Shared appreciation mortgages (SAMs) are becoming increasingly popular in the UK. SAMs can provide homeowners with a unique opportunity to reduce their mortgage costs, while also helping them to build their wealth. This full guide provides comprehensive information about Shared Appreciation Mortgages, including their pros and cons and how to secure one if you are a homeowner. Learn all about how SAMs can help you save money and maximize your return on your home.

What is a Shared Appreciation Mortgage?

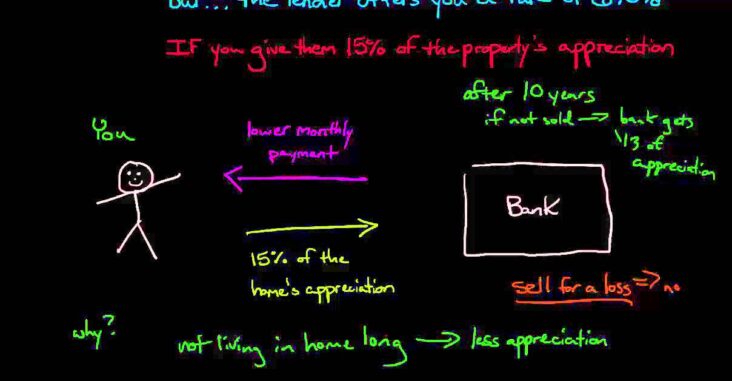

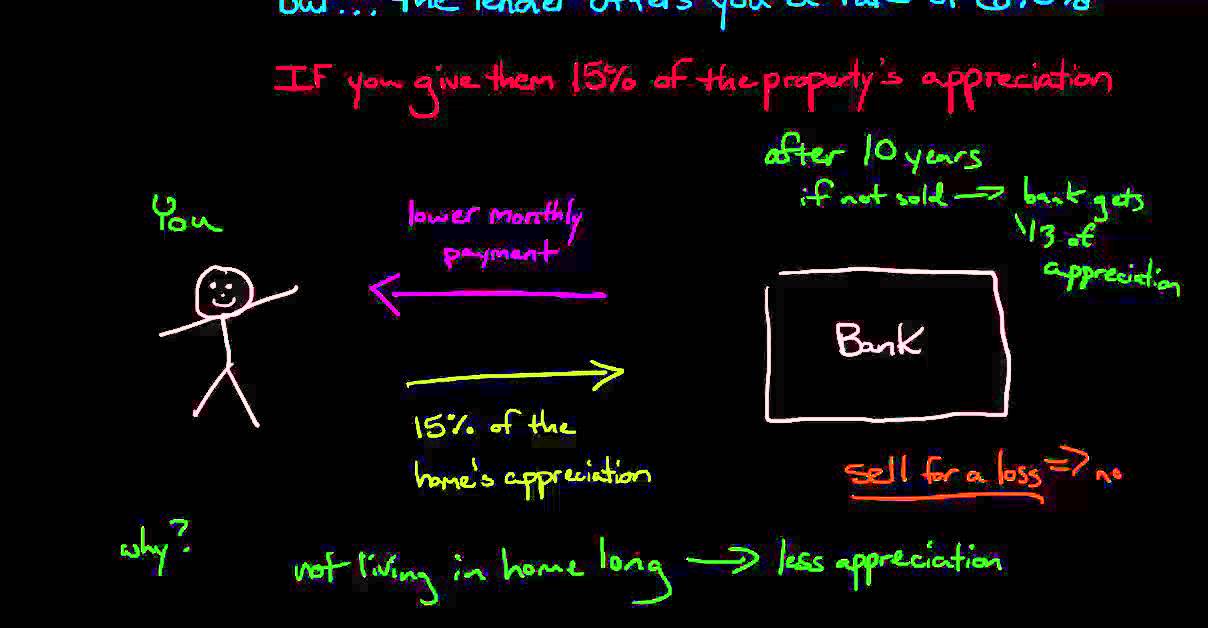

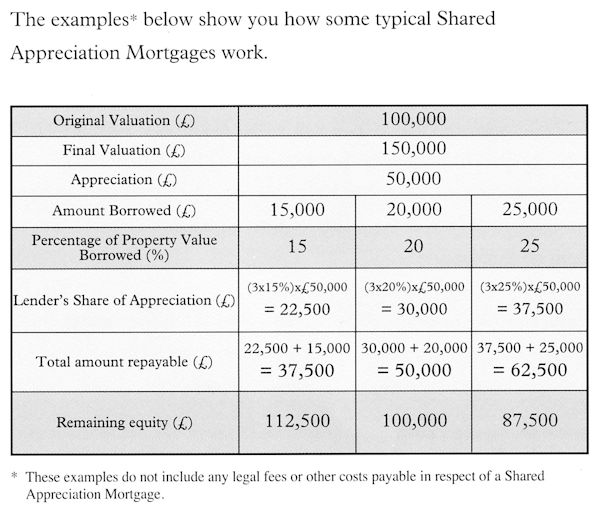

A shared appreciation mortgage (SAM) is a type of mortgage loan where the borrower agrees to pay back the loan with a portion of the appreciation that the property earns over time. Unlike a traditional mortgage, where the lender is repaid a fixed amount of money, a shared appreciation mortgage allows the borrower to pay back the loan with a share of the home’s value appreciation. This type of loan can be beneficial for borrowers who are looking for a lower monthly payment and the opportunity to build equity over time. With a SAM, the borrower’s appreciation share is usually much lower than a traditional mortgage, meaning that the borrower can potentially benefit from the growth of their property’s value while paying a much lower monthly payment.

Benefits of a Shared Appreciation Mortgage

Shared Appreciation Mortgages can be a great way to get the most out of a home loan, providing a number of benefits to the borrower. One of the biggest benefits of a Shared Appreciation Mortgage is the lower interest rate, compared to traditional mortgages. This means that borrowers could save money on their monthly payments, since they don’t have to pay as much interest. This can be especially helpful for those who live on a fixed income or are struggling to make ends meet. Additionally, Shared Appreciation Mortgages can provide more flexibility than traditional mortgages, as borrowers can often pay off their loan early and still enjoy the benefits of a lower interest rate. This makes it easier to manage finances in a tough economic climate, giving borrowers more control over their financial situation. Finally, the Shared Appreciation Mortgage can provide a way for borrowers who have limited resources to access the benefits of homeownership in a more affordable way.

