Are you looking for a way to cut down on your monthly mortgage payments? Biweekly mortgages can be a great option for homeowners looking to save some money on their monthly mortgage costs. This full guide will help you understand how biweekly mortgages work, their advantages and disadvantages, and how to decide if a biweekly mortgage is right for you. From understanding the terms to exploring different options, this guide will provide you with all the information you need to make an informed decision.

Overview of Biweekly Mortgages

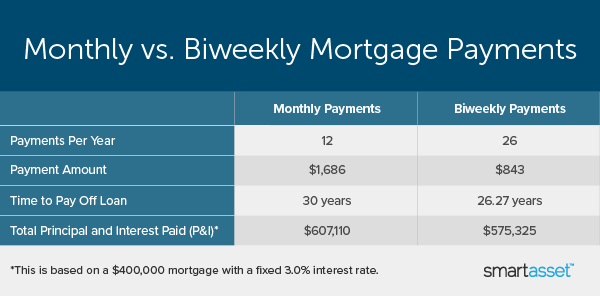

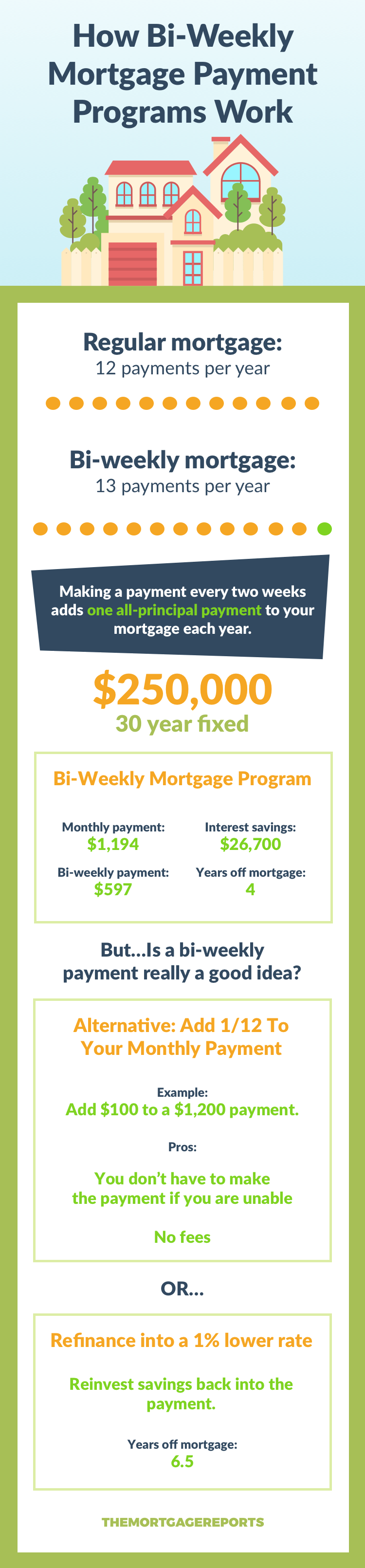

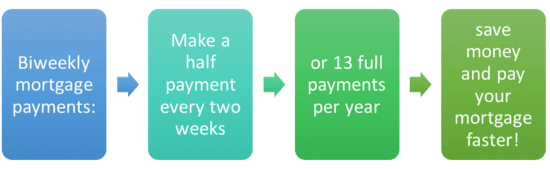

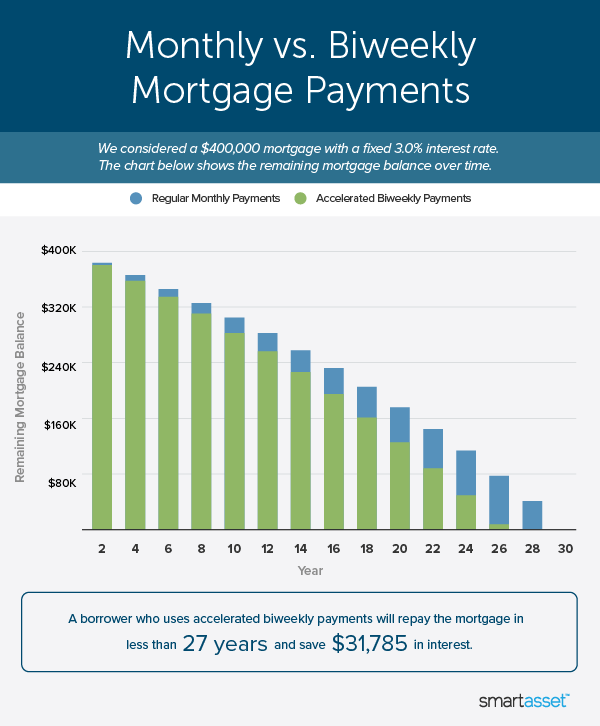

Biweekly mortgages are a great way to save money and pay off your mortgage faster. They offer a way to pay your loan off in a shorter amount of time while also reducing the amount of interest you pay in the long run. With a biweekly payment plan, you pay half of your regular mortgage payment every two weeks instead of once a month. This means you make 26 payments a year instead of 12, reducing the amount of time it takes to pay off your loan. Not only does this reduce the amount of time it takes to pay off your loan, but by making more frequent payments, you also reduce the amount of interest you pay on the loan. This means you will save money on your mortgage in the long run and get the satisfaction of paying off your loan quicker.

Key Benefits of Biweekly Mortgages

Biweekly mortgages are an awesome way to save time and money on a mortgage. There are a ton of key benefits to taking out a biweekly mortgage, like saving big on interest payments and reducing the time it takes to pay off the loan. One of the sweetest parts of a biweekly mortgage is that it can save you thousands of dollars in interest payments over the life of the loan. On top of that, you’ll be able to pay off the loan quicker and free up more of your cash for other things. With the extra money you’ll be saving, you can invest it, save it for a rainy day, or just enjoy life by buying yourself something nice. Making biweekly payments can also help you keep track of your mortgage payments better, so you won’t have to worry about falling behind or missing payments. All in all, biweekly mortgages offer a ton of benefits to savvy homeowners, and it’s definitely worth considering if you’re looking to save money and pay off your loan quicker.

