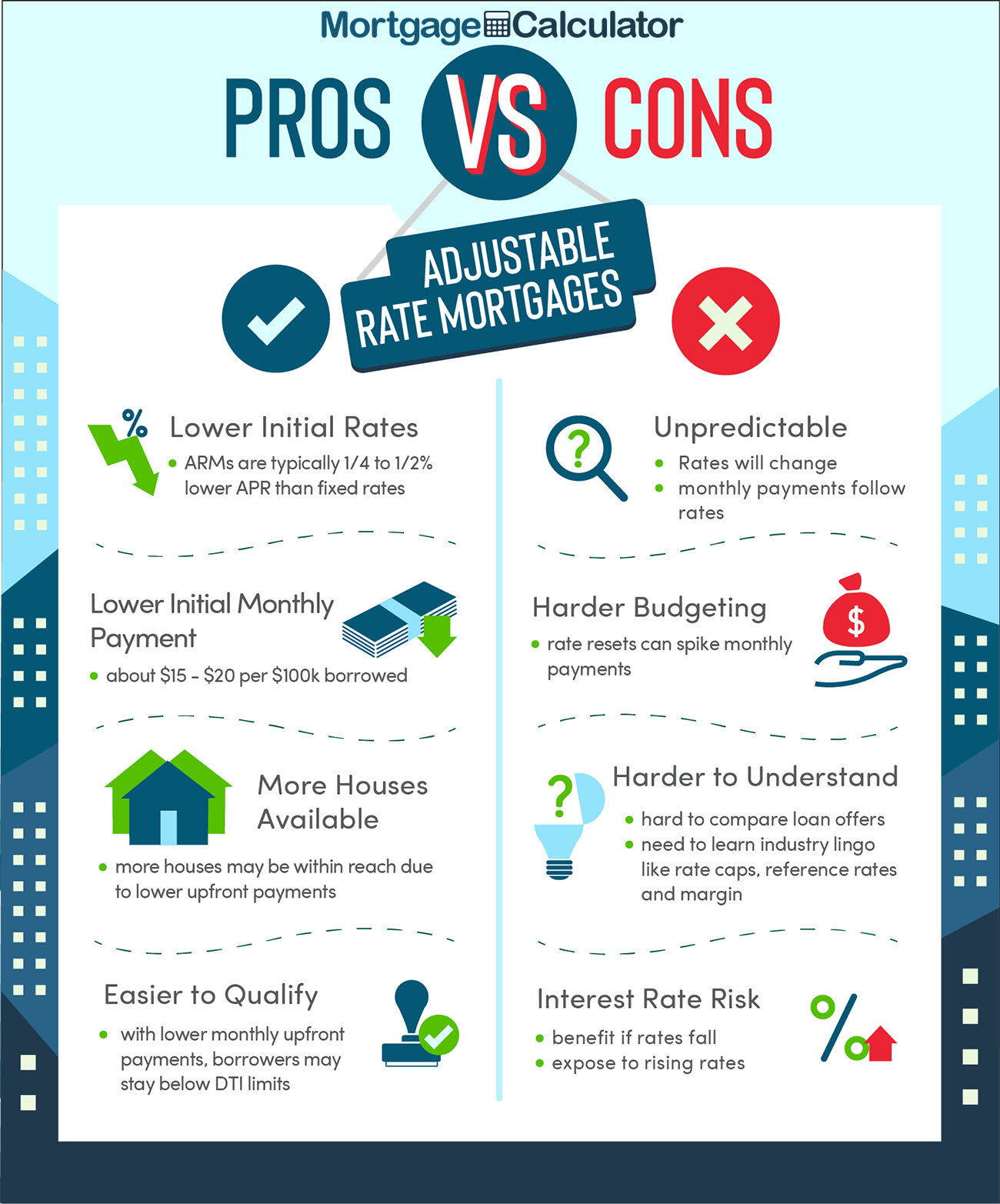

Getting an adjustable rate mortgage with a fixed period doesn’t have to be a daunting task. In fact, it’s not even as complicated as it looks! With the right information, you can easily secure a great rate and be on your way to owning a home. Whether you are an 18-year-old student looking to get your foot in the door of the housing market, or an experienced homeowner looking to refinance, understanding the ins and outs of adjustable rate mortgages (ARMs) can help you make the best decision for your individual situation. Read on to learn more about how to get an adjustable rate mortgage with a fixed period.

Research mortgage options.

Researching your mortgage options is key to finding the best adjustable rate mortgage with a fixed period. I’m 18, so I’m new to this, but I’ve been doing my research and it seems that the best way to get the mortgage I want is to compare different lenders, interest rates, and fees so I can make an informed decision. I’m also trying to get advice from friends and family who have experience with mortgages to make sure I’m making the right choice.

Compare rates, terms.

Comparing rates and terms of adjustable rate mortgages with a fixed period can be overwhelming. But there are a few things you can do to make it easier. First, look into multiple lenders to compare rates and terms. Be sure to take into account the length of the fixed period and any fees associated with the mortgage. Additionally, look for reviews from other customers who have taken out a similar loan to get an idea of their experiences.

Calculate long-term costs.

.Calculating the long-term costs of an adjustable rate mortgage with a fixed period can be tricky. To make sure you’re getting the best deal, use an online calculator or speak to a mortgage advisor. It’s important to understand the full implications of the loan including all fees and interest rates, as well as any potential risks. With the right guidance, you can make sure you’re getting the best deal for your situation.

Apply for adjustable mortgage.

Applying for an adjustable rate mortgage (ARM) with a fixed period can be overwhelming, but it doesn’t have to be! Start by talking to your local banker or credit union to get the best rate and terms for your specific situation. Be sure to have all your financial information on hand and be prepared to answer questions about your credit score and income. Once you have the details worked out, fill out the paperwork and submit it to your lender. With the right preparation and research, you can get an adjustable rate mortgage with a fixed period and save money in the long run.

Submit documentation.

Submitting documentation for an adjustable rate mortgage with a fixed period is the first step to take! To get started, you need to have all the necessary documents ready, such as your job history, tax returns, bank statements, credit report, and proof of income. You’ll also need to provide proof of insurance and other documents, depending on the lender’s requirements. Getting all this organized can be a bit daunting but it’s a must to secure your loan!

Wait for approval.

Once you’ve submitted all the necessary documents, it’s time to wait for approval. While this can be a nerve-wracking part of the process, it’s important to stay patient and trust in your lender. Make sure to keep an eye on your emails and follow up if you don’t hear back for a while. Getting an adjustable rate mortgage with a fixed period is a great way to save money, so don’t give up hope!