Are you ready to take the leap into homeownership, but worrying about how to save up for a hefty down payment? Fear not, because our guide to the Top 5 Best Mortgage Lenders for Low Down Payment Options in 2023 has got you covered! We’ve researched and compiled a list of the most reputable and trustworthy lenders offering attractive low down payment options, enabling you to secure your dream home without breaking the bank. Dive into our comprehensive analysis and discover the perfect lender to help you make that crucial first step onto the property ladder.

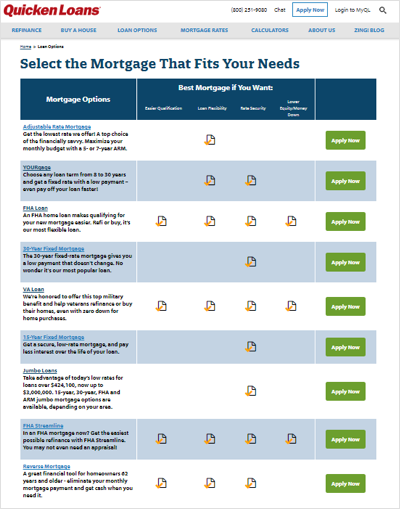

Quicken Loans: Quicken Loans is a well-known online lender that offers a variety of mortgage products, including low down payment options

Quicken Loans, the leading online mortgage lender, has consistently been recognized for its low down payment options in 2023. As a pioneer in the digital mortgage industry, they have made the home loan process easy and accessible for borrowers with limited funds. Quicken Loans offers flexible down payment options as low as 3% with their conventional loans, catering to first-time homebuyers and those with lower credit scores. Additionally, their FHA loans provide even more affordability, making it easier for borrowers to achieve their homeownership dreams. By combining competitive rates, user-friendly technology, and award-winning customer service, Quicken Loans is a top choice for low down payment mortgage solutions.

Their most popular low down payment mortgage is the FHA loan, which requires as little as 3.5% down

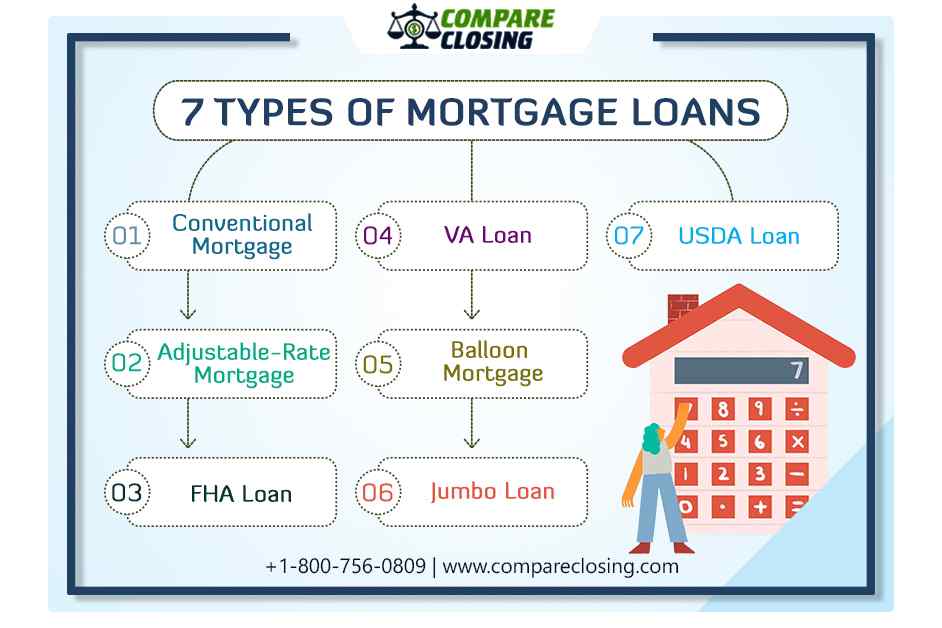

One of the most sought-after low down payment mortgage options in 2023 is the FHA loan, which has made homeownership accessible for countless individuals by requiring a minimal down payment of just 3.5%. This affordable alternative is highly favored by first-time homebuyers and those with less-than-perfect credit scores, as it offers flexible qualification criteria and competitive interest rates. In addition to being backed by the Federal Housing Administration, FHA loans have gained immense popularity among borrowers who seek cost-effective solutions for financing their dream homes. By choosing a mortgage lender that specializes in FHA loans, you can enjoy an affordable and hassle-free homebuying experience.

They also offer a 1% down payment option through their exclusive Power Buying Process.

Discover the power of Quicken Loans’ exclusive Power Buying Process, offering a remarkable 1% down payment option for prospective homebuyers in 2023. This innovative process is designed to empower borrowers with the most flexible and affordable financing solutions, making homeownership a reality for those with limited savings. With Quicken Loans’ commitment to customer satisfaction and an array of low down payment mortgage options, securing your dream home has never been easier. Explore the top 5 best mortgage lenders for low down payment options and unlock the door to your future with the confidence and support of Quicken Loans’ Power Buying Process.

Bank of America: Bank of America offers several low down payment mortgage options, including their Affordable Loan Solution mortgage, which requires as little as 3% down

Bank of America stands out as a top mortgage lender for low down payment options in 2023, thanks to its Affordable Loan Solution mortgage program. With a minimum down payment of just 3%, this offering caters to first-time homebuyers and those with limited savings. Additionally, Bank of America collaborates with Freddie Mac and Self-Help Ventures Fund to provide competitive interest rates and flexible credit requirements. This enables a wider range of borrowers to qualify for this mortgage, making it an excellent choice for those seeking affordable homeownership. Don’t miss out on the opportunity to secure your dream home with Bank of America’s low down payment options.

They also participate in FHA loans and VA loans, which require low or no down payments for eligible borrowers.

In 2023, finding the best mortgage lenders for low down payment options is crucial for borrowers aiming to secure their dream home. Many top lenders participate in FHA loans and VA loans, providing low or even no down payment requirements for eligible borrowers. FHA loans, insured by the Federal Housing Administration, allow qualified homebuyers to put down as little as 3.5%, while VA loans, backed by the Department of Veterans Affairs, offer zero down payment options for eligible military personnel, veterans, and surviving spouses. By exploring these affordable mortgage solutions, aspiring homeowners can access competitive interest rates and flexible terms, making the path to homeownership more accessible and financially feasible.

Wells Fargo: Wells Fargo is another major bank that offers low down payment mortgage options

Wells Fargo, a prominent financial institution, stands out in 2023 as one of the top 5 best mortgage lenders for low down payment options. With their diverse range of mortgage products and flexible down payment requirements, they cater to a wide spectrum of homebuyers, including first-time purchasers and those with limited savings. Wells Fargo’s commitment to simplifying the home buying process and providing exceptional customer service makes them an ideal choice for borrowers seeking affordable financing solutions. By choosing Wells Fargo, borrowers can confidently navigate the competitive housing market while securing the best possible mortgage terms tailored to their unique financial needs.

Their yourFirst Mortgage program allows

Discover the benefits of the yourFirst Mortgage program, a top-notch solution for homebuyers seeking low down payment options in 2023. This innovative program empowers you to secure your dream home with as little as 3% down, making homeownership accessible and affordable. YourFirst Mortgage also offers reduced mortgage insurance premiums and flexible credit score requirements, catering to various financial situations. By taking advantage of this program, you can confidently navigate the mortgage landscape and achieve your homeownership goals. Don’t let a hefty down payment hold you back – explore the yourFirst Mortgage program and unlock the door to your future home.