The Federal Housing Administration (FHA) mortgage loan is a great option for first-time home buyers and those with a limited budget. FHA loans provide an affordable financing option with flexible guidelines for borrowers to purchase or refinance a home with a low down payment. With an FHA loan, you can take advantage of lower interest rates and less restrictive qualification requirements than with a conventional mortgage loan. Read on to learn more about what an FHA mortgage is and how it can benefit you.

Overview of FHA Mortgage Loans

An FHA mortgage loan is a great option for first-time home buyers or those who don’t have a large down payment saved up. An FHA loan is insured by the Federal Housing Authority, and they make it easier for people to get a mortgage loan with a lower down payment and lower credit score requirements. With an FHA loan, you can get into your dream home with a smaller down payment and more flexible terms than you could with a traditional mortgage loan. Plus, you can get great rates and flexible repayment plans that fit your budget. FHA mortgage loans are great for those who want to get into a home quickly and affordably. If you’re looking to save money on a mortgage loan, an FHA loan is definitely worth considering.

Advantages of FHA Mortgage Loans

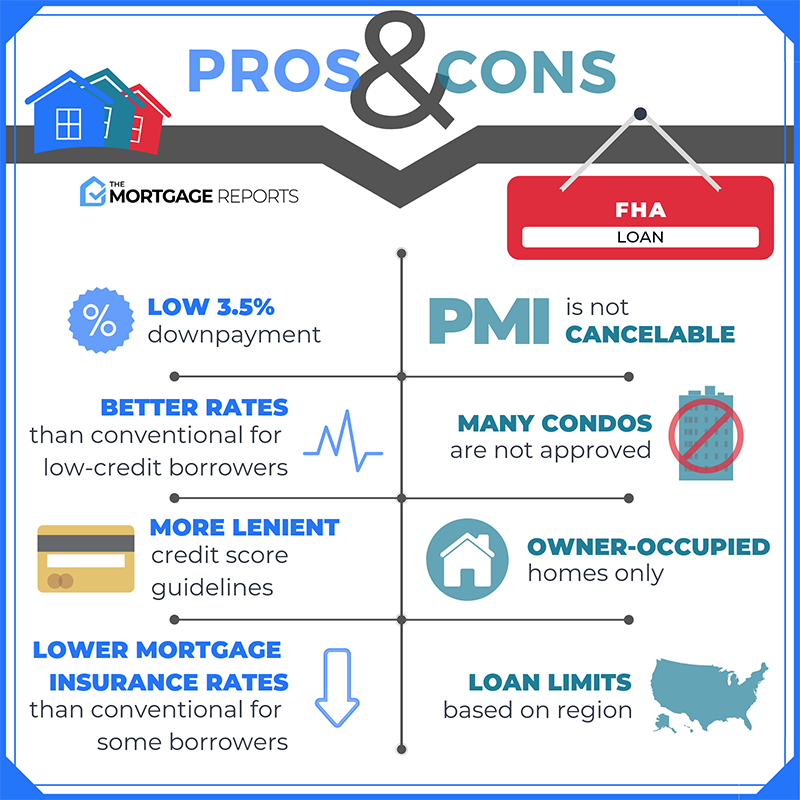

FHA mortgage loans have become increasingly popular over the past few years because of the many advantages they offer. One of the biggest advantages of FHA mortgage loans is that they can be used to purchase a home with a low down payment. Because the down payment is so low, it makes it easier for those with limited savings to buy a home. Additionally, FHA mortgage loans are much more forgiving of past credit blunders than other loan programs, as they don’t require a high credit score to qualify. Furthermore, FHA mortgage loans are backed by the government, making them much more secure than other loan programs. Finally, FHA mortgage loans come with lower closing costs than other loan programs. Ultimately, FHA mortgage loans make it easier for many people to purchase a home, and with the added security of a government back loan and the lower costs, it’s no wonder these loans have become so popular.

Requirements for FHA Mortgage Loans

If you’re looking to buy a home but don’t have the funds for a large down payment, an FHA mortgage loan may be the perfect option for you. FHA mortgage loans are backed by the Federal Housing Administration and they offer more relaxed requirements than traditional mortgage loans. For example, you can get approved with a lower credit score and a smaller down payment. There are also more flexible income requirements, so you may qualify even if you don’t make a large salary. To be eligible to apply for an FHA mortgage, you’ll need to meet certain requirements. These include having a consistent source of income, a good credit history, and proof of being able to afford the mortgage payments. You’ll also need to meet the FHA’s minimum down payment requirements, which typically range from 3.5 to 10 percent of the purchase price. Additionally, you’ll need to have a debt-to-income ratio that falls below 43 percent, which is the highest debt-to-income ratio accepted by the FHA. Lastly, you’ll need to show proof of homeowners insurance and pay a mortgage insurance premium. With an FHA mortgage loan, you can get into your dream home without having to jump through the hoops of traditional mortgage loans.

How to Qualify for an FHA Mortgage Loan

Qualifying for an FHA mortgage loan isn’t as intimidating as it may sound. All you need is to meet some basic criteria, such as having a steady source of income and a good credit score. To get started, you’ll need to fill out an application with the lender. Once your application is approved, the lender will need to review your credit report and other financial information to determine if you are eligible for an FHA mortgage loan. In most cases, you’ll need to provide proof of a steady job, income, and assets. The lender will also look at your debt-to-income ratio to make sure it’s within the range allowed by the FHA. If everything looks good and you meet the criteria, then you can start the process of getting approved for an FHA loan.

Tips for Obtaining an FHA Mortgage Loan

If you’re considering an FHA mortgage loan, there are some tips that can help you secure the best possible rate and terms. First, make sure your credit score is in good shape. The higher the score, the more likely you are to be approved, and the better the terms you’ll get. You can get a free copy of your credit score to make sure you’re in good standing. Second, save up for a down payment. FHA loans require a minimum of 3.5% down, but you’ll get a better rate if you can put down more. Third, shop around for the best rate. Different banks and lenders may offer different rates, so it pays to compare to make sure you’re getting the best deal. Lastly, make sure you meet all the requirements for an FHA loan. They can vary from lender to lender, so make sure you’re up to date on all the criteria. With these tips in mind, you’ll be on your way to a successful FHA mortgage loan.