Discover the incredible advantages of VA loans specifically designed for our brave veterans and active military personnel! As a token of gratitude for your dedicated service to our nation, VA loans offer unbeatable financial benefits that can make your dream of homeownership a reality. Unravel the top benefits of VA loans that set them apart from conventional mortgages and learn how they can remarkably ease your home-buying journey. Empower yourself with valuable insights on this government-backed mortgage program and pave the way for a secure and prosperous financial future for you and your family. Don’t miss out on these exclusive benefits tailor-made for our nation’s heroes!

No Down Payment Required

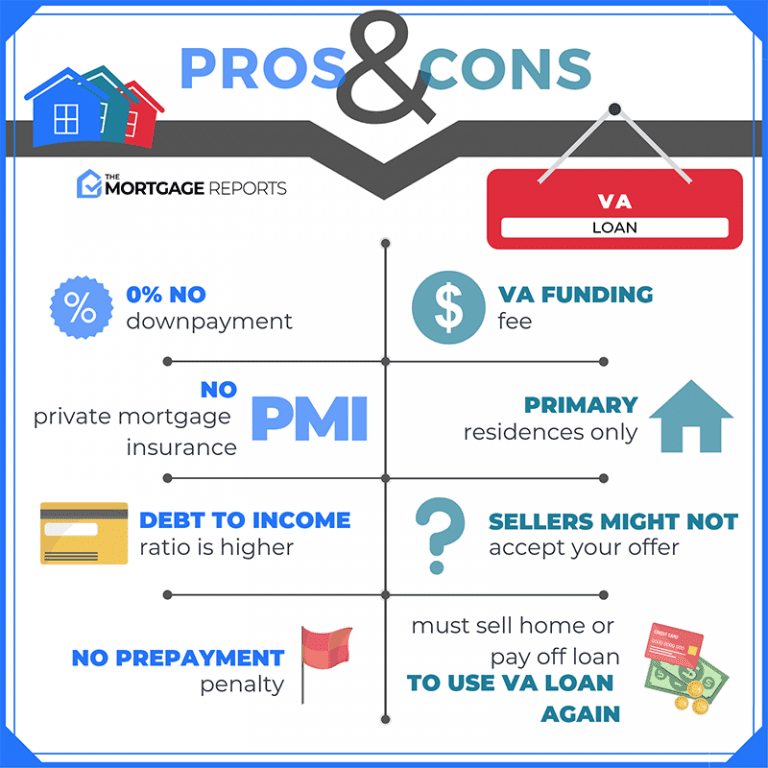

One of the best advantages of VA loans for veterans and military personnel is the perk of no down payment required. This means you can kiss goodbye to the stress of saving up a huge chunk of cash before buying your dream home. Plus, it’s super helpful for those who move frequently due to military life. No more wasting time and money on renting, you can dive straight into homeownership!

Lower Interest Rates Offered

One of the top advantages of VA loans is the lower interest rates offered to veterans and military personnel. These competitive rates can save you a significant amount of money in the long run, making homeownership more affordable and accessible for those who have served our country. Plus, lower monthly payments mean more cash for life’s other expenses!

No Private Mortgage Insurance Needed

One of the most significant advantages of VA loans is the elimination of private mortgage insurance (PMI). PMI is typically required by lenders when a borrower cannot make a 20% down payment on a conventional loan. This additional cost can be a burden, but with a VA loan, military personnel and veterans can save hundreds of dollars every month, making homeownership more accessible and affordable.

Lenient Credit Score Qualifications

Discover the ease of securing your dream home with VA loans, thanks to their lenient credit score qualifications. Don’t let past financial hiccups hold you back; VA loans are designed to support veterans and military personnel in achieving homeownership. Score lower rates and embrace a stress-free home-buying experience!

Simplified Loan Approval Process

Sail through the homebuying journey with VA loans’ simplified loan approval process! Say goodbye to stressful paperwork and stringent requirements typical of conventional loans. Enjoy a streamlined experience, designed just for veterans and military personnel, making it easier for you to secure your dream home. Get ready to move in faster!

Loan Assistance for Financial Hardship

Facing financial hardship? No worries, VA loans got you covered! These loans provide veterans and military personnel with the much-needed assistance during tough times. Say goodbye to the stress of dealing with money woes and hello to a hassle-free solution that’s tailored just for you. Secure your future with VA loans today!