Making a down payment on a house can be a daunting task, especially when you’re a young adult and still new to the world of finances. For 18 year-olds who are looking to purchase their first home, it can be difficult to know how to get a loan for a down payment, and where to even start. In this article, we’ll cover the steps you need to take to get a loan for a down payment on a house, including exploring all loan options, understanding your credit score, and budgeting for the down payment. By following these steps, you can be on your way to owning your first home in no time!

Benefits of Getting a Loan for a Down Payment on a House

Getting a loan for a down payment on a house has many benefits. For one, it gives you more flexibility when it comes to budgeting and making payments. By setting up a loan, you can spread out the cost of the down payment over several months, making it easier to manage. In addition, taking out a loan may increase your chances of being approved for a mortgage, as lenders are more likely to approve higher loan amounts. Furthermore, you can use the loan to cover closing costs and other fees associated with the purchase of a home. All in all, getting a loan for your down payment can be a great way to make house-buying more manageable.

Tips for Qualifying for a Loan for a Down Payment on a House

When it comes to getting a loan for a down payment on a house, there are a few tips that can help you qualify. First, make sure to have a good credit score. Paying off any outstanding debts and keeping your credit utilization low can help you build a good credit score. Second, make sure to save enough money for the down payment. This can be a daunting task, but it’s important to save up so that you can secure a loan. Third, make sure to have a steady job. Having a consistent income will help you demonstrate to lenders that you’re able to pay back the loan. Finally, seek out the best loan terms. You should compare different loan offers to see which one is most suitable for you.

Types of Loans Available for a Down Payment on a House

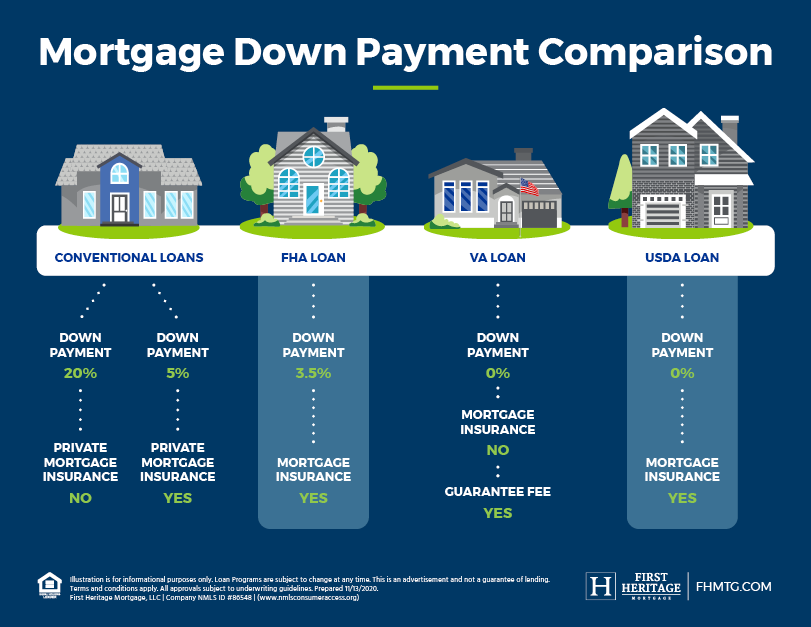

When it comes to loans for a down payment on a house, there are a variety of options available. Depending on your financial situation, you may be looking at getting a conventional loan, an FHA loan, or a VA loan. Conventional loans are usually the most popular option and are often the best choice. FHA loans are great for first-time home buyers, as they are more flexible and require lower down payments. VA loans are available to veterans and service members, and provide more lenient requirements than other types of loans. Each of these loan types has different requirements, so it’s important to research and compare your options before deciding which loan is right for you.

How to Find the Right Loan for a Down Payment on a House

When it comes to getting a loan for a down payment on a house, there are a few things you should consider. First, you need to find a loan that meets your needs and budget. You should compare interest rates, loan terms, and repayment plans to find the loan that works best for you. It’s also important to look at fees and closing costs to make sure you’re getting the best deal. Finally, you need to make sure that you can afford the loan payments and that you have enough money saved to cover any unexpected costs. Taking the time to research your options can help you find the right loan for your down payment.

Common Pitfalls to Avoid When Getting a Loan for a Down Payment on a House

When applying for a loan to make a down payment on a house, there are some common pitfalls to watch out for. First of all, make sure to do your research and find the right loan for you. It’s also important to be aware of any fees associated with the loan and make sure they are competitive. Additionally, make sure to read through the loan documents carefully and understand all the terms and conditions before signing. Finally, try to pay off the loan as soon as possible to avoid paying any extra interest. Avoiding these pitfalls can help you get the best loan for your down payment on a house.