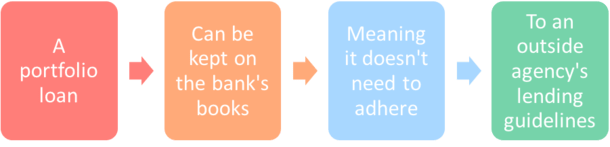

Are you 18 and looking for a way to get a mortgage but don’t have enough money for a down payment? You may have heard of portfolio mortgages, but don’t know how to get one? Don’t worry—you’re not alone! In this article, I’ll explain what a portfolio mortgage is and how to get one so you can start the process of owning your own home. So, let’s get started!

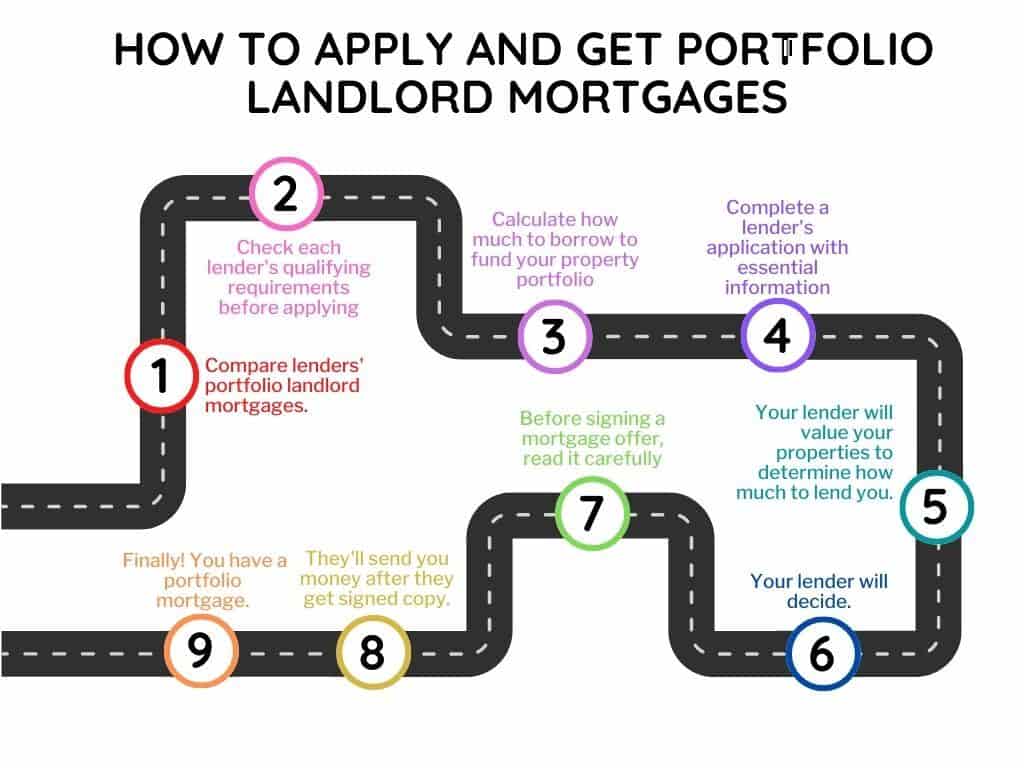

Research lenders/rates.

It’s important to research lenders and rates when looking for a portfolio mortgage. I’ve found the best way to do this is to look online for reviews from people who’ve used different lenders and compare their rates. You can also talk to your bank or financial advisor to get advice on which lender might be the best option for your situation.

Calculate loan amount.

Calculating the loan amount you are eligible to receive is the first step towards getting a portfolio mortgage. I’m 18 and new to this, so I’m not sure how to do it. Thankfully, there are online calculators that can help, like the one on the XYZ website. It requires basic information like your income, the loan amount and the interest rate. Once you have this information, you can easily calculate the loan amount you can receive.

Get pre-approved.

Getting pre-approved for a portfolio mortgage is a great step to take if you’re an 18-year-old looking to invest in real estate. It’s important to have a good credit score, proof of steady income and a down payment saved up before you apply so you can get the best deal possible. Don’t be afraid to shop around and compare rates from different lenders to find the best portfolio mortgage for you. Good luck!

Gather documents.

Gathering all the documents you need for a portfolio mortgage can seem overwhelming, especially if you’re a first-time homebuyer. To make the process easier, it’s important to know what documents you’ll need. Start by having your tax returns, bank statements, pay stubs, and any other financial documents that show your income. Additionally, have your credit report handy, as well as proof of any investments or assets you have. Don’t forget to have your ID and proof of residence, too!

Submit application.

Submitting an application for a portfolio mortgage can seem daunting as an 18-year-old student. However, it doesn’t have to be! With the right preparation and research, you can make the process much smoother. Make sure to have all documents like your credit reports and bank statements on hand, then fill out the application with as much detail as you can. Doing so will help you get the most competitive rate and make sure your application is approved quickly.

Finalize loan.

Once you have all the necessary documents, it’s time to finalize the loan. You need to provide the lender with your income and asset statements as well as a proof of your credit score. You might also need to provide an appraisal of the property you are planning to purchase. Make sure to read through the loan terms carefully and ask any questions before signing on the dotted line. It’s important to have a clear understanding of your loan before you commit!