An Adjustable Rate Mortgage with a fixed period offers a great way to keep your monthly mortgage payments low while still having the security of a fixed rate. With the right guidance, you can make the most of the ARM and find the ideal solution for your financial needs. In this guide, we will provide you with a full understanding of the ARM, including how it works, the advantages and disadvantages, and the best strategies for making it work for you. Whether you’re a first-time home buyer or an experienced homeowner, this guide will help you make the best decision for your specific situation.

What is an Adjustable Rate Mortgage with a Fixed Period?

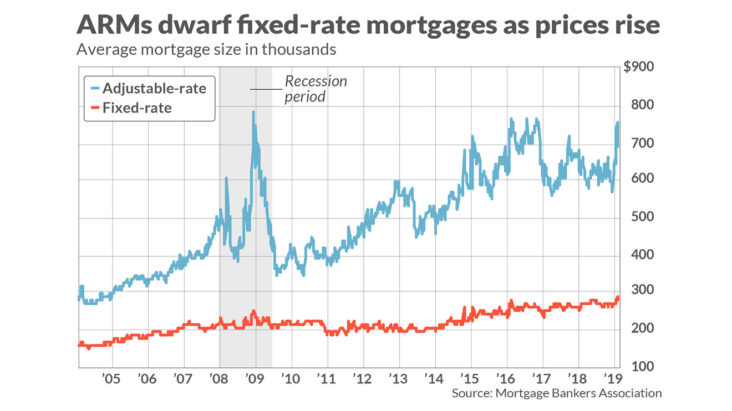

An adjustable rate mortgage with a fixed period, or ARM, is a type of home loan that offers a lower interest rate than a traditional fixed-rate mortgage. It’s called an adjustable rate because the interest rate can change over time, but it’s fixed for a specific period of time, usually five or seven years. With an ARM, you get the benefit of lower initial payments and the ability to lock in a low interest rate. The downside is that after the fixed period ends, your rate can increase depending on the current market rate. It’s important to do your research and understand the risks involved before committing to an ARM. With the right lender and a little bit of knowledge, an adjustable rate mortgage with a fixed period can be a great way to save money and get you into your dream home.