How to Calculate Biweekly Mortgage Payments

Figuring out how to calculate biweekly mortgage payments isn’t as complicated as it sounds. To get started, you’ll need to know your loan amount, interest rate, and loan term. Once you have this information, you can use a biweekly mortgage calculator to figure out how much your payments will be. You’ll start by dividing the loan amount by the number of payments you’ll be making during the loan term. Then, you’ll take the interest rate and divide it by 12. Lastly, you’ll multiply the number of payments you’ll be making during the loan term by the interest rate. Add this number to the loan amount and you’ll have your biweekly mortgage payment amount. It’s that easy! Biweekly mortgage payments can help you pay off your loan faster and save money on interest payments.

Tips for Choosing a Biweekly Mortgage

When it comes to choosing a biweekly mortgage, there are a few tips you should keep in mind. First, make sure you understand the terms of the biweekly mortgage and how it works. Ask your lender for a detailed explanation of the payment amount, interest rate, and other fees associated with the loan. Secondly, compare the biweekly mortgage to other loan options to make sure you’re getting the best deal and the lowest rate possible. Lastly, make sure you understand any potential penalties or fees associated with paying your biweekly mortgage off early. Knowing all the details of your loan upfront will help you make the best decision and ensure you’re getting the most out of your biweekly mortgage.

How to Avoid Plagiarism when Writing about Biweekly Mortgages

When writing about biweekly mortgages, it’s important to make sure you’re not plagiarizing. Plagiarizing someone else’s work is not only unethical, but it can also get you into serious trouble. To avoid this, make sure you always give credit to the original source of the material you use and cite them properly. When in doubt, you can always double check your work with a plagiarism checker like Grammarly. Additionally, always make sure you are using your own words and ideas when writing about biweekly mortgages. Doing your own research, reading up on the topic and having an original perspective will help you create unique and interesting content that won’t get you in trouble.