Are you in the market for a new home and feeling overwhelmed by the numerous home loan options available? Fear not, as our comprehensive step-by-step comparison guide is here to help you make an informed decision and secure the best possible financing for your dream abode. From understanding different loan types to comparing interest rates and repayment schedules, this article will walk you through the essential factors to consider in choosing the perfect home loan tailored to your unique financial needs. So, let’s embark on this journey together and turn your homeownership dreams into reality!

Assess personal financial situation first.

Before diving into the home loan comparison process, it’s crucial to evaluate your personal financial situation. Analyze your credit score, income, debts, and savings to determine your borrowing capacity. This will help you narrow down the best home loan options that suit your financial status and avoid any future complications.

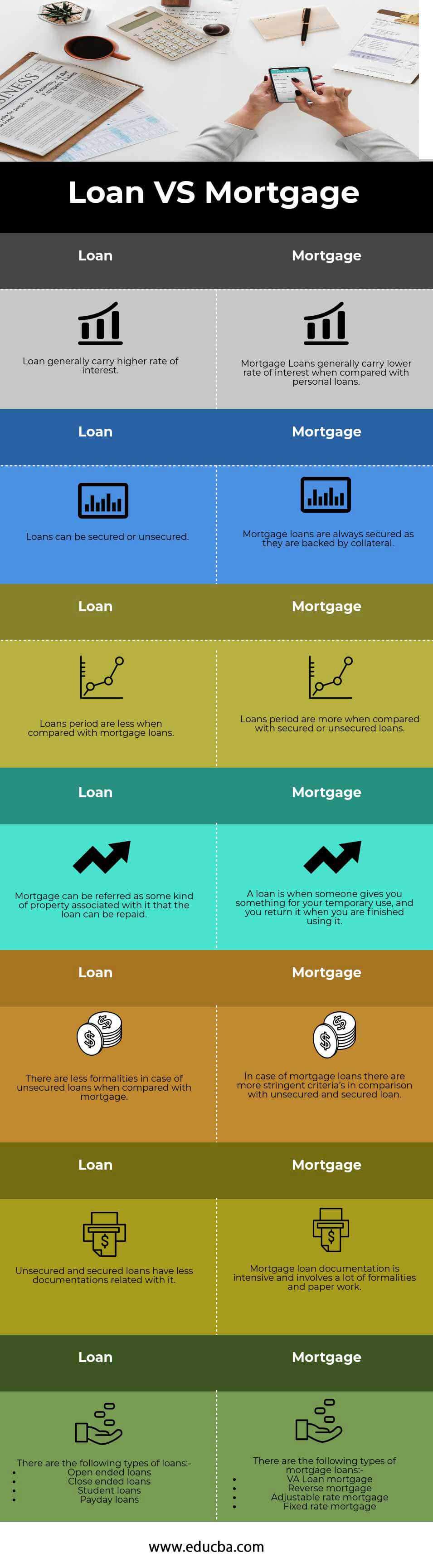

Research various loan types, offers.

Dive deep into researching different home loan types and offers to find your perfect match. Compare fixed vs. variable interest rates, repayment terms, and additional features. Don’t forget to check out promotional deals and first-time homebuyer incentives. By doing thorough research, you’ll be well-equipped to choose the best home loan for your dream house.

Compare interest rates, fees involved.

When choosing the best home loan, it’s essential to compare interest rates and fees from various lenders. This helps to ensure you select the most affordable option, ultimately saving you money in the long run. Remember to consider both fixed and variable rates, and don’t forget to factor in any hidden fees or charges.

Evaluate repayment terms, flexibility options.

When choosing the perfect home loan, it’s essential to evaluate repayment terms and flexibility options. Look for lenders offering a range of loan terms, allowing you to select the most suitable duration for your financial situation. Also, consider options like prepayment, refinancing, and loan modification to ensure you can adapt your loan to your changing needs.

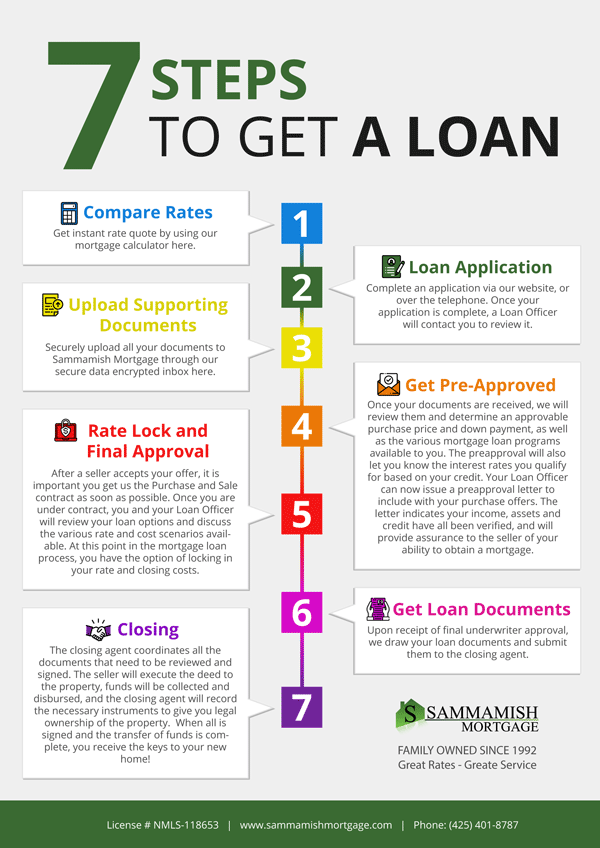

Check eligibility criteria, pre-approval process.

Kickstart your home loan journey by understanding the eligibility criteria and embracing the pre-approval process. This crucial step ensures you’re a suitable candidate and can boost your chances of securing your dream home. Stay ahead by being informed, and let your impeccable eligibility speak for itself!

Consult professionals for expert advice.

Seek guidance from professionals to make an informed decision on the ideal home loan for you. Mortgage brokers and financial advisors possess valuable insights into the home loan market, ensuring you find a tailored solution that matches your financial goals. Utilizing their expertise can save you time, money, and stress in your home-buying journey.