Are you considering tapping into the equity of your home to finance a large purchase or consolidate debt? A home equity line of credit (HELOC) could be the perfect way to make your financial dreams come true. In this comprehensive guide, we’ll explain the basics of HELOCs, outline the advantages, discuss the potential pitfalls, and provide all the guidance you need to make an informed decision about whether a HELOC is the right choice for you.

What is a Home Equity Line of Credit (HELOC)?

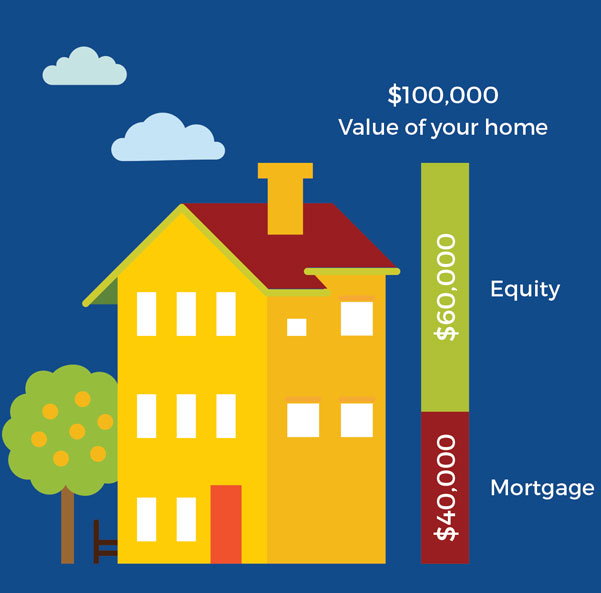

A Home Equity Line of Credit (HELOC) is a loan that uses your home’s equity as collateral. It’s kind of like a credit card, but instead of being able to spend it on whatever you want, the money is used to secure a loan that you can use for home-related expenses. With a HELOC, you can borrow up to a certain amount of money, and then you are only responsible for paying back the amount of money you actually use. It’s a great way to get access to funds for home projects and renovations without having to take out a traditional loan. Plus, since it’s secured by your home, the interest rates are usually a lot lower than other types of financing. Whether you’re looking to pay for a new roof, update your kitchen, or just need some extra money for anything else, a HELOC is worth considering.

Understanding the Benefits of a HELOC

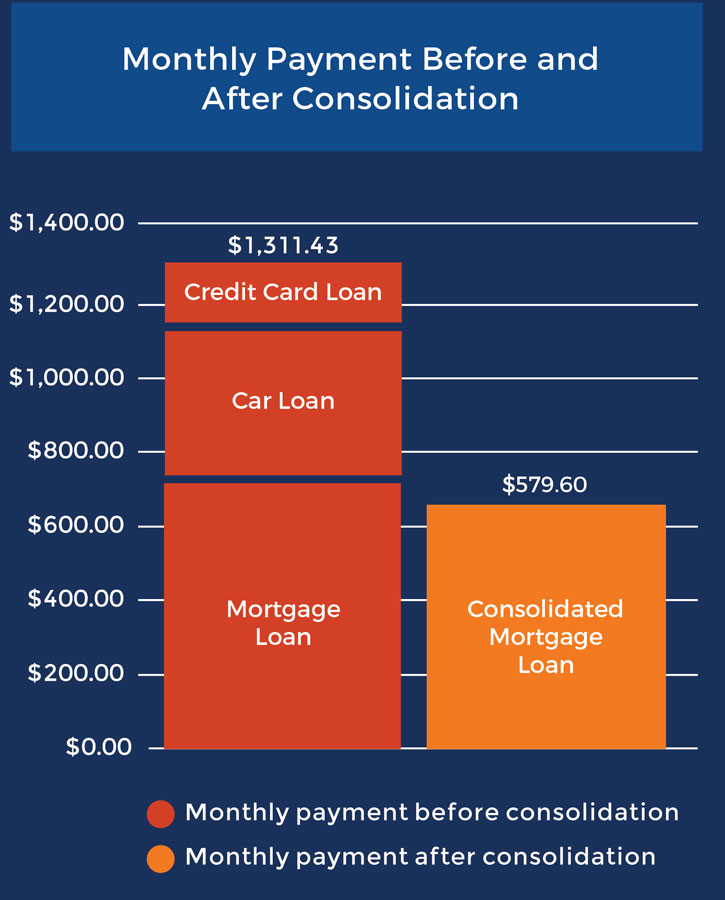

.When it comes to making the most of your money, a HELOC can be a great option. Not only can you access funds quickly and easily, but you can also use your HELOC to pay off higher interest debt or make home improvements. Plus, you can choose the repayment terms that best fit your needs. With a HELOC, you can get a low-interest loan that you can use for anything from making home repairs to consolidating debt. You can also use your line of credit to make large purchases like a car or vacation. Plus, if you’re a homeowner, a HELOC can be a great way to access the equity you’ve built up in your home. So if you’re looking for a way to make the most of your money, a HELOC could be the perfect solution.

How to Qualify for a HELOC

If you’re looking to tap into the equity you’ve built up in your home, getting a Home Equity Line of Credit (HELOC) may be the perfect way to do it. A HELOC is a revolving credit line secured by your home, which gives you a flexible way to access the funds you need. But before you can start using your HELOC, you first need to qualify for one. The qualifications for a HELOC can vary depending on the lender, but typically you’ll need to meet some basic criteria, like having a good credit score and sufficient income. You’ll also need to show that you have enough equity in your home to cover the loan. Once you’ve met the lender’s requirements, you’ll need to provide them with proof of your income and assets, as well as any other documents they may require. Having all of your paperwork in order can help the process move more quickly, so make sure you have everything readily available. With the right qualifications and the right paperwork, you can get a HELOC and start taking advantage of the equity in your home.

HELOC Draw Periods and Repayment Terms

HELOC draw periods and repayment terms can be confusing and it doesn’t have to be! The draw period is the amount of time during which you can use the money you’ve borrowed. This is usually somewhere between 5-10 years and is when you can withdraw money from your HELOC. Repayment terms are the amount of time you have to pay back the loan. This is typically around 10-15 years, depending on the lender and the size of the loan. Knowing your draw period and repayment terms is essential for understanding your HELOC and making sure you stay on track with payments. With a bit of research, you can find the perfect HELOC for your needs and get the most out of your home equity line of credit.

Tips for Successfully Managing a HELOC

.If you’re considering a HELOC, there are a few important tips you should keep in mind to make sure you successfully manage it. First, make sure you’re aware of your spending and repayment habits. Before you open a HELOC, it’s important to make sure you’ll be able to make regular payments, and that you understand the consequences of not doing so. Additionally, it’s important to understand the interest rates associated with your HELOC. Some HELOCs may have variable interest rates, so it’s important to be aware of the potential changes in your interest rate and how they will impact your payments. Finally, it’s important to plan ahead and budget for any potential large purchases or payments you may make using the line of credit. By planning ahead and budgeting for these types of payments, you can avoid any potential financial issues that can arise from not having enough funds. By following these tips, you should be able to successfully manage your HELOC and make payments in a timely manner.