If you’re an 18 year old student and you want to get a mortgage but don’t have a credit history, don’t worry – it’s possible! Getting a mortgage without a credit history may seem like a daunting task, but with the right knowledge and preparation, it’s definitely achievable. In this article, I’ll be discussing the different ways you can get a mortgage with no credit history, and providing some helpful tips to make the process easier for you. So if you’re ready to take the first steps towards buying your first home, read on to find out how you can get a mortgage with no credit history.

Start saving for down payment

As a young adult, saving for a down payment can be a daunting task. It can seem overwhelming, but with some dedication and a smart budgeting plan, it can be done. I’ve been setting aside a little extra each month and am attempting to save up as much as possible. Additionally, I’m also researching low down payment loan options to help me out. In the end, it’ll all be worth it when I’m able to buy my first home.

Gather financial documents

Gathering financial documents is an essential part of getting a mortgage with no credit history. As a 18 year old, I found it intimidating at first. However, I realized that having my bank and income statements ready, along with my tax returns, would help me get the best mortgage rate possible. I also looked into other documents such as proof of employment and pay stubs. With a bit of research, I was able to make sure I had all the necessary documents ready.

Find a creditworthy cosigner

If you don’t have a credit history, you can still get a mortgage by asking someone with good credit to cosign on the loan. This person needs to be willing to take on the responsibility of the loan if you cannot make the payments. You can ask your parents, relatives, or close friends. Make sure to have an honest conversation about the risks and rewards of cosigning for you.

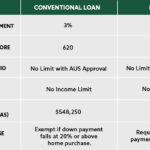

Research lenders/programs

I’m 18 and have no credit history so I’m researching lenders and programs that can help me get a mortgage. I’m looking for lenders that work with people like me with no credit history and offer low interest rates. I’m also looking for government programs that could help me get a mortgage with no credit history. I’m hoping to find something that will make getting a mortgage as an 18-year-old with no credit history possible.

Submit application materials

Getting a mortgage with no credit history may seem intimidating, but it’s not impossible. To start the application process, you’ll need to submit a few documents. This includes financial statements, employment verification, and proof of income. You’ll also need to provide a letter of explanation to explain why you have no credit history. With all the right documents in hand, you’re ready to submit your application and start your journey to homeownership.

Wait for loan approval

The waiting game can be nerve-wracking, especially when you’re a young adult trying to get your first mortgage. After you’ve submitted all the necessary paperwork, you just have to sit tight and hope that your lender approves your loan. It’s easy to get anxious and want to check up on the status of your loan, but I’ve learned the best thing to do is to just be patient and wait.