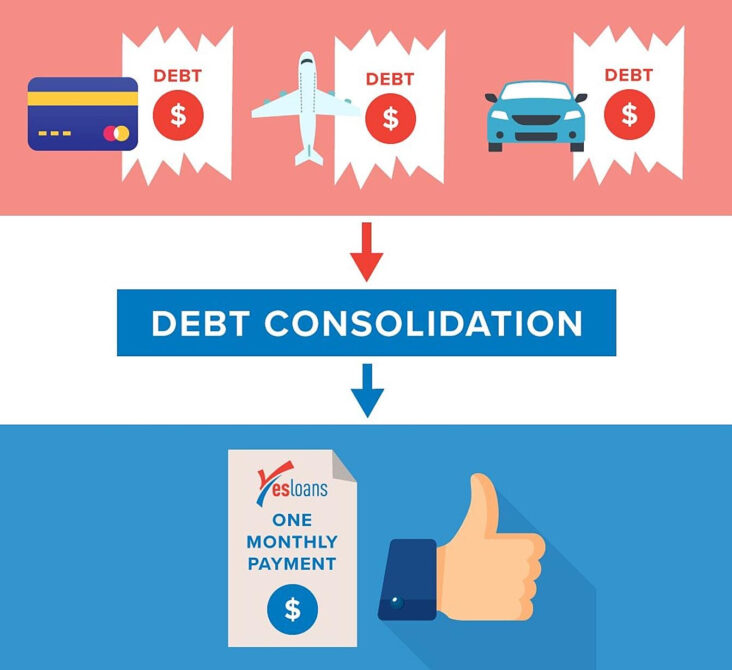

Are you drowning in debt and struggling to keep your head above water? Worry no more, as we bring you the ultimate guide on how to choose the best debt consolidation loan tailored to your needs. Our comprehensive article will arm you with invaluable tips and expert advice to help you navigate the complex world of debt consolidation loans. So, buckle up and get ready to embark on a journey towards financial freedom, as we show you the steps to select the perfect loan for a stress-free and prosperous future. Don’t let debt weigh you down any longer – dive into our insights and take control of your finances today!

Assess your current debt situation.

Before diving into debt consolidation options, it’s crucial to evaluate your current debt situation. Analyze your outstanding debts, interest rates, and monthly payments to gain a clear understanding of your financial standing. This assessment will enable you to make informed decisions and choose a consolidation loan that aligns with your unique needs and goals.

Compare various consolidation loan offers.

In your quest for the perfect debt consolidation loan, it’s crucial to explore different offers and compare them. Analyze factors like interest rates, repayment terms, and any hidden fees to make an informed decision. By doing so, you’ll be better equipped to choose a consolidation loan that aligns with your financial goals and helps you slay your debt monster.

Evaluate interest rates and terms.

Evaluating interest rates and terms is crucial in selecting the perfect debt consolidation loan. Lower interest rates mean reduced overall costs, so compare offers diligently. Additionally, consider the loan’s term length, ensuring it fits your financial goals without stretching your budget. Finding the right balance saves you money and stress in the long run.

Consider loan fees and penalties.

When selecting the ideal debt consolidation loan, don’t overlook the potential fees and penalties. Ensure you’re aware of any initiation, administration, or early repayment charges that may apply. To avoid unnecessary expenses, compare various lenders and choose one with transparent, reasonable fees, ultimately helping you save money and reduce your debt more efficiently.

Review lender reputations and feedback.

In your quest for the best debt consolidation loan, don’t forget to examine lender reputations and feedback. Doing a quick online search and reading customer reviews can provide valuable insights into their trustworthiness and service quality. This helps ensure a hassle-free experience as you work towards financial freedom.

Select a manageable repayment plan.

When choosing the best debt consolidation loan, it’s crucial to pick a repayment plan that suits your financial situation. Opt for a plan with affordable monthly payments to prevent straining your budget. Consider a loan with a longer repayment term to lower the monthly installments, ensuring you can manage your debt efficiently.