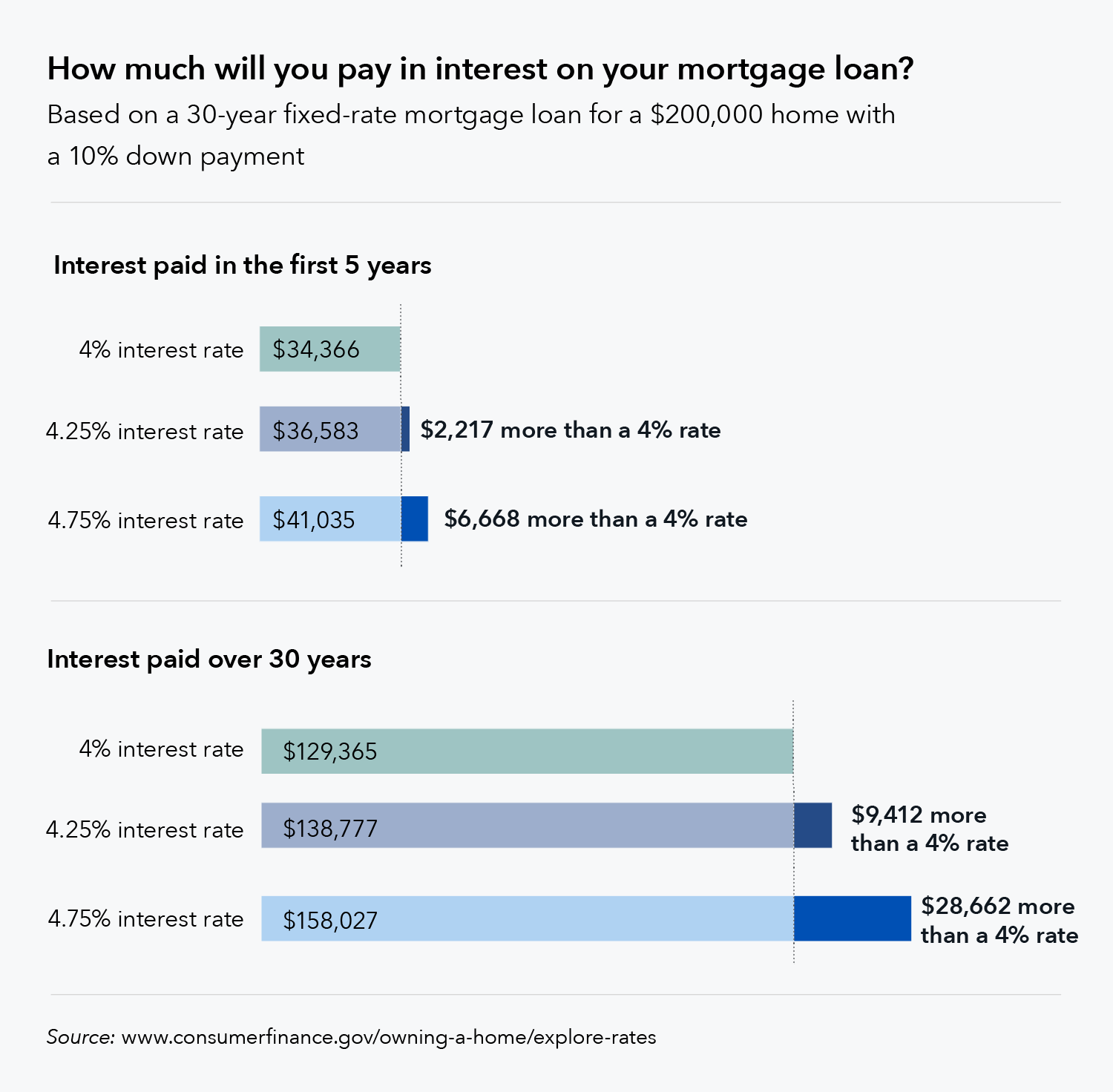

Finding a mortgage with a low interest rate can be daunting, especially if you’re a young adult just starting to navigate the world of personal finance. As an 18-year-old, you may be facing an uphill battle when it comes to getting the lowest interest rate possible. Luckily, there are plenty of steps you can take to make sure you get the best deal possible. In this article, I’ll explain how to find a mortgage with a low interest rate so you can get the most out of your hard-earned money.

Research mortgage lenders.

Researching mortgage lenders is an important step in finding the best mortgage with the lowest interest rate. I used websites like Credible and Bankrate to compare different lenders and their loan terms. I also looked at lenders’ reviews to get a better understanding of their services and customer service. Doing my research helped me find the best mortgage option with a low interest rate.

Compare interest rates.

Comparing interest rates is the key to finding a low-rate mortgage. Shop around and compare different lenders to get the best deal. Do your research, compare different options, and find the mortgage product with the lowest interest rate so you can save money in the long run. Don’t be afraid to negotiate with lenders and ask for a better rate.

Check loan requirements.

When looking for a low-interest mortgage, it’s important to check the loan requirements. Make sure you can meet the credit score, income, and other requirements of the lender. It’s also important to compare the fees and interest rates of multiple lenders to make sure you’re getting the best deal. By doing your research, you can find a mortgage that fits your budget and financial goals.

Assess credit score.

Assessing your credit score is crucial when looking for a mortgage with a low interest rate. You can easily check it online for free and it’s important to do so before applying to make sure you’re getting the best deal. Make sure to check for any errors that could be bringing down your score, and take steps to improve it if necessary. The better your score, the better mortgage rate you’re likely to get!

Negotiate terms.

If you’re looking to score a good deal on a mortgage, never be afraid to negotiate terms with potential lenders. I’m an 18 year old college student and I’ve managed to get a low interest rate on my mortgage by doing some research and talking to different lenders. You can always ask for a lower rate or a better deal – what’s the worst they can say? Don’t be afraid to take advantage of your bargaining power.

Apply for loan.

Applying for a loan can be a daunting process, especially when you’re looking for a mortgage with a low interest rate. It’s important to know what to expect and have all the proper documents ready before you apply. To find the best loan, compare lenders, get pre-approval, and consider your credit score. Doing your research and being prepared can make the process much smoother and help you find the best mortgage rate.