Are you looking for a way to finance multiple properties with one loan? Then a blanket mortgage may be just the solution for you! A blanket mortgage is a single loan used to finance multiple properties. It allows you to take out one loan to cover all of your properties, which means you don’t have to pay separate mortgages for each of your properties. This type of mortgage can be beneficial if you are looking to purchase multiple properties or refinance your existing properties. In this article, we’ll discuss what a blanket mortgage is and how it can benefit you.

Explaining a Blanket Mortgage: What It Is and How It Works

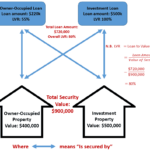

A blanket mortgage is a great way for people to invest in multiple properties with just one loan. A blanket mortgage allows one to borrow funds to purchase multiple properties in one loan. This is great for investors who want to purchase more than one property with just one loan. It is also great for investors who want to diversify their investments and spread their risk across multiple properties. With a blanket mortgage, one can secure multiple properties without having to take out multiple loans. A blanket mortgage is a great way to simplify the process of investing in multiple properties and allows borrowers to save money in the long run.

Advantages and Disadvantages of Taking Out a Blanket Mortgage

A blanket mortgage can be a great way to get the financing you need for multiple properties but it’s important to understand the advantages and disadvantages of this option. One of the biggest advantages is that it can save you money since you only need to pay one loan and one set of closing costs. Another advantage is that it can help you build equity faster since all the properties will be financed together. On the downside, you’ll need to have a substantial amount of money up front to make the down payment for all the properties and you may also face higher interest rates. Additionally, if you’re unable to keep up with the payments, you could end up losing all the properties in the blanket mortgage. Ultimately, it’s essential to weigh these pros and cons before deciding if a blanket mortgage is right for you.

Who Can Benefit from Taking Out a Blanket Mortgage?

A blanket mortgage can be an incredibly useful tool for a variety of people. Real estate investors, in particular, can benefit from taking out a blanket mortgage. This type of loan allows investors to purchase multiple properties under one loan, making it easier to manage the financing of their investments. By taking out a blanket mortgage, investors can reduce their risk and increase their buying power, meaning they can purchase more properties with less money. Furthermore, a blanket mortgage allows investors to acquire multiple properties at once, saving them time and effort. With a blanket mortgage, real estate investors can gain access to capital faster and more efficiently, allowing them to get more out of their investment.

How to Qualify for a Blanket Mortgage

If you’re looking to invest in multiple properties, a blanket mortgage could be the perfect loan option for you. To qualify for a blanket mortgage, you’ll need to have a good credit score and a stable source of income. Additionally, lenders will usually require a down payment of at least 20% of the total loan amount. You’ll also need to be able to prove to the lender that you have the ability to pay back the debt. This could include providing proof of liquid assets, cash flow, and income. Keep in mind that lenders may require other financial information, such as tax returns, bank account statements, and other financial documents. It’s important to have all the necessary documents ready to ensure you qualify for the best terms and rates.

Common Mistakes to Avoid When Taking Out a Blanket Mortgage

When taking out a blanket mortgage, it’s important to make sure you avoid some common mistakes. One of the biggest mistakes is taking out too much debt. Make sure you’re only taking out what you can realistically afford to pay back. Another mistake is not considering the tax implications of taking out a blanket mortgage. Depending on your situation, you may be able to deduct some of the interest paid on the loan, so make sure you do your research. Finally, make sure you understand the contract you’re signing. Read the fine print and make sure you understand the terms of your loan before signing anything. Taking out a blanket mortgage can be a great way to finance a large purchase, but it’s important to make sure you avoid these common mistakes.