Benefits of an Adjustable Rate Mortgage with a Fixed Period

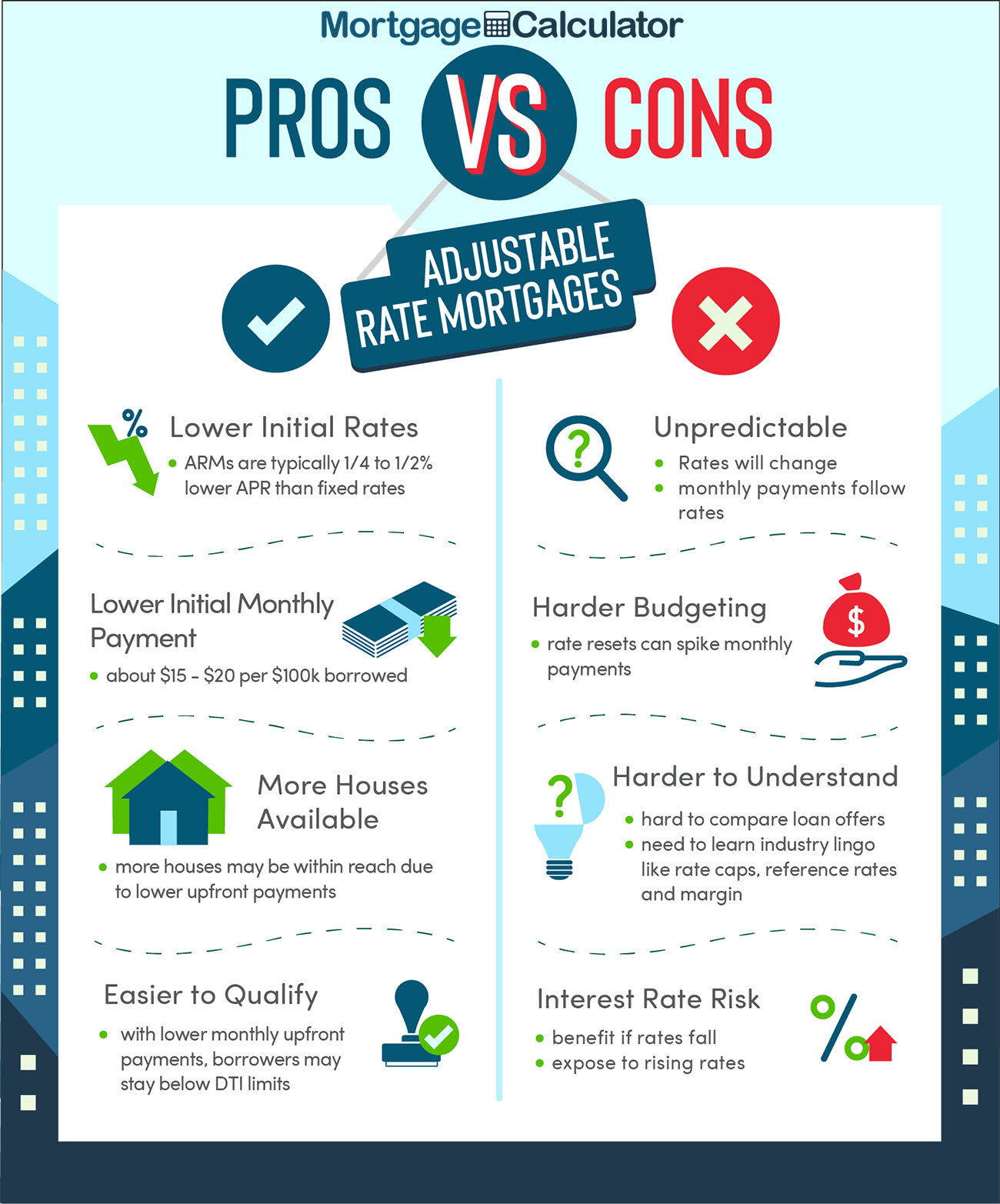

If you’re looking for a great way to save money on your mortgage, consider getting an adjustable rate mortgage with a fixed period. This type of mortgage can provide you with a lower interest rate and more flexibility in your payments, making it an attractive option for many homeowners. With an adjustable rate mortgage with a fixed period, you can lock in a lower rate for a certain amount of time and then have the option to adjust your rate as the market changes. This can help you save money over time, as you won’t be stuck with a high rate if the market changes. Plus, you may be able to take advantage of any reduced rates that may come up during your fixed period. An adjustable rate mortgage with a fixed period is a great way to save money on your mortgage and give yourself some financial flexibility.

How to Choose an Adjustable Rate Mortgage with a Fixed Period

Choosing an adjustable rate mortgage with a fixed period can be a great way to get a lower interest rate than a fixed rate mortgage while also having the stability of a fixed rate during the initial period. When selecting an adjustable rate mortgage with a fixed period, there are a few things to consider. First, you should look at the current interest rate for the loan, as well as any potential future rate increases. You should also consider the length of the fixed period, as well as any potential increases in the monthly payments. Additionally, you should research any additional fees or points associated with the loan, as these can add up over time. Lastly, be sure to carefully read all of the terms and conditions associated with the loan before signing. With these tips in mind, you can be sure to find the perfect adjustable rate mortgage with a fixed period for your needs.

Potential Disadvantages of an Adjustable Rate Mortgage with a Fixed Period

.If you’re considering an adjustable rate mortgage with a fixed period, there are a few potential disadvantages to consider. Firstly, if interest rates rise, you could end up paying more than you expected. Secondly, if you don’t plan to stay in the house for the duration of the fixed period, you could end up paying more for your mortgage than you anticipated. Finally, if you are unable to make your mortgage payments, you could face foreclosure or other legal action from your lender. So, it’s important to weigh all of the pros and cons before deciding if this type of mortgage is right for you. Ultimately, it’s important to do your research and make sure that you understand the terms and implications of an adjustable rate mortgage with a fixed period before signing on the dotted line.

Tips for Making the Most of an Adjustable Rate Mortgage with a Fixed Period

If you’re considering an adjustable rate mortgage with a fixed period, there are a few things you can do to make sure you get the best deal. First, make sure you understand the terms of the loan and the risks associated with it. Do your research and evaluate the various lenders to find the best terms for your financial situation. Then, compare the costs of different loans and find the one that works best for you. Finally, be sure to review your loan agreement and keep track of your payments so you can make the most of your adjustable rate mortgage with a fixed period. With a little bit of effort and some savvy financial decisions, you can make the most of your adjustable rate mortgage with a fixed period and get the most out of your loan.