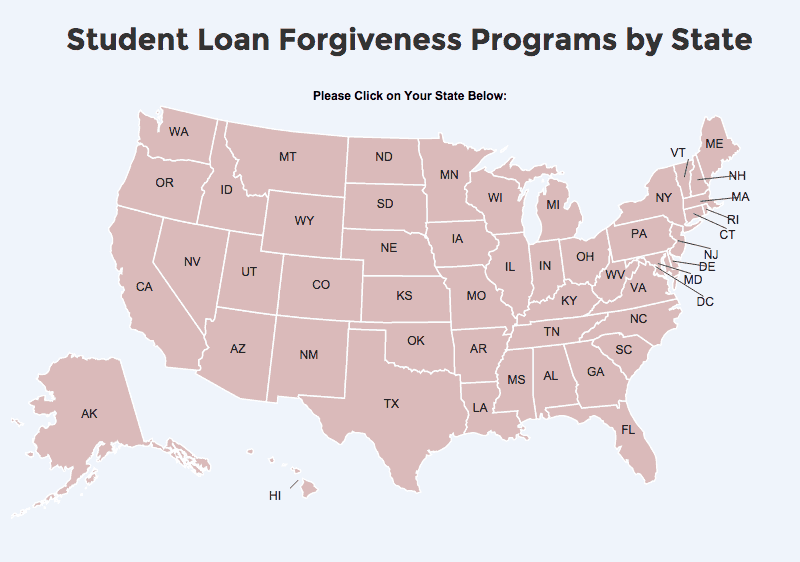

Are you drowning in student loan debt, seeking relief, and wondering if there’s a light at the end of the repayment tunnel? Look no further! Our comprehensive guide to state-specific student loan forgiveness programs is here to help you navigate the choppy waters of debt relief. With a thorough breakdown of each state’s unique offerings, you’re bound to find a program that fits your needs and puts you on the path to financial freedom. So, why wait? Dive into our expertly-curated list and discover the life-changing possibilities of student loan forgiveness today!

Exploring State-by-State Student Loan Forgiveness Programs: A Closer Look at Available Options

Delving into the realm of state-specific student loan forgiveness programs, we present a comprehensive guide to help you navigate the numerous opportunities available for reducing your student loan burden. Each state offers unique programs tailored to their residents’ needs, catering to various professions such as teachers, healthcare professionals, and public service workers. By examining these state-by-state options, you can identify the most suitable loan forgiveness initiatives to expedite your path to financial freedom. Our well-researched and regularly updated resource ensures you stay informed about the latest developments in student loan forgiveness, empowering you to make well-informed decisions for a brighter financial future.

Unlocking the Secrets to State-Specific Student Loan Forgiveness: Essential Tips and Strategies

Discover the keys to unlocking state-specific student loan forgiveness programs with our essential tips and strategies. Navigating the world of student loan forgiveness can be overwhelming, but we’ve broken it down to simplify the process for you. Our comprehensive guide will help you understand the eligibility criteria, application process, and benefits of various state-specific programs, ensuring you’re on the right path towards financial freedom. By staying informed and proactive, you can maximize your chances of qualifying for student loan forgiveness and start making strides towards a debt-free future. Don’t miss out on these invaluable opportunities – dive into our expert advice and start your journey today.

Decoding Regional Student Loan Relief Opportunities: How to Maximize State-Based Forgiveness Programs

Discovering Regional Student Loan Relief Opportunities: Unlock the Potential of State-Based Forgiveness ProgramsNavigating the complex world of student loan forgiveness can be overwhelming, but state-specific programs offer a valuable resource for borrowers seeking relief. By thoroughly exploring regional opportunities, you can maximize your chances of qualifying for state-based forgiveness programs tailored to your unique circumstances. Each state offers diverse programs, often designed to incentivize careers in high-demand fields like education, healthcare, and public service. To successfully unlock the full potential of these programs, it’s crucial to research your state’s requirements, application deadlines, and eligibility criteria. By staying informed and proactive, you can effectively reduce your student loan burden and pursue a brighter financial future.

Navigating the Road to Debt Freedom: A Guide to State-Specific Student Loan Forgiveness Paths

Embark on your journey towards debt freedom with our comprehensive guide to state-specific student loan forgiveness paths. Navigate the complex world of student loan repayment with ease, as we provide detailed information on various forgiveness programs tailored to meet the unique needs of each state. Find the perfect solution to your financial burden by exploring the diverse range of options designed to alleviate student loan debt for professionals in fields such as education, healthcare, and public service. Boost your financial well-being and secure a brighter future by leveraging the power of these state-specific programs that offer both monetary relief and peace of mind.

State-Centric Student Loan Solutions: Uncovering Hidden Opportunities for Forgiveness and Debt Relief

In our quest to provide you with the most comprehensive guide to state-specific student loan forgiveness programs, we have delved deep into uncovering hidden opportunities for forgiveness and debt relief tailored to your state of residence. These state-centric student loan solutions are often overlooked, yet they offer a wealth of benefits, from complete loan forgiveness to reduced monthly payments. By shedding light on these lesser-known programs, we aim to help you navigate your student loan journey more confidently and ease your financial burden. Explore our extensive list of state-sponsored initiatives and discover the ideal path towards a debt-free future.