Are you looking for a comprehensive guide on conventional mortgages? Whether you are a first-time homebuyer or a seasoned investor, understanding the basics of conventional mortgages can help you make the right decisions. This article is packed with all the information you need to know about conventional mortgages, from the different types to the eligibility criteria and the advantages and disadvantages of getting one. We’ll also provide you with some useful tips to help you secure the best deal. So, if you’re ready to learn more about conventional mortgages, let’s get started!

What is a Conventional Mortgage?

If you’re a first-time homebuyer or just looking to refinance your current mortgage, you’ve probably heard of a conventional mortgage. A conventional mortgage is one of the most common types of mortgages available, and it’s a great option for those who want to put down a larger down payment. It works like any other mortgage, but it requires more money up front. With a conventional mortgage, you’ll have a fixed interest rate, and you’ll need to meet certain requirements in order to be approved. This type of mortgage is often seen as the “standard” option, and it can be a great way to get your dream home without having to worry about fluctuating interest rates. Before you apply for a conventional mortgage, it’s important to know the details, such as what kind of down payment is required and what kind of credit score you need. With the right information and a little bit of research, you can find the perfect conventional mortgage for you.

Benefits of Taking Out a Conventional Mortgage

If you’re considering taking out a mortgage, there are a lot of options out there. One of the most popular is the conventional mortgage. A conventional mortgage is a type of home loan that is not backed by the government. This means that it is not insured by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). A conventional mortgage is usually the best choice for people who have good credit and a steady income. The benefits of taking out a conventional mortgage include lower interest rates, lower monthly payments, and less paperwork. With a conventional mortgage, you can also choose from a variety of loan terms, including 15-year and 30-year fixed rate mortgages, adjustable-rate mortgages, and jumbo loans. Plus, you can apply for a conventional mortgage with most banks and credit unions. With so many advantages, it’s no wonder that taking out a conventional mortgage is one of the most popular ways to finance a home.

How to Qualify for a Conventional Mortgage

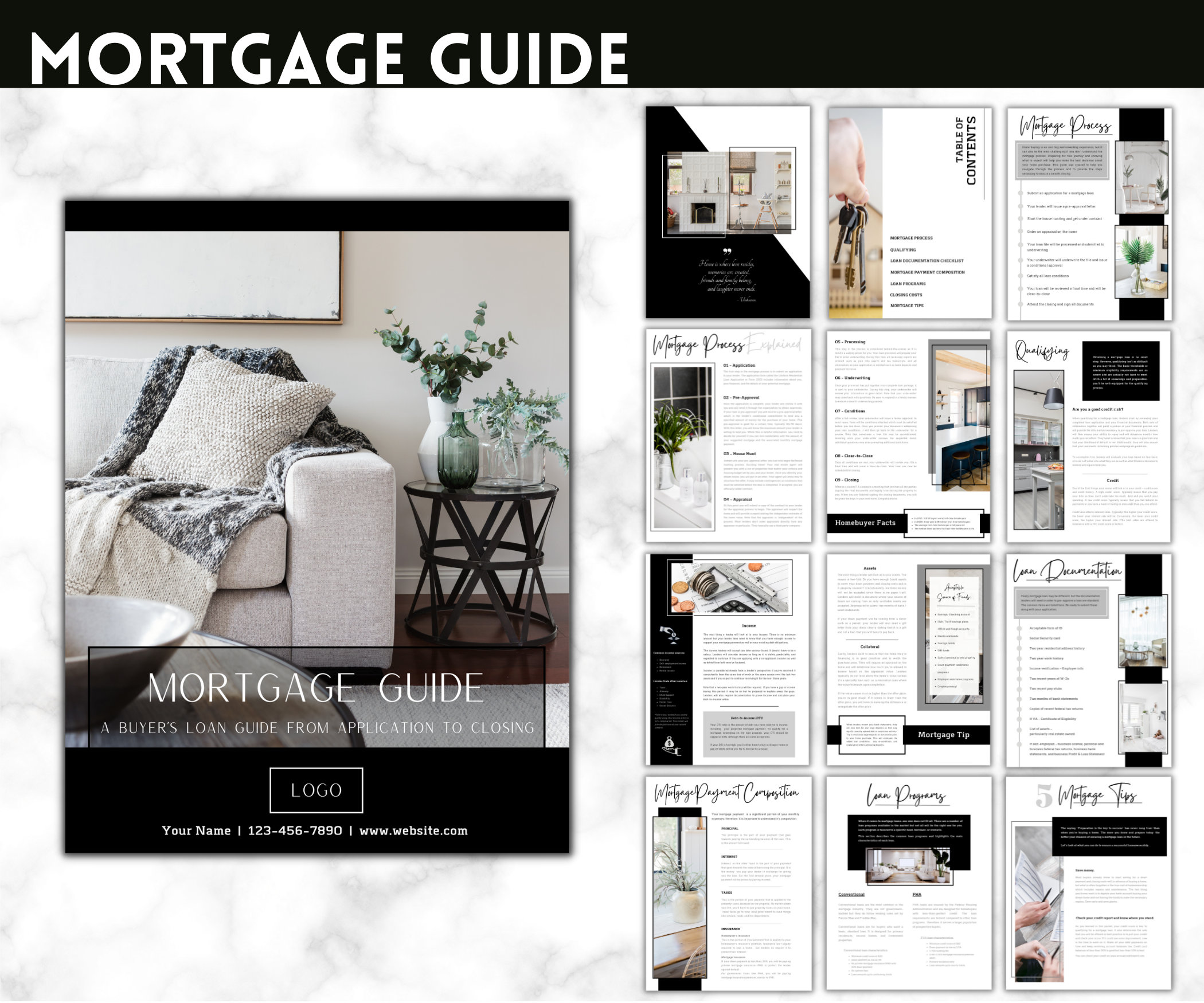

If you want to qualify for a conventional mortgage, there are a few things you need to do. First, you need to make sure your credit score is at least 620. This will ensure that you’re able to get a good rate on your loan. You should also make sure you have enough money saved up to make a down payment of at least 20% of the purchase price. This will help you avoid having to pay private mortgage insurance. Additionally, you should have enough money saved up to cover closing costs and any other costs associated with the mortgage. Lastly, you’ll need to provide proof of your income and assets to the lender in order to qualify. Once you have all the necessary documents in order, you’re ready to apply for a conventional mortgage.

What to Consider Before Taking Out a Conventional Mortgage

Before taking out a conventional mortgage, it’s important to make sure you’ve weighed all of your options. First, consider your budget and whether you can afford a down payment. You should also think about your credit score, as this will determine the interest rate and term of your loan. Additionally, you should look at the fees and closing costs associated with the loan. Lastly, you should determine whether you want a fixed or adjustable-rate mortgage. Taking the time to consider each of these factors can help you make the best decision for your financial situation.

How to Avoid Plagiarism When Writing About a Conventional Mortgage

When writing about a conventional mortgage, it’s essential to make sure that you’re not plagiarizing someone else’s work. Plagiarism can get you into serious trouble and can damage your reputation as a writer. To stay safe, make sure to always cite the sources you use and to avoid copying and pasting from other sources. Additionally, make sure to double check your work with a plagiarism checker to ensure that you haven’t accidentally copied any text. When in doubt, always cite the source you got your information from and make sure you are writing in your own words. Don’t be afraid to get creative when writing about a conventional mortgage, as long as you’re not plagiarizing any content. By taking the time to ensure your work is original, you’ll be able to write confidently and without worry.