Risks & Drawbacks of a Shared Appreciation Mortgage

When it comes to Shared Appreciation Mortgage (SAM) there are a few risks and drawbacks to take into account. SAMs can potentially have a high interest rate, which can make them a costly option for those looking to borrow money from their home equity. Additionally, the terms of a SAM require borrowers to surrender a portion of their potential equity gains when they sell or refinance their home, which can mean a lower return on investment than other mortgage options. Finally, borrowers may face difficulty if they need to make changes to their mortgage, as the terms are locked in from the start and can’t be changed. While SAMs may not be the best choice for everyone, they can be a great option for those looking to get access to cash without taking out a loan.

How to Apply for a Shared Appreciation Mortgage

If you’re looking to apply for a Shared Appreciation Mortgage, there are several things you’ll need to do. First, you’ll need to find an approved lender that offers these mortgages. Once you’ve done that, you’ll need to provide the lender with all of your financial information, such as your income, assets, and debt. You’ll also need to provide proof of ownership of the property you’re looking to finance. Once all of this information has been provided, the lender will assess your application and will provide you with a decision. It’s important to remember that these mortgages do come with risks, so make sure you understand the terms and conditions before signing any paperwork.

Tips to Avoid Plagiarism When Writing About Shared Appreciation Mortgages

Writing about shared appreciation mortgages can be tricky, but it’s important to make sure you don’t plagiarize someone else’s work. Plagiarism is a serious offense, and it’s important to make sure you are writing your own original content. Here are some tips to help you avoid any plagiarism when writing about shared appreciation mortgages: use your own words, cite any sources you use, and make sure you are not using any copyrighted material. Additionally, make sure you are not copying any other content that has already been published. Always double-check any information you use to make sure it is accurate and up-to-date. Finally, make sure to use your own unique voice and style in your writing. By following these tips, you can make sure that your content is original and you are not plagiarizing anyone else’s work.